Daily highlights for the crypto market – Solana and The Sandbox show the way

Key insights:

-

It was a bullish start to the week for cryptocurrency top ten, with Solana (SOL) and Ethereum (ETH) in the lead.

-

Following the filing of the 3AC bankruptcy, news of more platforms freezing withdrawals failed to intimidate investors.

-

The total market value of crypto increased by $ 37 billion to reverse losses from the beginning of the month.

It was a bullish Monday session for the crypto market. Bitcoin (BTC) rose for the second day in a row, the best race since a three-day winning streak in late June.

Solana (SOL) led the top ten, with BNB and ETH also finding strong support.

While behind the front runners, Dogecoin extended his winning streak to four consecutive sessions.

At the time of writing, the NASDAQ 100 Mini was up 82 points, with an increase in risk appetite that is likely to support the crypto market.

The total market value of crypto rises for a third session

The bullish session saw the total market value of crypto inches return to $ 900 billion on Monday.

A bearish start to the day saw the market value fall to a low of $ 837.4 billion before jumping to a high of $ 893.9 billion.

At the end of the day, the market value increased by $ 37.23 billion to $ 888 billion.

It is significant that Monday’s gain drew the total market value to positive territory for July.

But it is also worth noting that the market has not had more than a three-day winning streak since March,

Crypto Market Movers and Shakers from the top ten and beyond

SOL increased by 9.99% to lead, and ETH (+7.19%) and BNB (+ 5.57%) found strong support.

ADA (+ 3.08%), BTC (+ 3.66%), DOGE (+ 3.23%) and XRP (+ 2.36%) also continued to find support.

From CoinMarketCap top 100, The Sandbox (SAND) jumped 15.1%, with Convex Finance (CVX) and THORChain (RUNE) rising 14.1% and 10.4% respectively.

However, the NEM (XEM) fell by 2.7% to lead the way down. XEM joined a handful of cryptocurrencies to counter the broader market trend

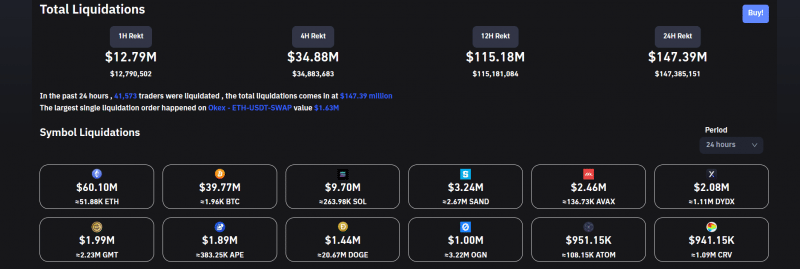

Total crypto liquidations to test the current market upturn

24-hour liquidations picked up during Tuesday, which could test investor resistance after the US holidays.

This morning, 24-hour liquidations were $ 147 million, up from $ 80.74 million on Monday and $ 58.2 million on Sunday.

Liquidated traders increased in the last 24 hours. At the time of writing, liquidated traders stood at 41,573 against 25,320 on Monday morning.

One hour of liquidation figures also indicated a possible withdrawal of the crypto market at the current change.

According to Coinglass, the one-hour liquidation was $ 12.79 million, compared to $ 0.920 million on Monday.

Daily news Highlights

-

DappRadar and LayerZero launched the first cross-chain token betting mechanism.

-

FTX and BlockFi agreed on an agreement with an FTX option to buy BlockFi for $ 240 million.

-

Meta-acclaimed crypto wallet project Novi.

-

Hacker offered to sell over 23 terabytes (TB) of personal data for 10 BTC, and highlighted the use of crypto for criminal activity.

-

The Bankless Times revealed American romance scams as the second most common crypto scam.

-

Another crypto lender succumbs to the crypto winter. Vauld suspended withdrawals, trade and deposits due to market conditions.

This article was originally posted on FX Empire