Crypto winter risks turning into an ice age

After a spectacular crash earlier this year, the crypto industry’s most popular tokens have gone dormant, suggesting that amateur investors have fallen out of love with the once exciting asset class and large funds have decided to stay away.

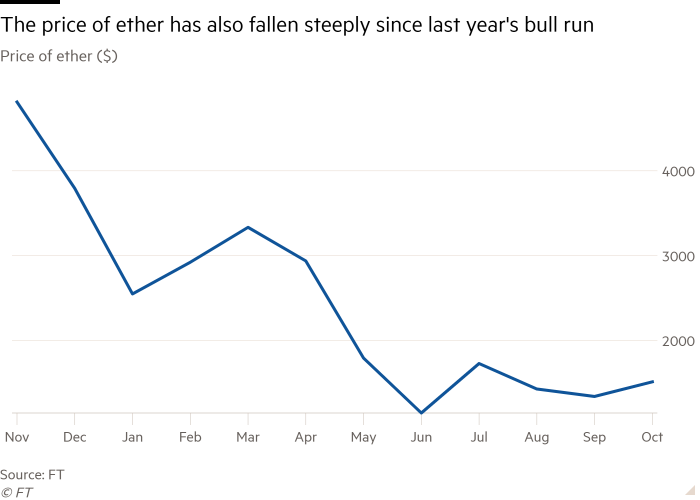

The price of the largest token, bitcoin, has largely hovered around $20,000 now since August, after peaking a year ago near $70,000. Ether, the second largest, has failed to rally since the environmental overhaul in September. Average annual volatility for bitcoin is now the lowest since October 2020, according to analytics platform CryptoCompare.

Initially, the drop in token prices was labeled a “crypto winter” – one of the market’s periodic falls. But the length of this now dismal phase, coupled with thousands of job losses in the sector in recent months, suggests this is more of an ice age, with no grand theories emerging as the next rallying fuel.

“The narrative silence is deafening,” said Edmond Goh, head of trading at crypto broker B2C2. “Eventually there will be a story that will [break the impasse] — perhaps inflation or a major regulatory announcement. Maybe something completely unexpected.”

CoinShares describes this as an “apathetic period”.

In part, crypto has suffered the same malaise as other highly speculative asset classes since it became clear almost a year ago that US interest rates would have to rise quickly to tackle sticky inflation.

The technology-heavy Nasdaq stock index in the US has fallen 30 percent over the past year – one of the worst performers across developed markets. But bitcoin’s nearly 70 percent fall over the same period is steeper, and May’s collapse of the token luna, and the related so-called stablecoin terraUSD, cost investors about $40 billion and shook confidence in crypto deeper. The industry’s market value has shrunk from $3.2 million to less than $1 billion.

Thousands lost their jobs after exchanges including Coinbase and Gemini cut large parts of their workforces, while crypto hedge fund Three Arrows Capital and lending platform Celsius Network have collapsed into bankruptcy. High-profile senior executives across the industry have also resigned, including former industry executives Jesse Powell of Kraken, Michael Saylor of MicroStrategy and Alex Mashinsky of Celsius.

The flat price has deterred speculators, leaving the market to long-term bulls. Known in the industry as “Hodl-ers” – short for Holding On for Dear Life – they seem to be doing just that. Morgan Stanley estimated this week that 78 percent of all bitcoin units had not been used for any transaction in the past six months, a record amount.

Aside from the tougher interest rate environment, some of the key arguments underpinning crypto have been proven wrong. El Salvador’s experiment with bitcoin as an official currency has fallen flat, while crypto has failed as a hedge against inflation – prices have fallen even as inflation in developed economies has approached 10 percent.

“[Bitcoin] has not acted, over the last couple of years, as an inflation hedge or as a store of value,” said Alkesh Shah, digital asset strategist at Bank of America.

Even a successful shift away from energy-intensive crypto mining to a carbon-light alternative has not helped to lift spirits. In September, the Ethereum network performed the so-called Merge, jumping to a greener blockchain. The move has cut the network’s energy use by about 99 percent, but it has yet to trigger an increase in the value of ether, the token associated with the blockchain.

The pain for others may not be over yet. Crypto miners, who typically use computers to solve puzzles in return for tokens, are also feeling the pressure. While they must continue to spend ever-increasing sums of money on energy, the symbol they are rewarded with is depressed.

US-listed mining company Core Scientific warned this week that it could run out of cash by the end of the year and have to file for bankruptcy, sending shares down more than 70 percent. In a regulatory filing, the company blamed the low price of bitcoin, rising electricity costs and litigation with now-bankrupt lending platform Celsius.

Despite falling value, some are still optimistic. Dan Ives, CEO of Wedbush Securities, said “this has been a brutal period for risk assets including crypto . . . but the asset class is here to stay”. However, he also said that “blockchain and multiple use cases are key to looking ahead” .

In August, Coinbase announced a deal with BlackRock to give the asset manager’s clients access to digital assets in a move seen as a potential watershed for crypto’s mainstream hopes. The asset management giant said it “continues to see significant interest” from institutional clients despite the market’s slowdown.

Nasdaq, Mastercard and BNY Mellon have also announced crypto services in recent weeks, bolstering the argument that institutional interest in digital assets remains despite this year’s crash. But it may take some time before the interest turns into something more permanent.

“There are no fundamentals underlying crypto, or to the extent that they exist, they have not been identified yet,” said Charley Cooper, CEO of blockchain firm R3. “The idea that we’re suddenly going to see a spectacular bull run before the broader economy gets a foothold, I think is fanciful.”