Dump NFT Indices Reveal the Hidden Costs of y00ts, DeGods’ Cross-Blockchain Movements

A USD 3 million incentive to lure a large non-fungible token (NFT) project from one blockchain to another appears to have had consequences some might not have expected.

According to data from Forkast Labs’ NFT Index—a measure of the performance of the top tokenized assets across all blockchain networks—Polygon’s seven-figure transfer to DeLabs in January to move y00ts over to its blockchain may have cost its own users and ultimately own ecosystem.

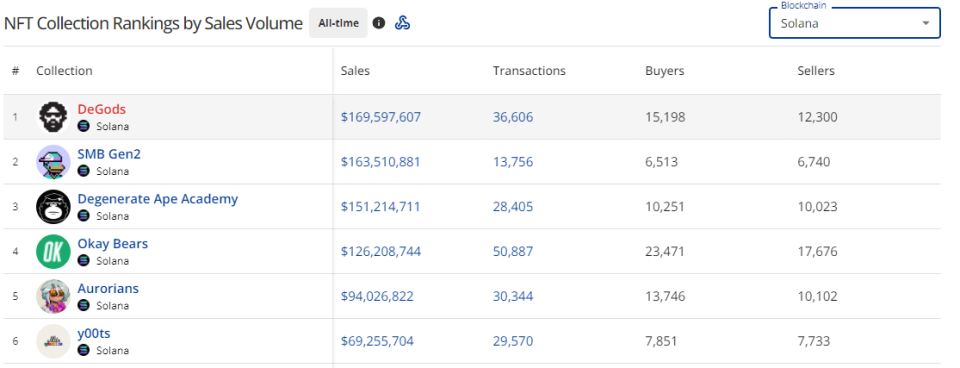

In recent weeks, NFT titans y00ts and DeGods began migrating from the Solana blockchain. DeLabs, the Los Angeles-based startup behind both projects, moved y00ts to Polygon, while DeGods ventured to “explore new opportunities” on Ethereum. The allure of being in the company of the biggest brands in the world, including Disney, Starbucks, Reddit, Budweiser and countless more, appeals to NFT projects that create intellectual property rights. Many investors have wondered whether these measures will pay off for the NFT projects. Will proximity to big names have an amplifying effect? And what about Solana, the blockchain that both projects left behind?

Let’s take a look at the data:

Because Fork indices exclude collections that are less than six months old, we can get a more macro view of the entire ecosystem and the overall impact these movements have had on these blockchains.

Since y00ts began its departure from Solana on March 27th, the Forkast Solana NFT Composite is up nearly 7.5%, suggesting that investors did not leave with y00ts. Instead, they found other Solana projects to invest in.

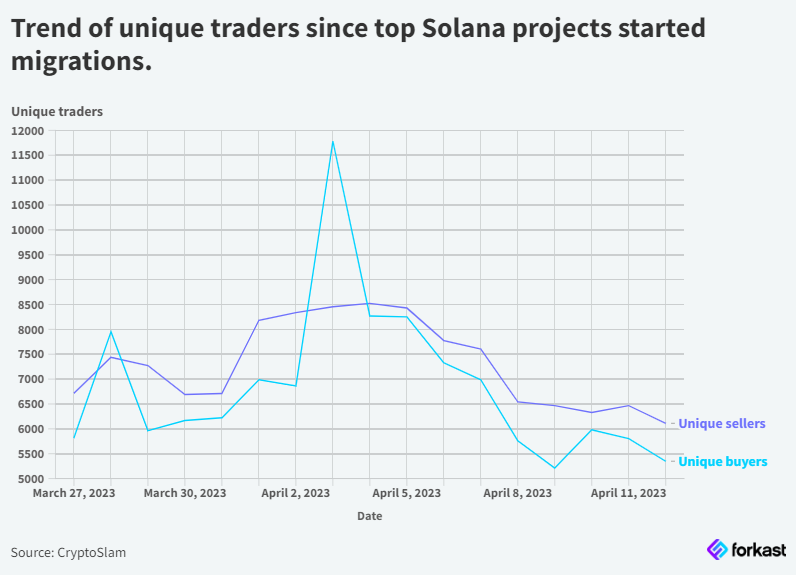

The activity of unique traders is consistent with the Solana NFT Composite. As of April 13, there were 9,128 Polygon y00ts and Ethereum DeGods owners, including stakeholders. However, the number of unique traders on Solana has not reflected the mass exodus of investors from the network.

The Polygon ecosystem has paid an unexpected price beyond the $3 million Polygon-funded incentive paid to y00ts to call their EVM blockchain home.

Existing Polygon collections bore the brunt of this hidden cost, evidenced by the Polygon NFT Composite – which currently excludes y00ts – which has lost nearly 6% of its weighted value since the move. This is reflected on the Polygon NFT Composite from March 27 to April 13 and shows what is referred to as the NFT casino. Simply put, traders sold their existing Polygon NFTs, hoping to take part in the latest hot NFT rally.

We can see a similar effect on Solana and Ethereum in line with DeGods’ move to Ethereum. From March 31 to April 13, the Forkast SOL NFT Composite, a proxy measure for the Solana NFT market, gained nearly 6%, while Ethereum (excluding DeGods) lost over 2%.

If there was market concern that y00ts and DeGods’ move would deal a crushing blow to Solana’s chances of remaining relevant, the blockchain community has backed its words of support with its wallet. While the Forkast Ethereum NFT Composite has fallen nearly 8% year-to-date, Solana has rallied over 13% for the year.

We continue to see the trend of traders valuing hot commodities over big brands and the latest fads over veteran NFTs. But it seems that Solana investors believe in the young blockchain more than expected. Solana investors appear more loyal to the ecosystem rather than projects that live on that blockchain. While most people would be willing to bet on the success of Polygon, Ethereum and their two newest blue chip projects, Solana has benefited from the strong foundation they have built with the community.

Over the next several months, we will begin to see the greater impact, costs and benefits of the y00ts and DeGods movements as they are expected to enter the blockchains respective Forkast NFT Composites after they reach the six month requirement to enter in the indices and become central players in their ecosystems.

It could be a difficult road ahead. According to the Forkast 500 NFT index, the NFT market continues to trend downward. But strategically, for blockchains, winning over the community may be more valuable than winning projects.