Data fees for Layer 2 have reached all-time highs on Ethereum’s Blockchain

[gpt3]rewrite

The Layer 2 solutions of the Ethereum Blockchain have gained some exposure since they can address the blockchain network’s sustainability and high transaction fees. As a result of traction L2 data fees on the Ethereum blockchain have hit an ATH. the data was revealed by The Block recently.

Increase in Layer-2 Fees on Ethereum

Layer-2 data is basically the data fees associated with the cost of transferring and executing data on L2 networks built on the Ethereum L1 network. Due to the high adoption of L2 solutions due to their benefits, the demand for off-chain transactions has increased, which indirectly resulted in increased usage and demand for such solutions.

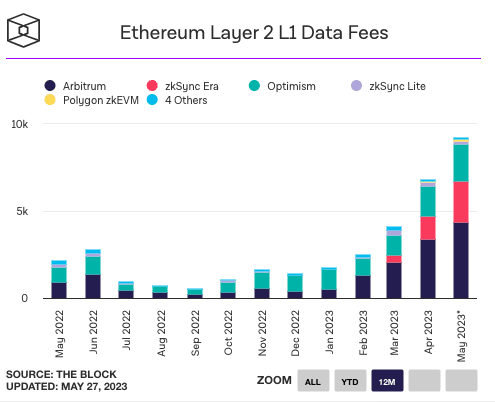

The chart above shows that Optisimim and ZK summaries have contributed to the milestone of high transaction fees. But if a closer look at the chart will reveal that Arbitrum and Optimism, which fall under the same optimistic summary, have contributed more than ZK.

Arbitrum contributed a whopping 47.3% in the month of May, while Optimism was behind with 23.04% of the change for the same month. While ZK rollups couldn’t beat Optimistic roll-up numbers, zkSync stole second place ahead of Optimism with 25.38% of the total $16.2 million recorded.

One of the most important things the chart and the data charges indicate is that the usage and use of these networks has been huge. It can be connected to the peak in Ethereum Mainnet transaction fees.

One of the most notable observations from the publication record is the Polygon (MATIC) zkEVM. Despite the hype around the launch even during the beta phase, the project has cooled significantly with only 1.03% of the total fees.

Decrease in TVL

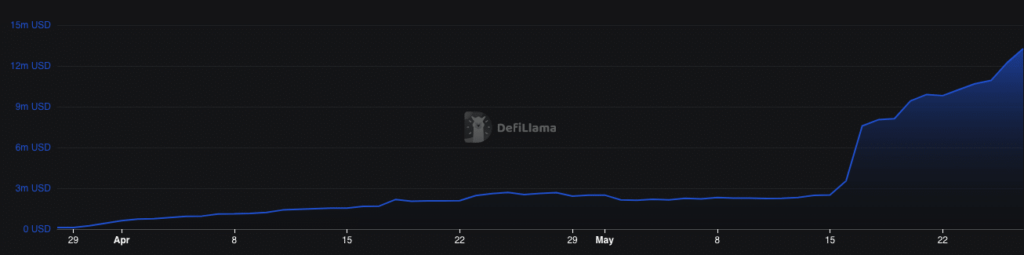

Due to the cooldown, it affected the performance of Total Value Locked. Despite DefiLlama data showing the tally is increasing, it should be noted that it is well below its biggest competitors at $13.27 million.

Total value locked is mainly used for liquidity pool purposes for smart contract lending and stake in the respective blockchain. An increase in TVL indicates excellent health for the protocol and a decrease in TVL indicates threat and drying up of liquidity.

zkSync with its total value locked at $127.63 million, is way ahead of Polygon zkEVM. However, the landscape in Optimism is very different. Optimism has maintained its TVL stability of $889.36M. Arbiturm has taken first place here as well with a TVL of 2.34 billion dollars.

Essentially, Optimistic rollups have taken the majority of investors and market shares as well. To beat Optimistic, ZK will have to do a lot to impress investors.

[gpt3]