Diversify with gold, Bitcoin and other decentralized assets

bodnarchuk

The way I see it, decentralized assets have never looked more attractive than they do now. That includes gold, silver and Bitcoin (BTC-USD), and you can also make the case for collectibles like art.

By “decentralized” I mean that these assets are not issued by a central authority. They are nobody’s responsibility. No central bank makes the decision to mint more gold or silver. No finance minister decrees that Bitcoin production should be slowed or accelerated.

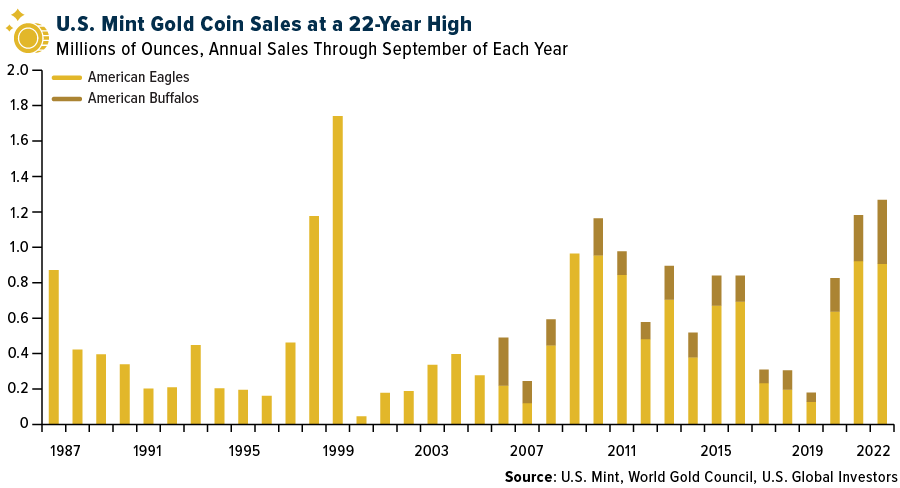

Investors have diversified with gold and silver for decades to limit exposure to poorly executed monetary and fiscal policies. As I shared with you last month, investors bought more American Eagle and American Buffalo gold coins between January and September of this year than in any other such period dating back to 1999.

I think this is largely a reflection of Americans’ poor perception of the state of the economy and the imbalance they see in monetary and fiscal policy.

American global investors

For the same reasons, more and more investors are also diversifying with Bitcoin, an asset whose payment system is based on “cryptographic proof rather than trust.” It’s from Satoshi Nakamoto’s Bitcoin whitepaper, published 14 years ago.

Satoshi’s point about trust is key to the idea of decentralization. As users of government-issued fiat currency, we have little choice but to rely on politicians’ economic and financial decisions, which can significantly affect the value of our money.

The US spends more on interest than on the military

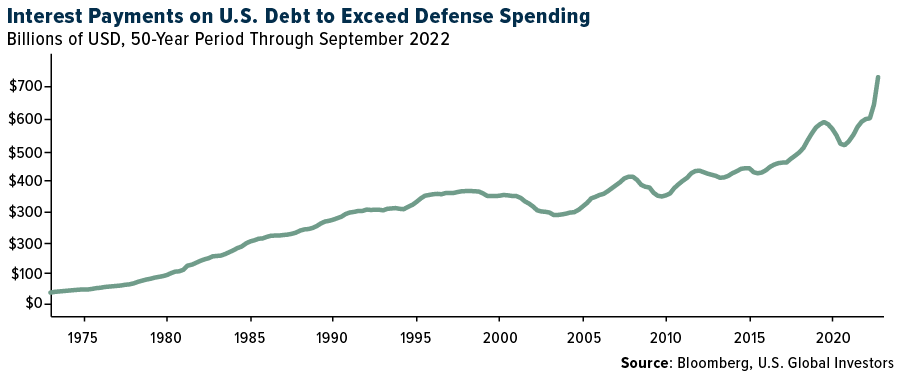

Take a look at where monetary and fiscal policy has taken us. The total US debt is now a staggering $31 trillion, or about a quarter of a million dollars per American taxpayer. Debt makes up over 121% of the entire US economy. That means that for every dollar the US has, it owes a dollar and a quarter (almost).

Meanwhile, the Federal Reserve has raised interest rates at a pace not seen in 40 years, making debt servicing much more expensive. The amount of money the US government pays in interest alone now exceeds defense spending.

In the third quarter of 2022, the government paid over 736 billion dollars in interest alone. That’s more than the 2020 national defense budget of $714 billion.

American global investors

Central banks load up on gold

With gold, silver and Bitcoin, there is no need for investors to put their trust in a third party or intermediary, especially one who may not have their best interests in mind.

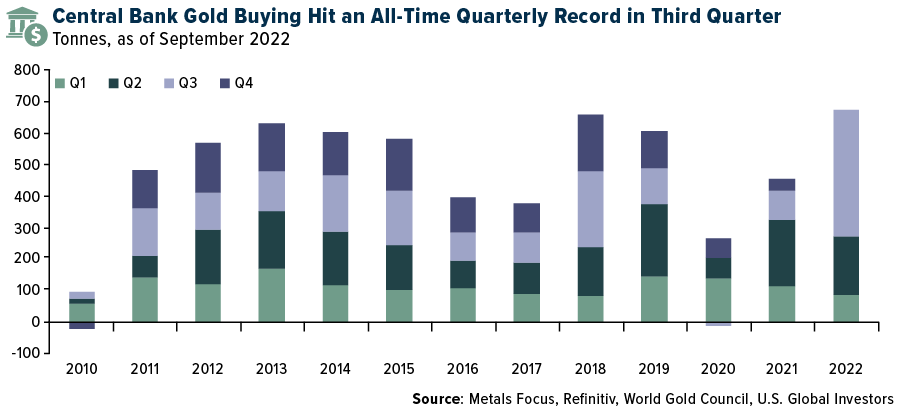

What I find interesting is that the central banks themselves – the ultimate central authorities – recognize the power of diversifying with decentralized assets. According to the World Gold Council (WGC), global central banks added a record amount of gold during the third quarter. Purchases increased to almost 400 tonnes, more than double the amount compared to the previous quarter and a new quarterly record. With these purchases, the year-to-date total for 2022 is now 673 tonnes, higher than any year since 1967, the WGC says.

American global investors

Gold down for record seventh month – a buying opportunity?

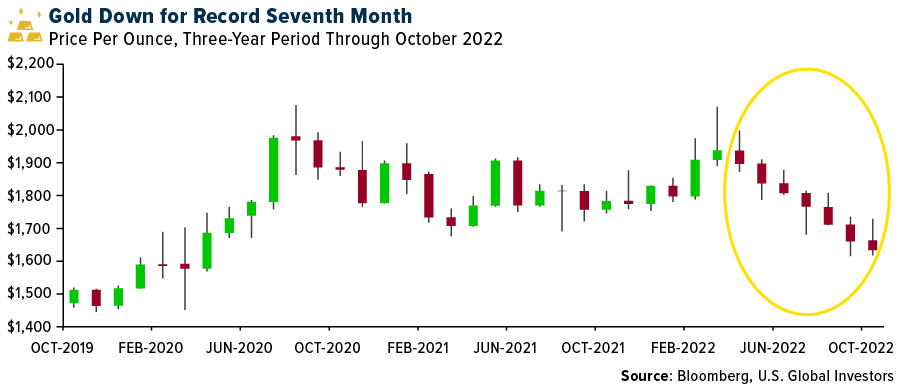

Gold’s critics and haters will point out that the price of the precious metal has been down for seven consecutive months, a new record since October.

They are correct. Due to rising interest rates and a historically strong US dollar, gold has experienced an unprecedented monthly losing streak since – are you ready for this? – 1869.

American global investors

This sounds terrible, but let’s put it into context. Through the end of October, gold has fallen 11% in 2022. The S&P 500, by comparison, has lost 18%.

What about other asset classes? Well, tech stocks (Nasdaq 100) have lost even more at around -30%. Emerging markets have fared just as poorly in 2022.

Government bonds are down 14%, corporate bonds are down 20%. Bitcoin is down 55% for the year.

So yes, the price of gold has fallen for a record seven months, but it’s still beating pretty much everything else. That must count for something.

For these reasons, I believe gold is priced very attractively, trading below $1,700 per ounce. The Fed will need to swing at some point, and when it does, I think gold (and Bitcoin) could rally.