Crypto to move closer to TradFi infrastructure

The main consequence of recent falls in crypto prices will be that the market is moving closer to the infrastructure of traditional finance according to research from Acuiti, a management intelligence platform.

Half of the respondents, 50%, in the second Acuiti Cryptocurrency Derivatives Management Insight Report believe the main consequence of the decline in crypto values will be that the market moves closer to the TradFi infrastructure. Bitcoin has fallen to between $19,000-$23,000 since mid-June, from a peak of more than $65,000 last November, wiping $2 trillion off its market value, according to the report.

In addition, the majority of respondents, 59%, expect that a stricter regulatory approach will be the main effect in the medium and long term. The research is based on the views of the Acuiti Crypto Derivatives Expert Network, a group of top executives from around the world from hedge funds, banks, brokers, prop traders, asset managers and exchanges.

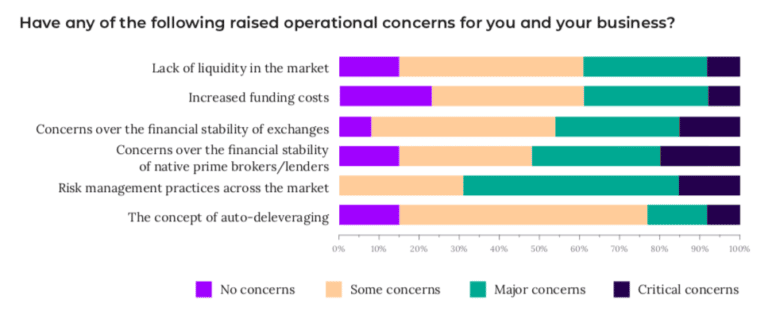

The fall in valuations and the collapse of crypto hedge fund 3 Arrows Capital which required bailouts of associated firms have raised questions about how crypto markets work. The survey found that the most critical concerns were financial stability of lenders and native primary brokers and risk management practices.

Source: Acuiti

“Ultimately, the systemic impact of the collapse of a relatively small lender across the market reflects not only the need for regulation, but also the risks arising from the significantly lower levels of capital committed to support the digital asset market compared to traditional financial markets,” the report added. “There is a noticeable cooling on native crypto providers in their present form, as demonstrated by the concerns about the financial stability of stock exchanges and native brokers and lenders.”

However, the report also highlighted that it is noteworthy that most companies in the market have withstood the shock.

The majority of the network, 58%, also believe that banks will play a strong role in permissioned decentralized finance (DeFi). However, a third, 35%, expect banks not to engage in DeFi at all in the future.

Enhanced Digital Group

Increased institutionalization was demonstrated by Enhanced Digital Group (EDG), which provides structured products to institutions in digital assets, raising $12.5 million in a seed funding round in May this year.

Genesis is proud to announce its investment in Enhanced Digital Group, which aims to provide institutions with structured products and derivatives trading solutions that meet the suitability characteristics of a diverse crypto client base.

Full release: pic.twitter.com/jhFv4Fd1ys

— Genesis (@GenesisTrading) 26 May 2022

EDG was founded by bankers from traditional finance, including Chris Bae, a former member of the management and investment committee of UBS’s $40 billion-plus alternative investment group. He also led valuable currency options and equity derivatives trading at Goldman Sachs and Bank of America Merrill Lynch.

Bae, CEO of EDG, told Markets Media that the firm was based on the thesis that the asset class would institutionalize. He said: “We structure derivatives packages to help solve asset and liability errors in the cryptocurrency universe, and we definitely don’t see anyone else like us today.”

He continued that when the business started in October 2021, institutions could only invest in coins, and EDG felt that a variety of products needed to come to market for institutions to address individual liability perspectives or time horizons.

Chris Bae, EDG

“We saw a lack of financial engineering in the space,” Bae added. “We wanted to build products in a regulatory way, and that has become very important.”

The volume of incoming requests from around the world has grown remarkably according to Bae as crypto values have fallen and volatility has increased.

“In all markets, not just crypto, investors have a Cinderella moment when they think ‘I’ll get out before midnight'” he added.

EDG operates under the derivatives regulation in the USA Commodity Futures Trading Commission and part of the funding round will be for regulatory capital.

“That’s a big differentiator for us as CFTC swap exemptions require regulatory capital to be kept unencumbered, and that’s what we’ve done,” Bae said. “What’s really exciting for us in the next 12 months is that things that need to evolve in the institutional ecosystem are happening.”

For example, there is a lack of credit delivery in crypto, with no traditional financial products such as repos, and new players are entering the market to fix this gap.

Bae compared the current crypto markets to frontier markets in traditional finance, which are a level below emerging markets. He added: “It affects how you manage risk, size and express trades.”

EDG’s funding round was led by WebN Group, a research-based incubator backed by Alan Howard, and Genesis, with additional investors New Form Capital, Nexo Ventures, Kenetic, BH Digital, Tribe Capital and IntoTheBlock founder Jesus Rodriguez.

Joshua Lim, Head of Derivatives at Genesis, said in a statement: “As the cryptocurrency and blockchain environment continues to mature, we have observed a growing need for crypto-native firms able to bridge the gap between traditional markets and this new financial ecosystem. EDG fills this gap by developing tailored strategies and financial products for institutional and retail investors that match their unique needs.”