Crypto prices under pressure – Here are 10 ways to protect your wealth from the Fed

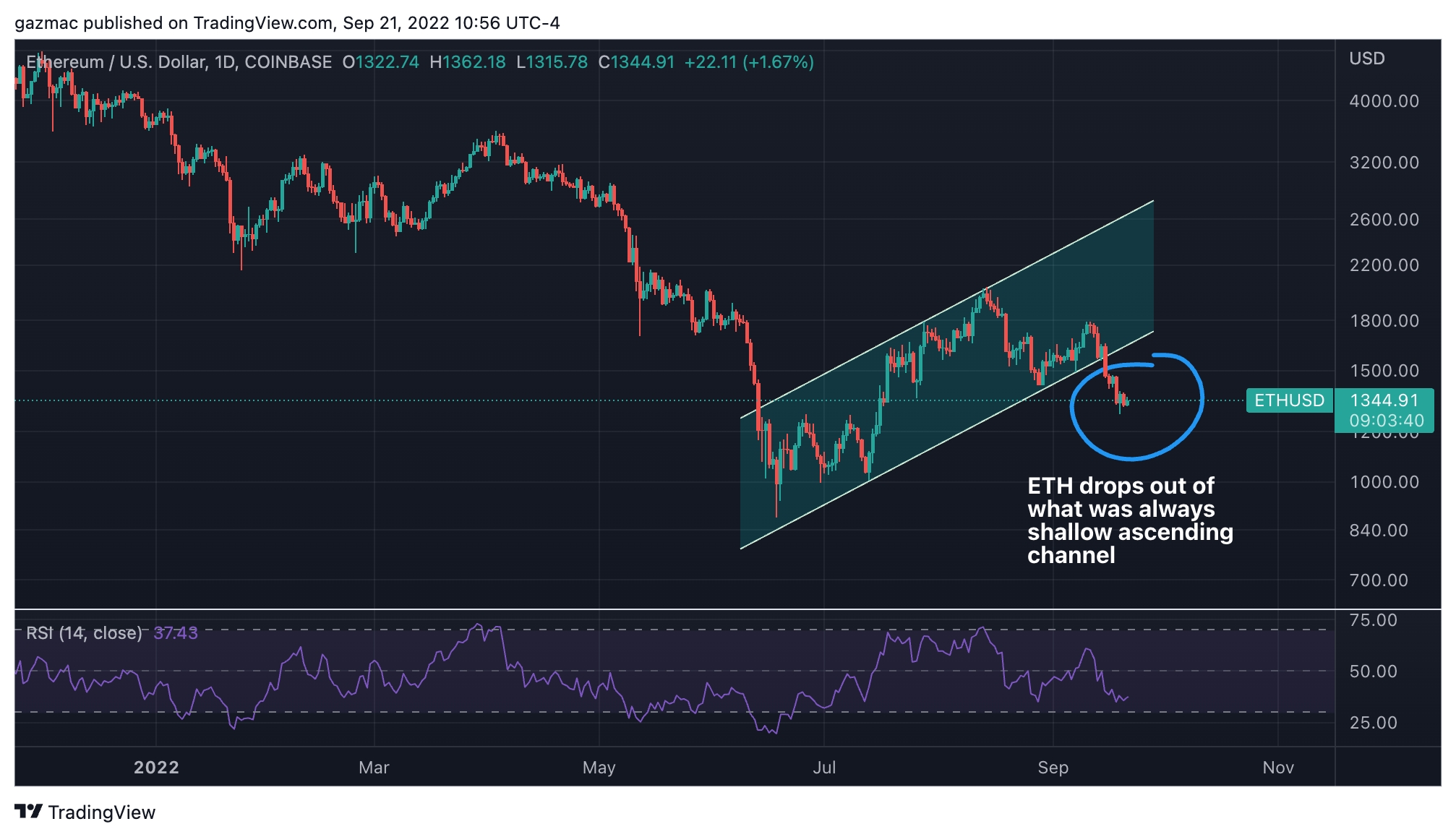

Crypto prices are telling us that a storm is coming if it isn’t already here, so the sensible thing to do is batten down the hatches.

But what does it mean for the market players in the cryptocurrency space? What measures can and should you take to preserve your wealth?

Increasingly, it looks like the US Federal Reserve FOMC will raise interest rates by a minimum of 0.75%, with 1% a distinct possibility.

Crypto investors have never before been so fixated on the price of borrowing money, or at least not when it comes to the old kind of money we know as fiat.

The circulation of goods and services naturally depends on the wheels of commerce being oiled by an abundant supply of liquidity. But too much of that liquidity in the wrong places can cause problems, one of which is inflation.

Inflation is the most obvious sign of malaise that crypto followers will be quick to shout, we told you – all the fun QE money just set off the crisis.

But the storm is such that it is and will engulf everything before it, including crypto, so how to prepare to weather it?

1. Not realizing your losses

The first rule of investing also applies to crypto – don’t realize your losses by selling. We will moderate this later, but as a general rule do not sell unless you have to.

For sure, your favorite portfolio management tool will flash red. But if you are happy with the case to invest in all these coins you have, then stop firing up the app on the hour every hour and let it rest. Maybe turn off some of those watchlist notifications too.

As he often does, legendary investor Warren Buffett sums it up nicely:

“The first rule of an investment is no loss [money]. And the second rule of an investment is don’t forget the first rule.”

2. Time in the market no timing the market

Another useful saying to be aware of at this point is the ultimate folly of trying to decide when to enter and exit the market. Normal practice for the herd is to buy at the top and sell at the bottom.

The smart investors do the opposite, they try to buy at the bottom – or at least when others are fleeing the market and decimate prices – and sell at the top.

That is not to say that you should sell everything, go into cash and then wait for when you think the bottom is in.

Even Wall Street’s finest can’t get these calls right, and they charge you top dollar for their active mutual funds that claim they can.

The best strategy is to stay in the market, but to adjust and rebalance, which we talk about further down.

3. Become a cryptocurrency investor

Warren Buffett is the classic value investor, and that’s one of the reasons why he hates crypto with a vengeance.

He doesn’t know how to measure value in crypto as there is no earnings and allegedly therefore no net income and dividends to be paid to shareholders.

Maybe it’s generational bias, but there are plenty of crypto companies and assets that produce income and pay dividends, so much so that the SEC has knocked on the door of some of these entities, or will – here you are looking at your Ethereum Foundation!

So there are fundamental things that can be valued, which ultimately lie in the value a network represents, be it data storage, gaming, value transfer, etc.

So the value investor looks for companies, or in our case coins, that are undervalued by the market. You could say it’s a tough call because everything is undervalued right now. True to some extent, but some more than others.

Is BNB coin undervalued?

Exchanges like Binance Coin (BNB) are hugely undervalued, for example, it could be argued, given that Binance is likely to emerge from this crypto winter as an even bigger and more dominant exchange than it already is.

Is Ethereum Undervalued?

Ethereum, it can be argued, is also a contender as a uniquely undervalued network, given the success of the Merge upgrade.

Admittedly, much more needs to be done before Proof of Stake is a meaningful reality for end users, but in the eyes of a value investor, Ethereum has just become a cash cow for the network’s validators.

Gaming is a sector where revenue is generated by a variety of networks and the games that run on them. There is no indication that this trend is slowing down – on the contrary, it is likely to accelerate.

So in addition to some of the network-level plays, like Decentraland and The Sandbox, there are new kids to watch, like Battle Infinity and Tamadoge.

4. Be a bottom-up investor

Don’t be too dogmatic in your approach. Even if you use the value approach and you have a bias towards certain sectors and sub-sectors, don’t let that blind you to a really good prospect.

Bottom-up investors take each case as it comes, analyzing companies on an individual basis, even if they operate in a sector that is considered unfavorable. We can use the same approach when it comes to crypto.

You may have decided that cross-border crypto payments at a commercial level are going to be pushed by the use of central banks’ digital currencies, but does that mean you should reject all opportunities in that area.

What if Ripple wins its lawsuit? There could be a big increase in the price of the XRP token and it could see the adoption rocket as one of the leaders in the space.

5. Banish short-termism

The difference – or at least one of them – between a speculator and an investor is time.

The speculator is looking to make a quick buck while the investor takes a longer view, will typically be measured in months and years rather hours and days when it comes to the speculator.

Warren Buffet once famously said:

“The stock market is a device for transferring money from the impatient to the patient.” Remember that is also true in crypto.

6. Run your winners

Unfortunately, many investors do not do the rational thing. As soon as a position goes into profit, the temptation to knock it is strong.

On the face of it, it may seem like a sensible approach, but more often than not, investors will close out winning positions prematurely, only to miss out on huge future profits.

Certainly at times like this, when the market is moving as one on a downward trajectory, it doesn’t seem like much to choose between winners and losers.

However, in your overall portfolio allocations, there will be better performers than others – they may still be the ones that are going to contribute the most to future returns.

7 … cut your losses

Another way human psychology acts against the smart crypto investor’s best interests is when our heart makes us attached to a losing position.

We said earlier not to realize losses by selling, but sometimes it makes sense if the situation cannot be recovered.

There are some coins that are cheap for a reason – in fact there are thousands of them among the 20,000 or so listed by coinmarketcap.

Perhaps the technology is beyond redemption, the path to user growth is irresolvably blocked and the business model shot to pieces. If so, get out.

8. Capital preservation with passive income

When billions evaporate from the markets daily and inflation runs rampant, it starts to feel scary. Where can you park your cash and prevent it from devaluing?

The answer used to be government debt (treasury bills) and savings accounts. But savings accounts still pay a pittance, and the only bonds worth buying are Treasury inflation-protected securities, or tips as they’re called.

Fortunately, there is a safe haven for your wealth to be found in crypto – staking.

Staking may have gotten a bad name after a bunch of crypto lenders imploded triggered by the TerraUSD debacle. However, not all efforts are the same.

Staking your coins to secure a valuable network is different than throwing them into the black box of tricks that underpinned the algorithmic financial engineering of the TerraUSD non-stable stablecoin.

Bet with a network that has demonstrable traction like Ethereum

Admittedly, betting on Ethereum requires you to have a minimum holding of 32 ETH, which is the threshold to become a validator and may be beyond the ability of many.

That will earn you enough – around 12% by some estimates if you include the burn effect that all ETH holders benefit from – to beat inflation at today’s rate.

However, you can leave your ETH to intermediaries of some kind who will bet on your behalf, so you will receive less return, but it will still be far better than a savings account.

And there are alternatives to Ethereum – but go for the protocols and service providers with the deepest pockets.

These devices may not have the best ROI, but they are much less likely to fail. Many of these intermediaries will be found among the larger, more established crypto exchanges, such as Kraken, Coinbase and Binance

9. Look at the whole picture (other asset classes)

Professional investors say that, along with compound interest, asset allocation is the key to investment success.

To this way of thinking, it’s not so much which stocks or coins you invest in, as much as which asset class weights (percentage of holdings) you choose for your portfolio.

From a crypto investor’s perspective, that means asking some hard questions about what percentage of your wealth is in crypto, and is it an amount you feel comfortable with in relation to your own risk profile.

To state the obvious, if crypto is 5% of your net worth, you’re going to have a different attitude to a 20% drop in the total market value of the asset class than you are if you have 50% of your wealth tied up. up in crypto.

If you have money on the sidelines, a crash is a big possibility

If you have cash on the sidelines and relatively small amounts tied up in crypto, market crashes are big opportunities.

Still, if you’re on the other end of the spectrum and are all in when it comes to your net worth, then even if your best bet is to hold on, after the winter is over, look back and remember how you felt then and put for some diversification to your portfolio by investing in other asset classes.

A crypto core with some larger satellite holdings might be preferable – and keep your blood pressure under control next season explosion.

10. Don’t panic

Easier said than done. The best way to avoid panic decisions you’ll later regret is to have a plan. Hopefully we have come up with some tips in that regard.