Different use cases in crypto innovation

Ethereum and Bitcoin are two distinct powerhouses, each offering unique use cases and opportunities that disrupt and transform legacy institutions. Each has its own maximalist followers, but the trend is towards synergy and away from a zero-sum approach.

As the crypto ecosystem continues to expand, these two titans are driving innovation and adoption through different approaches. This article delves into Ethereum and Bitcoin’s unique strengths, and shows their role in the evolving crypto landscape.

Explore Ethereum’s versatility and Bitcoin’s persistence

Ethereum’s journey began as an ambitious project, which sought to expand the possibilities of blockchain technology. While Bitcoin was supposed to stand out as “digital gold”, Ethereum’s flexibility and adaptability have positioned it as the most popular blockchain.

Diverse applications, including decentralized finance (DeFi), non-fungible tokens (NFT), and blockchain gaming, contribute to Ethereum’s growing influence in the crypto space.

Ethereum: A DeFi Powerhouse

The DeFi sector, powered by Ethereum’s smart contracts, has fundamentally changed financial services. Users can now access a variety of products without relying on traditional intermediaries. Ethereum-based lending and borrowing platforms such as Aave and Compound, as well as decentralized exchanges such as Uniswap and SushiSwap, give individuals unparalleled control over their assets.

Decentralized Autonomous Organizations (DAOs) have also emerged, enabling communities to govern themselves and allocate resources through consensus. Projects like MakerDAO and the decentralized insurance platform Nexus Mutual exemplify Ethereum’s potential to foster innovation, attracting both developers and users to its ever-growing ecosystem.

The NFT revolution: Ethereum at the forefront

The NFT market exploded in 2021, disrupting the art, collectibles and digital content industries. Ethereum’s blockchain stands as the backbone of this phenomenon, enabling artists and creators to create unique tokens that represent ownership of digital assets. Traded on platforms such as OpenSea and Rarible, these tokens have democratized access to art and collectibles, connecting creators and collectors like never before.

Notable examples include the sale of digital artist Beeple’s Weekdays: The first 5,000 days for $69 million and the meteoric rise of CryptoPunks, a collection of 10,000 unique pixel art characters. Also, NFTs have become an important tool for digital content creators, allowing them to monetize their work through royalties and secondary sales. Ethereum’s role in this transformative market demonstrates its potential to reshape industries and redefine values.

Gaming Reimagined: Ethereum’s Tokenized Worlds

Blockchain gaming is another frontier where Ethereum shines. Developers leverage its robust capabilities to create immersive experiences, offering players new levels of ownership and engagement. Tokenized assets in these games give players real ownership of digital items, which can be traded or sold on decentralized marketplaces.

Axie Infinity, a popular Ethereum-based game, allows players to collect, breed and battle digital creatures called Axies. These axes can be traded on a decentralized marketplace, creating a thriving in-game economy. In addition, Ethereum-based games often have decentralized economies, giving players the power to influence and shape in-game worlds. This innovation promotes deep engagement as players contribute to their virtual environments and earn rewards for their efforts.

Bitcoin’s Historic Strength: Digital Gold and Store of Value

Bitcoin, the original cryptocurrency, has been the most valuable digital asset since its inception in 2009. Its ability to maintain value over time has earned it the name “digital gold.”

As a decentralized, limited and censorship-resistant currency, Bitcoin’s strength lies in its simplicity and security.

One of Bitcoin’s primary use cases is as a store of value. Its scarcity, with a maximum supply of 21 million coins, ensures that it remains a deflationary medium, making it an attractive hedge against inflation. Many investors consider Bitcoin a safe haven, like gold, in times of economic uncertainty.

In addition to its scarcity, Bitcoin’s robust security and decentralized nature have contributed to its enduring appeal. The proof-of-work consensus mechanism, which relies on a large network of miners, ensures the network’s integrity and resilience against attack.

Furthermore, Bitcoin’s global acceptance and liquidity make it an ideal medium for cross-border transactions. Lower fees and faster transaction times compared to traditional transfer services have popularized Bitcoin as a means of transferring value across borders.

Bitcoin’s position as the most valuable cryptocurrency is a testament to its unique qualities as digital gold and a reliable store of value. These characteristics, combined with Ethereum’s versatility, show that both cryptocurrencies play crucial roles in the evolving blockchain ecosystem.

Can Ethereum Outpace Bitcoin?

As Ethereum continues to gain adoption, questions are being raised about its potential to overtake Bitcoin as the leading cryptocurrency. Ethereum’s real-world applications span multiple industries, and its growing popularity is hard to ignore.

Nevertheless, the two cryptocurrencies serve different purposes. Bitcoin’s scarcity and established reputation make it a reliable store of value, while Ethereum’s versatility fuels its expanding use cases. It is not necessarily a zero-sum game, as both cryptocurrencies can coexist, fulfilling different needs in the market.

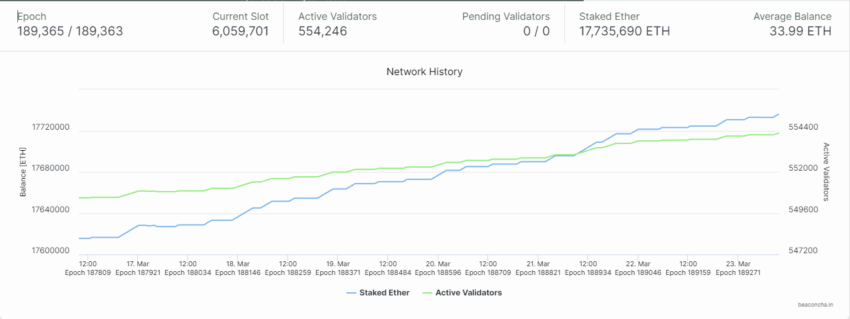

A notable development is Ethereum’s transition to Ethereum 2.0, which aims to improve scalability, security and sustainability through a shift from proof-of-work to proof-of-stake. This upgrade and others could further strengthen Ethereum’s position as a leading blockchain platform.

Ultimately, Ethereum’s growth and development demonstrate the potential to challenge the status quo, push the boundaries of blockchain technology, and establish its place as a formidable force in the crypto world.

The Future of Crypto: A Tale of Two Titans

As the crypto landscape evolves, Ethereum and Bitcoin remain at the forefront, each with a loyal following. Ethereum’s innovative spirit challenges Bitcoin’s dominance, but both cryptocurrencies offer unique value propositions that appeal to different audiences.

Visa, the global payments giant, has already started using Ethereum’s blockchain to settle transactions in the stablecoin USDC. This move signifies the growing acceptance and adoption of Ethereum’s technology in mainstream finance.

Meanwhile, projects like Stacks aim to improve Bitcoin’s capabilities by building smart contracts and other features on top of the blockchain. Stacks demonstrates that Bitcoin’s potential extends beyond its status as digital gold, opening up new possibilities for the original cryptocurrency.

The future of cryptocurrency may depend on the ability of Ethereum and Bitcoin to coexist and complement each other. They are both likely to play a decisive role in shaping tomorrow’s economic terrain as the lines between digital gold and utility blur.

Embrace the synergy between Ethereum and Bitcoin

With the popularity of Layer 2 solutions like Polygon and Optimism for Ethereum and platforms like Stacks for Bitcoin, the crypto ecosystem is poised to become even more robust and versatile. This progress opens up new opportunities for developers and users, sparking creativity across both platforms.

As the decentralized world continues to expand, the combined strengths of Ethereum and Bitcoin can lay the foundations for a more inclusive, transparent and efficient financial future.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.