DeFi App Development Why it’s a good idea for Fintech companies

The technology is constantly gaining ground around the world, considering its various advantages, such as providing faster access to crypto trading, lending and other financial services.

Decentralized Finance (DeFi) is the latest buzzword to take the world by storm. The technology is constantly gaining ground around the world, considering its various advantages, such as providing faster access to crypto trading, lending and other financial services.

DeFi has ultimately reduced the need for intermediaries such as banks to process all types of transactions, thereby redefining the way FinTech companies operate. According to a report, the total accumulated revenue of DeFi protocols has increased to a market size of $106 billion as of 2022. Large FinTech organizations are moving towards investing in DeFi apps to enable efficient operations and processes.

Now, if you are one of the cryptocurrency enthusiasts who need to redefine the way your financial business works, now is the right time to invest in DeFi DApps development services organization that can help you put things into perspective and help you tap into the growing market share of the DeFi ecosystem.

Decentralized financial applications are built on blockchain technology and work according to the traditional financial platforms, but without centralized authority. Although the concept is technically new to the world, the benefits of the technology are already being exploited by various financial institutions, laying the foundation for the financialization of everything. Here are some benefits of using DeFi apps for your financial business:

- It allows you to stream the salary of your employees in real time.

- It has created new avenues for digital content creators and allows them to generate revenue through new channels.

- It has facilitated easy transaction for even millions worldwide without the need for user identification every step of the way.

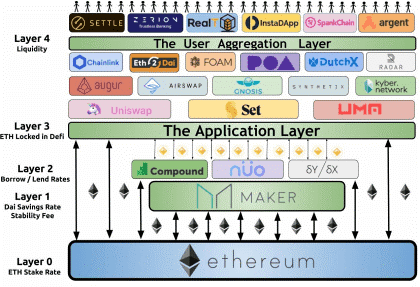

Now that you have a clear idea of how DeFi DApps are changing the way traditional financial business is conducted, let’s move on and discuss the different layers of a DeFi technology stack

Understanding the DeFi Tech Stack

Layer 0 – The settlement layer

The settlement layer serves as the foundation for every DeFi transaction. It consists of a public blockchain combined with a cryptocurrency such as Ethereum.

The settlement layer uses tokenized assets that are further available as US dollars or in another digital currency that represents real-world assets.

Layer 1 and Layer 2 – The protocol layers

Layer 1 and Layer 2 of the DeFi technology stack include the DeFi protocols. They are also interoperable, which makes it possible for financial companies to create an application at the same time. The protocols are further responsible for offering liquidity to the entire decentralized financial ecosystem.

An example of a decentralized finance protocol is Synthetix which is an Ethereum-based trading platform. Synthetix is used by several developers to create digital copies of things used in the real world.

Layer 3 – The application layer:

The application layer is the home of consumer-facing apps. This layer is responsible for hosting hundreds of bitcoin ecosystem apps in addition to housing the decentralized cryptocurrency exchanges.

Layer 4 – User Aggregation Layer:

The various applications available in the application layer are further connected together using user aggregation layers and offer services to investors. The team is also responsible for moving money seamlessly between several financial products and increasing the return on investments. Lending and borrowing are the two services available in the aggregation layer. In addition to this, all services related to banking and cryptocurrency are further handled by the user aggregation layer itself.

Now that you have a clear understanding of the various layers available in the DeFi technology stack, let us now move forward and discuss the various benefits and features of DeFi for financial firms.

DeFi benefits and features

Transparency:

In a traditional financial setup, there is no role for retail players in controlling the overall banking service providers. Now, with DeFi, the open source protocols are governed by smart contracts and run on public blockchains, thus ensuring the highest levels of transparency.

Global access:

Internet penetration is increasing at an exceptional level, even when more than 30% of the population is economically excluded. Now, these open-source and blockchain-powered DeFi DApps can be accessed by users in any region of the world using a stable internet connection and a smartphone. Thus, it is now easy to make financial transactions on a global level without the need for any centralized authority.

Immutability:

Since the data is now stored in the ledger’s storage, there are negligible chances of it being changed or tampered with.

Programmability:

The higher flexibility of the apps makes it easy to create smart contracts.

So these were the various benefits of using DeFi DApps for your finance business. Now let’s go ahead and discuss How to make money on DApp.

How to Monetize DApp: Understand the Different Monetization Strategies

There are a number of monetization strategies available for your DeFi DApps that can help you increase your overall ROI as well as help you gain traction in the competitive world. Let us discuss them in detail below:

- Transaction Fees

The most widely used and viable revenue stream that can help you monetize your DApp is the transaction fee model. You can charge the user a small number of transaction fees for each transaction they make using the DeFi app. For example, there may be transaction fees for carrying out lending and borrowing of cryptocurrencies, in addition to fees for payments and other services.

- Premium

If you want to design a finance DApp for your business to be made available to a higher audience, you can charge a premium for your services. For example, users can purchase a premium subscription if they want to transfer a larger amount of money across remote regions or perform multiple transactions in a single day.

- Subscription

Another way to monetize your DApp is by choosing a subscription revenue model stream. If users want to use your decentralized finance app, they need to purchase a monthly or annual subscription.

- Advertisements

An advertising-based revenue model is another monetization strategy used by financial institutions. You can provide a space for users to promote their services on your app and charge an additional fee for the same.

We hope all this information has made you aware of the various benefits and monetization strategies available with a DeFi DApp. Now is the time to hire a dedicated DApp development organization to create a decentralized financial app capable of influencing the future of finance, accessing risk and making room for potential collaboration with investors.

Press release distributed by The Express Wire

To view the original version on The Express Wire visit DeFi App Development Why It’s a Good Idea for Fintech Companies