Cryptos at a crossroads

- Bitcoin price falls to an important Fibonacci level.

- Ethereum price shows the possibility of a mining rally.

- The Ripple price can be set up for a low to within the coiling range.

The crypto market is at a crossroads. The next move is likely to determine the trend in the coming weeks. Key levels are defined.

Bitcoin price on a road

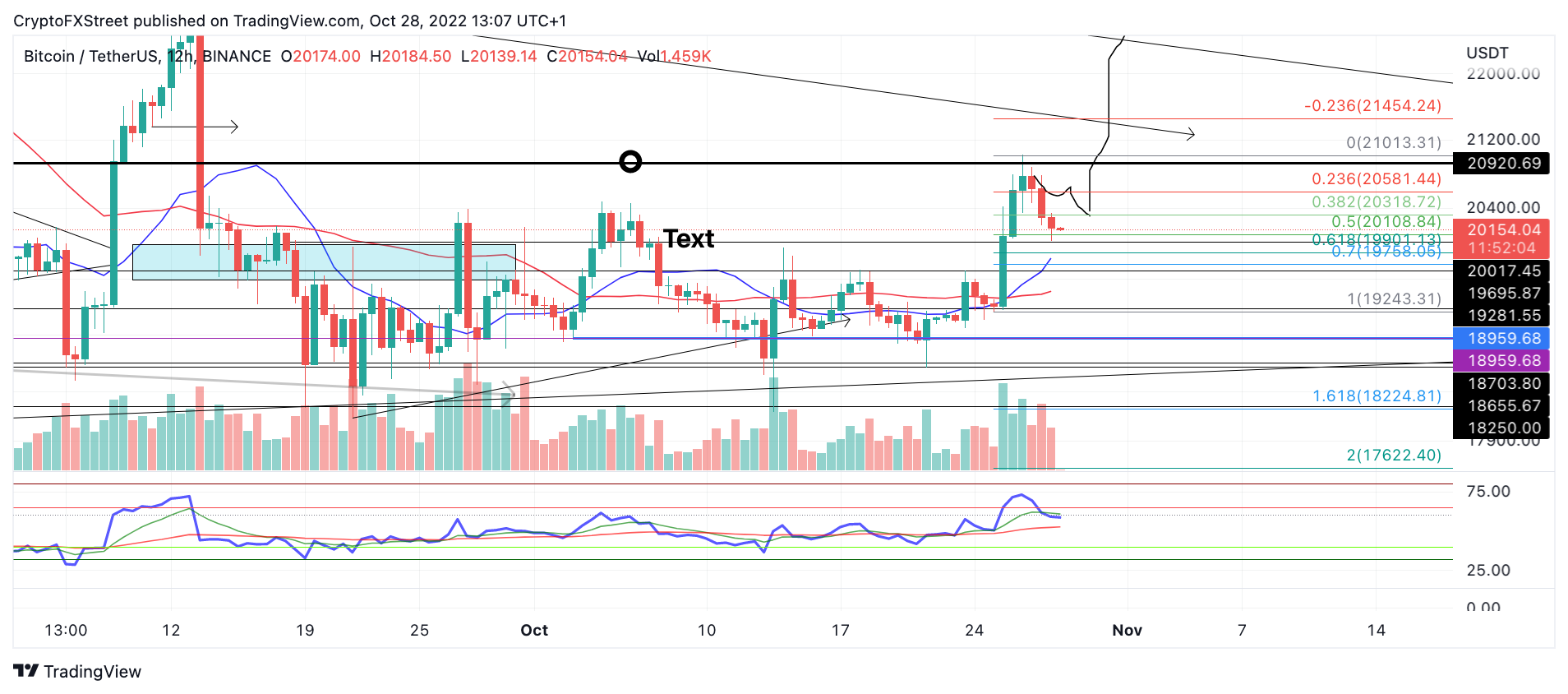

The Bitcoin price is currently trading at $20,503. After being rejected from the $21,000 level on Wednesday, October 26, the peer-to-peer digital currency fell 4%. As it hovers a few hundred dollars above its 2017 highs of $19,600, leaving investors wondering what will happen next?

Bitcoin price broke overbought conditions of the previous rally. If a bounce is to occur, a divergence between swing lows on the Relative Strength Indicator would be ideal for sideways bulls to enter the market. Currently, the RSI is not showing a divergence, but is coming down to test previous resistance zones as support. If the market is genuinely bullish, $22,000 could be the next target, assuming support is established soon.

The bulls have yet to test the 8-day exponential moving average (EMA) of $19,700 after breaking through it earlier in the week. A Fibonacci retracement tool surrounding the strongest part of this week’s rally shows the current selloff low as a 61.8% retracement. The bear’s ability to go lower will be worrisome for the health of the uptrend.

The bullish thesis would be invalidated if the swing low of $18,650 was marked. If the bears happen to re-mark that level, a further decline towards the October 13 low of $18,300 is likely to begin. Such a move would result in an 8% decline from Bitcoin’s current market value.

BTC/USDT 4-hour chart

In the following video, our analysts dive deep into the price action of Bitcoin, analyzing key levels of interest in the market. -FXStreet Team

Ethereum shows strength

The Ethereum price witnessed a 5% bounce on the last Friday of October. Ethereum, the decentralized smart contract token, fell to the mid-$1,390 level during the overnight session and rebounded on a surge in volume from New York’s opening bell.

Ethereum price auctions at $1,545. If the market is genuinely bullish. ETH’s price should head towards the $1,600 level over the weekend. Traders should hold on to the decentralized smart contract token that has yet to test the rising trend channel that broke through earlier this week. A break below the $1,450 swing low could trigger a sell in the lower half of the $1,407 trend channel.

ETH/USDT 4-hour chart

In the following video, our analysts dive deep into the price action of Ethereum, analyzing key levels of interest in the market. -FXStreet Team

The XRP price could print a new low

The XRP price is in a challenging situation. As the trading range winds down from the October highs of $0.54 to the lows of $0.42, most of the trading has taken place near the lower half. The digital remittance token remains submerged as low volume continues to signal a bullish lack of interest.

XRP price auctions at $0.4676. An optimistic signal is that the 8-day exponential moving average has provided support, enabling Ripple’s ongoing 3% bounce. The bad news is that the 21-day simple moving average rejected the price earlier, and the volume showing doesn’t look significantly different from Ripple’s previous attempt.

A failure to bar the 21-day simple moving average of $0.48 could lead to a sweep-of-the-lows event targeting $0.41. Such a move would result in a decline of 11% from today’s market value.

Invalidating the bearish idea is a break above the October 27 swing at $0.48. If the bulls manage to regain the $0.48 barrier, an additional rally aimed at the September highs of $0.56 could occur. Such a move would result in an 18% increase from the current XRP price.

XRP/USD 4-hour chart

In the following video, our analysts dive deep into the price action of Ripple, analyzing key levels of interest in the market. -FXStreet Team