Demand for crypto ETFs persists despite market downturn

Nearly half of investors plan to add cryptocurrency and digital asset-themed exchange-traded funds despite the fall in crypto prices and the collapse of the FTX exchange last year.

Brown Brothers Harriman’s 10th Annual Global ETF Investor Survey found that 48% of investors plan to add ETFs with cryptocurrency and digital asset themes, down just 6% from a year ago. In particular, three quarters, 74%, of institutional investors are extremely/very interested in this strategy.

Source: BBH.

“Initiatives such as the draft regulation from the EU proposal on Markets in Crypto Assets are expected to significantly ‘derisk’ investments in crypto assets for asset managers and provide an ‘additional layer of comfort’ for fund managers to engage with crypto,” BBH said.

Crypto ETFs are still being launched. For example, ETC Group, a European digital asset securities provider, has announced its intention to list the first crypto ETP based on an MSCI index in April. The ETC Group MSCI Digital Assets Select 20 ETP is expected to be listed on the German Deutsche Börse XETRA.

Stéphane Mattatia, MSCI

Stephane Mattatia, head of thematic indices at MSCI, said in a statement: “The digital asset ecosystem is evolving rapidly and investor demand for access to this new asset class is growing. The MSCI Digital Assets Indexes have been developed with a systematic and process-oriented approach to help global investors with gaining transparency about this long-term, disruptive trend and enabling them to make better investment decisions.”

BBH surveyed more than 300 institutional investors, fund managers and financial advisors from the US, Europe and Greater China, with 40% of respondents having more than $1 billion in assets under management.

ESG demand

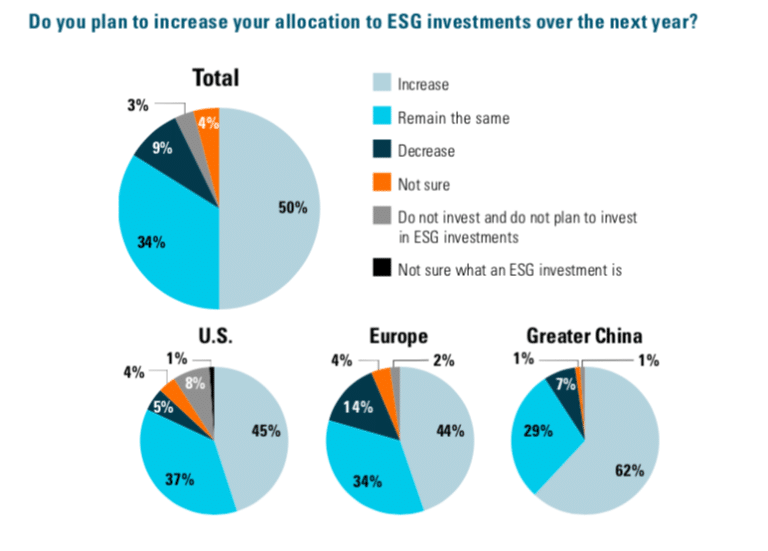

Environmental, social and governance funds also continue to attract attention, with half of investors planning to add ESG exposures this year, while a third plan to keep the same allocation.

Source: BBH

BBH said assets in ESG ETFs have grown at a compound annual growth rate of 40% over the past five years. After 43 consecutive months of inflows, $403 billion was invested in ESG ETFs at the end of November last year. The study highlighted that ESG dominates inflows in Europe, representing 65% of all inflows into the ETF market in 2022.

“By the end of 2022, ESG ETFs accounted for 19% of the European ETF market,” BBH added. “We expect the momentum behind investor flows into ESG funds in Europe to continue.”

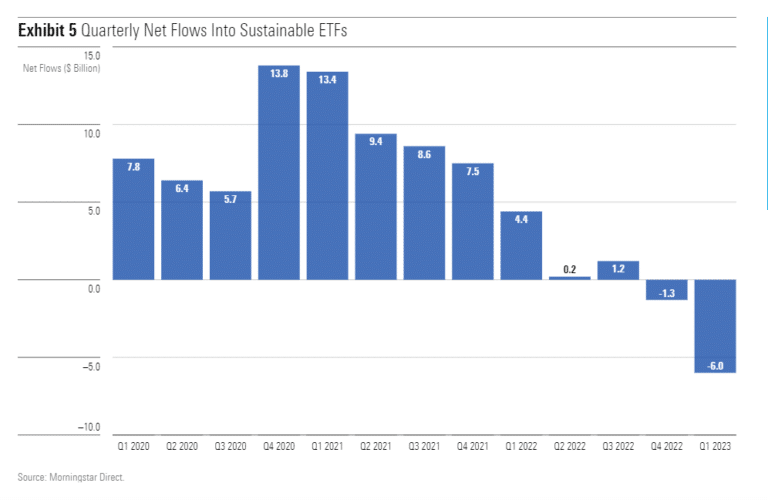

However, data provider Morningstar noted that in the US, Sustainable ETFs had outflows of $6 billion in the first quarter of this year, their worst figure to date.

Source: MSCI

Regular income

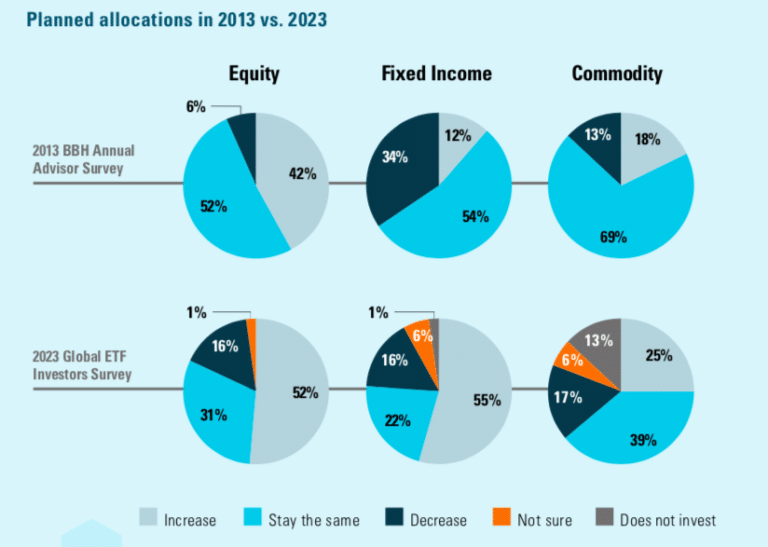

Fixed income ETFs were the preferred vehicle for investors globally in 2022 according to the BBH survey.

Since interest rates have risen almost half, 46%, of respondents expect to increase their allocation to fixed income ETFs, and 40% expect to allocate more to short-term fixed income ETFs.

Summary of March and Q1 ETF flows from @ETFObserveren.

Bond ETFs took 68% of flows in the first quarter despite representing ~20% of assets.

ETFs holding foreign stocks collected around 30 trillion in Q1, while their US counterparts saw their first quarterly payouts since 2016. pic.twitter.com/6qzq1KLlhX

— Ben Johnson, CFA (@MstarBenJohnson) April 4, 2023

Ryan Jackson, lead research analyst, passive strategies, for Morningstar Research Services, said in a report that U.S. ETFs had inflows of around $77 billion in the first quarter of this year.

“After a February of modest outflows, bond ETFs bounced back in March with $28.4 billion in inflows,” Jackson added. “That pushed their first quarter to $52.5 billion, or about 68% of all ETFs’ net flows for a cohort that represents only about 20% of the market.”

Ultra-short bond funds took in $17 billion in the first quarter, which Morningstar said marked a stellar follow-up to their record-setting 2022. Long-term government bond funds led all categories with $9.1 billion in flows in the first quarter, but Morningstar added intermediate- and short-term offerings also did well.

“By 2022, government bond funds accounted for 38% of bond ETF flows with only 18% of the market share,” Jackson said. “Ultrashort bond funds have taken over the mantle in 2023, but these categories are still near the top of the pile.”

In contrast, riskier bond categories continued to endure outflows, with high-yield bond funds posting first-quarter outflows of more than $9 billion, the most of any category.

Growth

Shawn McNinch, global head of ETFs at BBH, said in the report that the data shows investors continue to embrace ETFs as a vehicle of choice, with new categories such as active and fixed income continuing to gain ground.

“It also shows that the way investors use ETFs is evolving, and asset managers and service providers must constantly adapt to meet these changing demands,” McNinch added.

The findings from our 2023 Global ETF Investor Survey are out. Explore the report to learn about the changes ETF investors are making in the face of macro and market changes, and what the past decade of ETFs can tell us about the next ten years. https://t.co/KeTeAUfz8G#ETFs pic.twitter.com/ueDlwvynNQ

— Brown Brothers Harriman (@bbh) 3 April 2023

BBH continued that ETFs are a $9.23 trillion market overall and had the second highest global inflow on record at $856 billion in 2022.

“Our 2023 survey shows that 41% of US investors, 25% of investors in Europe and 38% of investors in Greater China have more than a quarter of their assets under management invested in ETFs,” BBH added.

Almost all, 89%, of investors plan to increase or maintain their ETF allocations over the next 12 months. As a result, the custodian and administrator estimated that the ETF market could grow to more than $30 trillion by 2033.

“In 2022 alone, 66% of investors moved capital from mutual funds to ETFs,” BBH added. “We believe the next 10 years will see a significant focus on actively managed strategies to complement existing investor interest in low-cost index products.”