Crypto prices jump as FTX searches for rescuers, the tow peg slips, the risk of infection increases

Crypto prices jumped today, but how long can the deadline last and will FTX survive?

Well, the game isn’t up for FTX just yet, as various reports suggest that the crypto exchange teetering on the brink of bankruptcy is in talks with investors as it seeks a bailout deal.

Now the market players are worried that infection could spread like wildfire.

However, there was some reprieve for crypto prices today as US CPI inflation numbers turned weak, leading to a burst in stock indexes, with the Nasdaq Composite jumping 6%.

Bitcoin reversed losses for the day and is up nearly 1% at $17,756.

US CPI inflation a tipping point for cryptocurrency crash?

Inflation eased to an annual increase of 7.7% in October from 8.2% the previous month, with both headline and core readings below the median of economists’ forecasts.

It was taken as a sign that the worst may be behind us, which would be good news for crypto.

The rally could buy valuable time for FTX founder and CEO Sam Bankman-Fried (SBF), even as US regulatory agencies circle and the exchange’s legal team flees the sinking ship

He tweeted about two hours ago, in a long thread, that the company was in talks with a number of players regarding LOIs [letters of intent] and termark.

SBF claimed that FTX.US, the exchange for US clients, was “100% liquid” and “not affected by this shitshow”:

The rest of the exchange – which operates under the FTX International brand – is the business staring insolvency in the face.

Today, FTX.com posted a message on its website that reads: “FTX is currently unable to process withdrawals. We strongly advise against depositing.”

SBF has also made it known that Alameda Research has ceased trading and will close. It also turns out that FTX.US will also stop trading in a few days, but SBF says withdrawals will remain open:

Justin Sun, founder and CEO of crypto project Tron, is believed to be in talks with FTX. He tweeted earlier today that all holders of Tron-based tokens on FTX would be made whole.

However, it is unlikely that Sun will have the resources to advance as much as the $4 billion that FTX needs to cover its immediate obligations. The total hole in the FTX balance sheet is estimated to be in the order of $8 billion.

Crypto contagion: Tether hit by $700 million in redemptions, Coinshares loses $30m, Sequoia $150m

Meanwhile, stablecoin Tether at one point fell to $0.96, losing its 1:1 peg to the US dollar. It has since recovered, but as much as $700 million was redeemed today.

When the link slips, those seeking redemption can make money, as Tether must honor the link regardless of the market rate.

Elsewhere, longtime crypto fund manager Coinshares revealed it was on the hook for $30 million in losses related to FTX, while Sequoia Capital wrote down a $150 million loss.

There are currently no signs of contagion in other asset classes, namely shares, although the Robinhood share has fallen in recent days due to the stake that SBF took in the online brokerage house. Robinhood stock is up 7% today.

The Kaiko research team emphasized the consequences of the collapse of FTX and why it has had such a profound impact on self-esteem. Kaiko wrote in an email comment:

“FTX’s collapse has shaken the industry to its core, in part because it is a fundamentally different type of business than a crypto lender like Celsius. FTX is a cryptocurrency exchange. The service it provides is a facilitator of trades: they earn a transaction fee for each trade executed by one of their customers FTX is neither a trading firm nor a lender so theoretically they should at all times have access to the equivalent of 100% of the customer’s funds.”

The fact that FTX cannot meet deposit withdrawals is an indication of the likelihood that it has used client funds in its own trading and lending activities.

And worse, some of that lending activity looks strong as it was for sister company Alameda Research, effectively the trading arm of FTX.

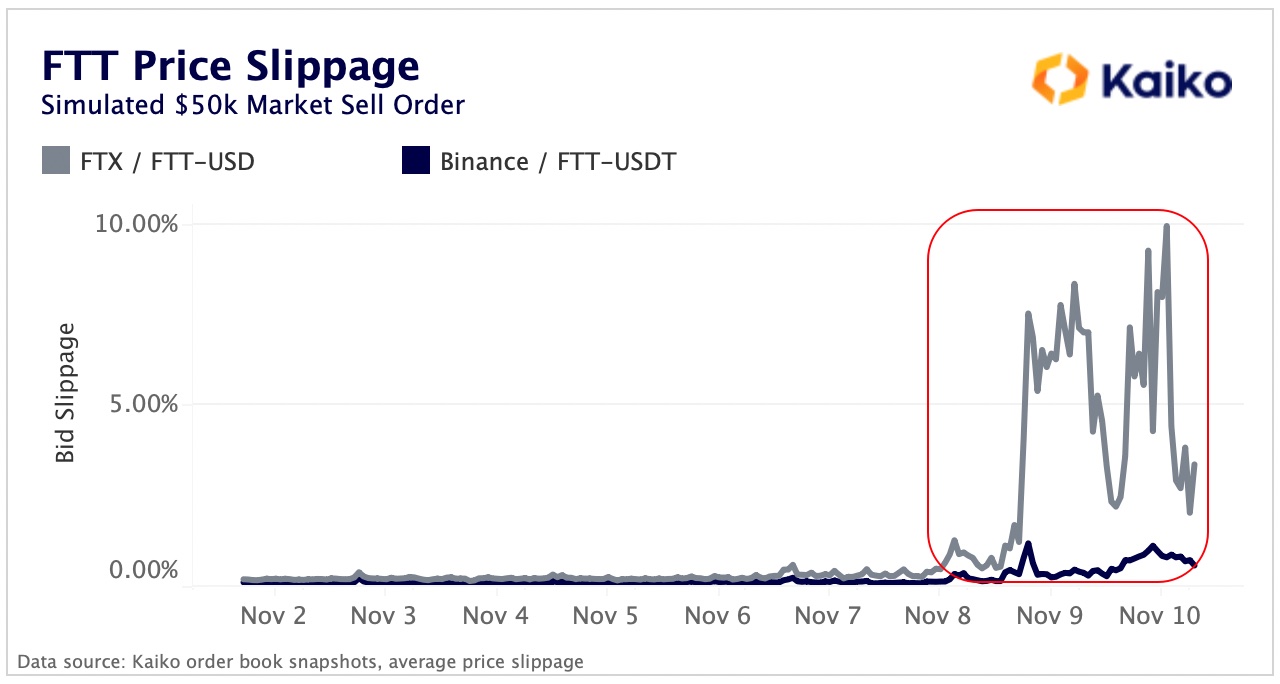

The great speed of the collapse is also shaking the industry. On November 6th, the FTT price slip – the difference between a market order and the price actually paid – began to appear, then ballooned on November 8th and became stratospheric on November 9th.

Put some money to work with these promising pre-sale symbols

A couple of coins that may fit the bill in that regard are Dash 2 Trade which is a trading analytics and signals platform with a pre-sale access token called D2T.

‘Bloomberg Terminal for Traders is built by traders for traders and is supported by the team at Learn 2 Trade, which already has a community of 70,000 traders.

D2T has already secured a listing on the LBank stock exchange after the pre-sale ends.

You need to buy early to get discounted prices as there is a 10 stage price ladder. D2T is priced at $0.0513 and is in its third phase.

The other is RobotEra, which is similar to The Sandbox, but where you build planetary worlds using robots.

The TORA token presale began yesterday and the token is priced at $0.020, but as with D2T there is a price ladder so early birds can get a discounted price today. RobotEra is supported by LBank Labs.

Buy Dash 2 Redeem Pre-Sale

Buy RobotEra in pre-sale