Crypto Recession Strategy: Staking Litecoin (LTC-USD)

vadiko/iStock Editorial via Getty Images

In a previous non-crypto article, I provided the rationale for why I suspect a recession is likely just around the corner. One of the more simple reasons I can give is that the federal Reserve is now openly acknowledges a possible recession as well. Many of the traditional metrics that investors have noticed leading to a recession are showing some warning signs. For the sake of this specific article, I will not repeat the entire thesis from my previous work. But the main points are as follows:

- The 10 minus the 2 is deeply inverted

- We had two negative real GDP pressure quarters in 2022

- Inflation-adjusted retail sales peaked two years ago

- Consumer sentiment is dire

In my view, these factors taken together can certainly justify moving portfolios to more than one risk strategy. For crypto investors, this is something that should also be considered. The problem for market participants in this industry is that we don’t have a large amount of historical context to guide us because most of these assets are less than 10 years old. Furthermore, the crypto response to the 2020 recession is unlikely to repeat itself unless there is a major and immediate pivot to central bank easing. While I won’t get into the likelihood of that happening, I will say that there are things we can do within crypto rails to play defense.

The stablecoin problem

One of the easiest approaches crypto investors can take right now is to allocate to stablecoins. There are several to choose from, but the overwhelming majority of them still require a centralized custodian bank that has traditional bank rails for collateral. My personal preference is not to use these strategies because of the counterparty risk. Especially heading into a recession where financial institutions potentially have collateral that is underwater.

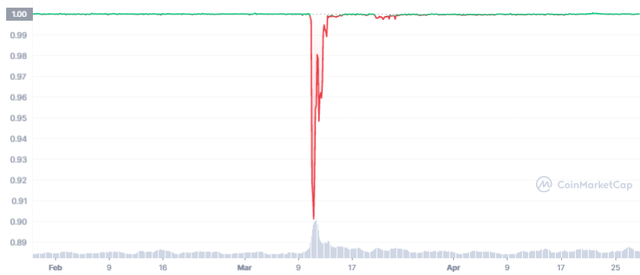

USDC Peg (CoinMarketCap)

In mid-March, we saw how exposure to traditional bank rails could lead to significant problems in the crypto market when USDC (USDC-USD) briefly settled by more than 10%. One of the most popular decentralized stablecoins is Dai (DAI-USD), and even that coin was not immune to banking panics because it is backed by the USDC to a large extent:

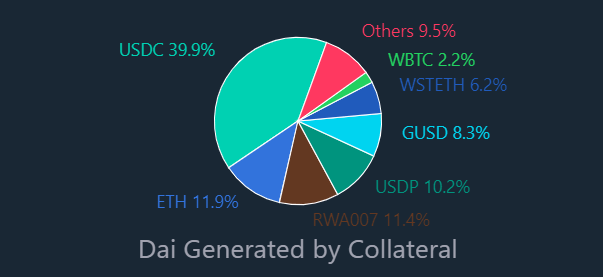

DAI security (Daistats)

40% of DAI’s collateral is USDC. When USDC’s peg broke, so did DAI. While there are other decentralized stablecoins being developed on blockchains like Cardano (ADA-USD) that are very interesting, most of these coins are still experimental and subject to peg risk.

Litecoin is still solid

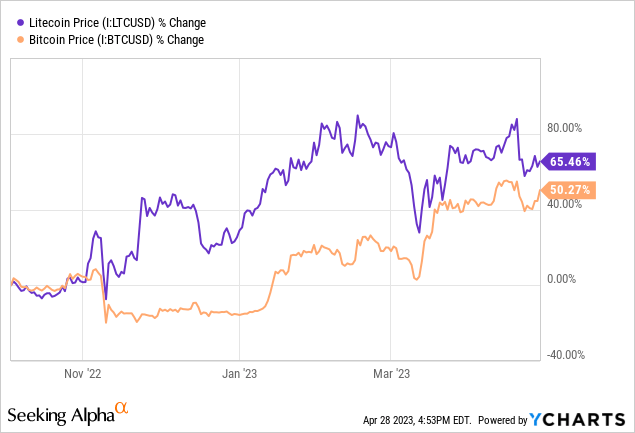

Back in October, I wrote what I felt was a strong contrarian view on Litecoin (LTC-USD). Litecoin is a proof-of-work fork of Bitcoin (BTC-USD) that many in the crypto investment community choose to ignore. My view since October has been that skipping LTC out of some nonsensical Bitcoin fervor is foolish, and diversification into crypto makes sense.

Not only has Litecoin increased by more than 65% since that article was published, but it is also the only top 10 tier 1 crypto to beat BTC in the last 6 months. Much of what I talked about in the October article still applies today. It remains one of the most distributed coins in crypto and one of the most used for payments according to BitPay.

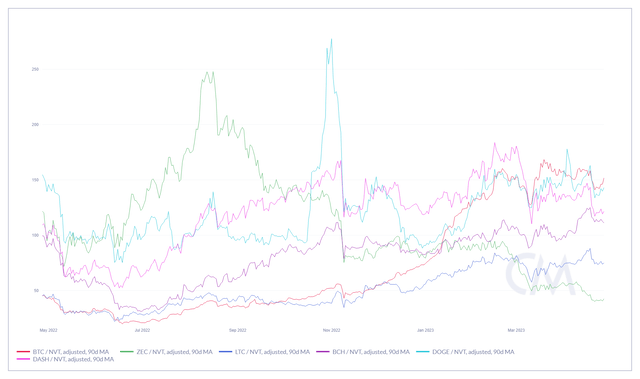

90 day adjusted NVT (CoinMetrics)

From a pure network valuation standpoint, only ZCash (ZEC-USD) is cheaper from a 90 day adjusted NVT ratio. The question for Litecoin bulls is how do you manage your holdings in a downturn if the valuation in the broader market is elevated and you prefer not to switch back to fiat or other cryptocurrencies? You can adopt a betting strategy to generate returns without giving up control of your keys.

How to Stake Litecoin

Although Litecoin is a proof that blockchain works, it is possible to deposit LTC and return benefits in kind. The most popular ways to do this have historically been through centralized units such as Celsius (CEL-USD) or Nexo (NEXO-USD). However, there are obvious drawbacks to this approach, and Celsius did not survive the crypto winter. These depositors are still waiting to get back part of their funds. Giving up control to a non-transparent, centralized custodian is not what I’m suggesting.

THORChain (RUNE-USD) allows Litecoin holders to deposit LTC on the chain and earn benefits in kind through the THORFi “savings vault.” These vaults differ slightly from THORChain LPs because the asset deposits do not require RUNE exposure to qualify for rewards:

Savers Vaults are a key innovation for THORChain and the first decentralized product to offer returns on native Bitcoin and many other native assets. Users anywhere in the world can enter and exit THORChain Savers Vaults at will and receive returns without the need for wrapping, permanent risk of loss or price exposure to multiple assets.

The difference between staking collateral through a proof-of-stake chain and doing so through THORChain is that PoS stakes typically generate returns from token emissions while THORFi savers are more like LPs for THORChain swaps. In the main, the return comes from fees that users pay when they switch between chains. This results in an APR that fluctuates, but returns can often be higher than US Treasury bills.

| resource | Saver’s Depth | Saver filled | Saver APR |

|---|---|---|---|

| BTC | $20.35 million | 100.68% | 3.41% |

| LTC | $741.95K | 54.45% | 5.22% |

| DOGE | $224.61K | 22.64% | 7.46% |

| BCH | $203.95K | 33.65% | 4.30% |

Source: THORChain Explorer, PoW Coins

For Litecoin specifically, the coin’s annual inflation rate is currently 3.7%, meaning that the THORFi saver pool is currently generating a 1.5% real return in the original asset if demand for the coin remains constant. This also does not take the halving into account. Much has been made of Bitcoin’s halving, which is about a year away. Litecoin also has an impending block reward halving, but that halving is less than 100 days away.

After that event, the annual LTC inflation rate will drop to 1.8%. Assuming THORFi savings vault APRs remain in line with current levels, LTC’s THORFi real investment return will jump to 3.4% of the original asset.

Risks with THORFi

Of course, the returns don’t come without trade-offs, and one of the biggest risks inherent to any on-chain DeFi application is the loss of funds through hot wallet phishing scams or a major network hack. When you provide liquidity through something like THORChain, the liquidity pools generate synthetic assets. What this means is that when a user deposits LTC into the THORFi savings vault, that user actually has a claim on the LTC deposited rather than full control of the original asset. The THORFI savings program is also variable interest. So as the pool depth increases, the reward associated with betting through the pool may decrease. Since the savings vaults pay out switching fees to liquidity providers, more liquidity chasing lower fees can also reduce returns.

Crypto goods

There has been no shortage of cases recently where the Securities and Exchange Commission has designated various cryptocurrencies as unregistered securities through enforcement actions. Despite Dash (DASH-USD) serving as a notable recent exception, the common thread shared by most of the SEC’s securities designations is that the coins had an ICO and are native to proof-of-stake chains. Litecoin never had an ICO. In a recent lawsuit against Binance (BNB-USD), the CFTC claimed that Bitcoin, Ethereum (ETH-USD), and Litecoin are all commodities.

While I think we’re probably still quite a bit of time and litigation away from the US market getting better clarity on digital asset designations, it’s hard for me to imagine the SEC trying to argue that LTC is an unregistered security since it’s a proof of work coin with no centralized issuer and no initial coin offering. In the event that the courts find that a large majority of crypto market coins are unregistered securities, it could position LTC quite well as a digital commodity that is a cheaper alternative to Bitcoin.

Summary

This THORFi approach to returns is not a strategy that everyone will do, nor is it a strategy that everyone will be able to do. The savings vaults have depth levels and program completion targets. The Litecoin vault is only 54% full and has the second best return of the PoW THORFi offerings. For a more defensively themed cryptocurrency portfolio, finding safer return opportunities without losing keys is an attractive option.

There are not many individual assets or asset classes that perform well in a recession. Crypto is probably not an asset class that will have many winners in a recession, and that is if it has any winners at all. However, Litecoin specifically has a halving coming up in the near future. It is a coin that has legitimate utility as a decentralized payment network. Long-term crypto holders who do not want to convert back to fiat, but want to position themselves defensively, can use THORFi savers to generate in-kind returns on LTC positions while waiting for a downturn.