Crypto’s favorite bank tank – no bank

Dear Bankless Nation,

If you thought the crypto company explosions were over, this week offered an alternative. Major exchanges and lenders are running out of banking options, and regulators are still swarming.

For our weekly roundup, we dig into:

-

Silvergate shoe drops

-

Krypto descends on Denver

-

Solana has another shutdown

-

Oasis impales its hacker

-

“Everything But Bitcoin”

– Bankless team

👉 Kraken has been at the forefront of the blockchain revolution since 2011 ✨

Here’s a roundup of the biggest crypto news from the first week of March.

Crypto companies are not licensed as financial lenders, so they need licensed banks to service their customers’ on-boarding and off-boarding needs.

One of the biggest crypto-friendly banks, Silvergate, saw its shares plunge 55% on Thursday. This comes amid market concerns about its financial sustainability following FTX’s collapse last November. Silvergate has also been facing a DoJ probe over its FTX and Alameda deals since early February. The bank previously reported a loss of ~$1 billion for the fourth quarter of 2022 and cut by 40%.

As a result, Silvergate’s customers are jumping ship in droves. Coinbase, Circle, Paxos, Crypto.com, Bitstamp, Cboe Digital Markets, Galaxy Gemini and LedgerX have each announced they are cutting ties with Silvergate.

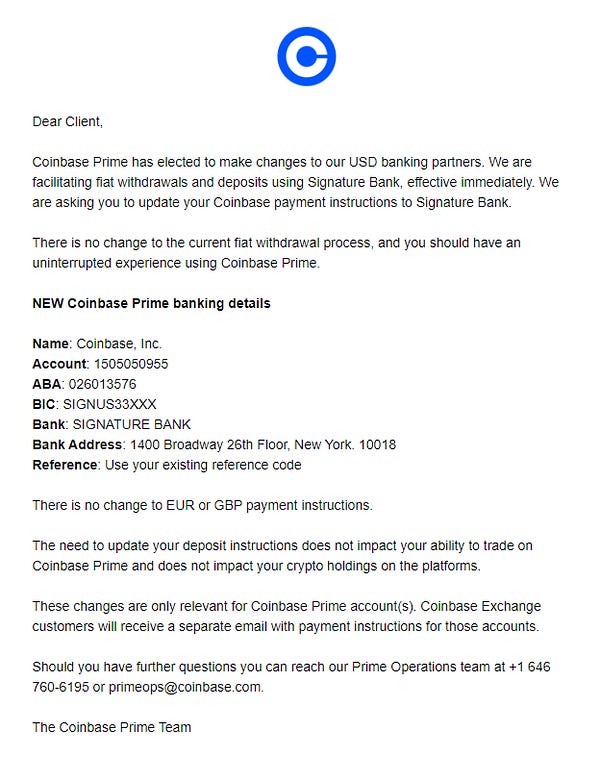

This week, Coinbase announced that it was switching to another crypto-friendly bank, Signature, to serve Coinbase Prime account holders.

Kraken, on the other hand, is withdrawing from using Signature bank to serve private customers. On January 22, Binance also reduced its exposure to retail customers through Signature, setting a new policy that only served customers who traded more than $100,000.

On Friday, Silvergate announced that it is suspending crypto payments.

“Effective immediately, Silvergate Bank has taken a risk-based decision to discontinue the Silvergate Exchange Network (SEN). All other deposit-related services remain operational,” Silvergate wrote in a statement released to the media.

It’s ETH Denver week.

Here’s a roundup of product launches this week so far:

Solana walks out… again.

After the network received a “significant performance degradation“, the network went into a secure mode that stopped processing transactions. Solana was then restarted by validators and came back up after 19 hours.

Developers still do not know the reason why the network went down.

Each is Solana close their shops in NYC and Miami.

Jito Labs, an MEV-focused research lab, states that over 30% of all Solana transactions are MEV spam attempts.

The wormhole bridge succumbed to an attack in February 2022 that saw 120K WETH ($321M) stolen. Since then, the hacker has been constantly mixing the stolen crypto through various Ethereum dapps.

According to one official Oasis blog post, whitehat hackers contacted the Oasis team on February 16 and demonstrated how to recover the money from the hacker thanks to a “previously unknown vulnerability in the design of the admin multisig access”. Oasis is a DeFi aggregator that was spun off as its own entity from Maker DAO in mid-2021.

Five days later, Oasis received an order from the High Court of England and Wales last week to retrieve the stolen assets.

So Oasis used their multisig and carried out a “counter-exploit” via one upgradable “proxy” smart contract, recovered $225 million from the hacker and sent it to an “authorized third party” likely to be Jump Crypto, the trading firm that recovered the funds last year. See Dan Smith’s article for a technical breakdown.

The good news: Some funds have been restored. The bad news: Oasis had a multisig-enabled backdoor to upgrade its code all the time, and regulators can rely on protocols to use them whenever they want.

What precedent does this set for DeFi?

Much to the delight of Bitcoiners and everyone else’s dismay, Gary Gensler declared last week that everything in crypto is a safe deposit box for Bitcoin.

The immediate response from Twitter was that Gensler’s opinion is just that: opinion. That crypto tokens are securities is a legal matter that has not yet been decided in US courts.

Nor does Gensler’s opinion reflect lawmakers in Congress. The Digital Assets Subcommittee, a body of Congress, is examines the SEC’s increasing aggressiveness and style of “regulation by enforcement” against the crypto sector.

Brian Armstrong writes on CNBC this week:

The UK, Japan and the EU have all made significant strides to close the gaps in existing EU financial services legislation by establishing a harmonized set of rules for cryptoassets… But while we see progress in other jurisdictions, the US seems more focused on turf battles between regulators. No other country in the world has spent so much time and energy trying to convince its citizens that crypto-assets are securities. The US is missing the forest for the trees.

To be continued…

Krakenthe safe, transparent, trusted digital asset exchange, makes it easy to instantly buy 200+ cryptocurrencies with fast, flexible funding options. Your account is backed by industry-leading security and award-winning client engagement, available 24/7.

👉 Visit Kraken.com to learn more and start your experience today.

Listen to the podcast episode | apple | Spotify | YouTube | RSS feed

-

📘 It’s open season at OpenSea

-

📘 5 Promising NFTfi Ops

-

📘 The new Stablecoin

-

📘 What’s new with ZKs?

-

📘 Bankless Token Ratings | March 2023

-

📘 First Base NFTs 🔵

-

📘 Game On: MetaMask x Unity 👾

-

📘 Surviving lower NFT royalties 💪

-

📘 Erotica comes to Blockchain with slimesunday

-

📘 A science-based approach to community building

-

📺 Is the CIA spying on crypto? with Annie Jacobsen

-

📺 Ledger CTO on how NOT to lose crypto

-

📺 ETHDenver with John Paller

-

📺 RegenPunk with Gregory Landua

Go Bankless. $22 / mo. Includes archive access, Inner circle & Divorced—(pay w/ crypto)

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or to make financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Mediation. From time to time I may add links in this newsletter to products I use. I may receive a commission if you make a purchase through one of these links. In addition, the Bankless authors have crypto assets. See our investment information here.