Crypto prices could rise this week as the Federal Reserve’s interest rate decision approaches

Prices of major cryptoassets could pump hard this week if the US Federal Reserve even hints at slowing the pace of interest rate hikes later this year.

The expectation that markets could rally this week leading up to — and potentially after — the Fed’s interest rate announcement on Wednesday is shared by both investment banks and members of the crypto community. But there are still different opinions about what a rally will look like and what it will take to make it happen.

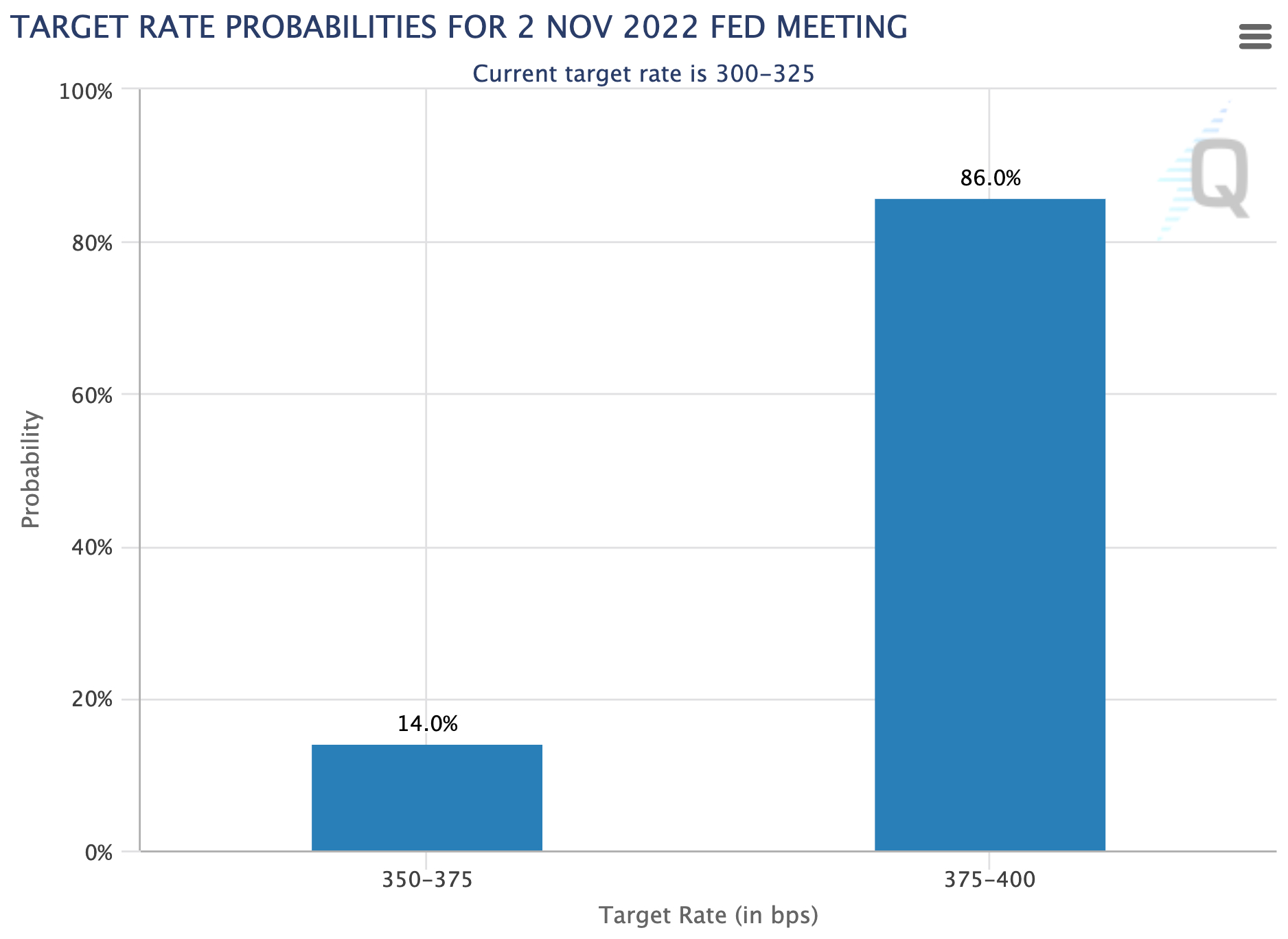

It is widely expected by analysts that the Fed will raise interest rates by 75 basis points this week, but economists are uncertain about what will happen at the next Fed meeting in December. The expectation of a 75-point hike at this meeting is also shared by the market, with derivatives exchange CME’s FedWatch Tool currently indicating an 86% probability that the Fed will raise interest rates by 75 basis points.

Notably, the tool also indicates a 14% chance that prices will rise by only 50 basis points, which will certainly trigger a rally in the crypto market.

According to a note from the major investment bank Merrill Lynch, a discussion about slowing the pace of rate hikes starting in December is likely to have taken place at the Fed. The bank therefore expects Fed Chair Jerome Powell to communicate that such discussions have taken place, which could open the door to moving to a 50-point hike in December.

Similarly, Goldman Sachs, another major Wall Street bank, said in a note that it also believes in a 75 basis point increase this week, likely followed by a 50 basis point increase in December.

“We expect the FOMC to eventually pair this decline to 50bp in December with a slightly higher projected top funds rate in the December plot. We add another 25bp increase to our own forecast – which now calls for increases of 75bp in November, 50bp in December, 25bp in February and 25bp in March – and now see that the fund rate peaks at 4.75-5%,” wrote.

Will Powell’s comments spark a crypto rally?

The question now is whether comments from Powell about a possible slowdown in rate hikes starting in December will be enough to push crypto and other risk assets higher.

On crypto Twitter, many users are hopeful that just that will happen, with some claiming that bitcoin (BTC) will “pump” as soon as the Fed makes its announcement this Wednesday:

Others, like popular economist and crypto trader Alex Krüger, said he believes both bitcoin and ethereum (ETH) will “ride higher” after this week’s Fed announcement. “Uptrend remains,” Krüger added in the tweet:

How the week will play out is still anyone’s guess at this point. But with last week’s surprise rally that took bitcoin from around $19,000 to $21,000, the bulls might be right this time.

Is bitcoin’s recent price action an early signal that the Fed is about to pivot? Wednesday’s announcement may at least give us part of the answer.