Crypto news for Solana and Monero

by Arthur · March 14, 2023

Important crypto news in these difficult days for Solana (SOL) and Monero (XMR). How do these two react to the delicate situation Silicon Valley Bank collapse?

It is worth noting that Solana is a public blockchain platform. It is open source and decentralized, and achieves consensus using a proof-of-stake algorithm along with a new algorithm called proof-of-history.

Monero, on the other hand, is a cryptocurrency created in April 2014 that focuses on privacy, decentralization, scalability and fungibility.

Latest Crypto Updates for Solana (SOL)

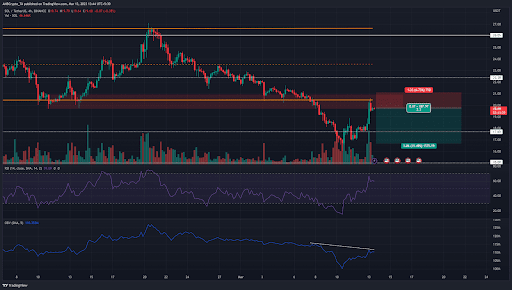

Over the past two days, Solana (SOL) appeared to reverse the bearish trajectory it had been on since late February.

Notably, this was a trend across the cryptocurrency market following the short-term bullish sentiment behind it Bitcoin in the morning on Monday.

As such, was this the beginning of a bullish trend, or was there a transition to a pool of liquidity before a reversal? Monday’s ups and downs generally provide information about the direction for the coming week

Thus, traders can also incorporate this information before formulating an action plan regarding Solana. At the moment, SOL’s price is traded at $19.68 and has tested previous lows as resistance.

This range was highlighted in orange, and Solana traded within it from mid-January until it fell below it on March 7. The range extended from $20.5 to $26.6.

Solana’s gains measured 28.6% from the swing low of $16 that SOL recorded over the weekend. RSI was also above 50 neutral showing strong bullish momentum.

However, OBV failed to make a higher high, showing some muted buying pressure over the past three days of gains.

Although trading volume has been high in recent H4 trading sessions, when Solana made these gains, the trend has yet to reverse.

From a technical point of view, the market structure was bullish as the last high under $18.9 was broken.

However $20 the area represented a confluence of resistance from the lows and the bearish breakout in February. Therefore, short selling the asset may be of interest to aggressive bears. In the south, $18.5 and $16.6 can be used to take profits.

Focus on the price of Monero (XMR): the wedge pattern

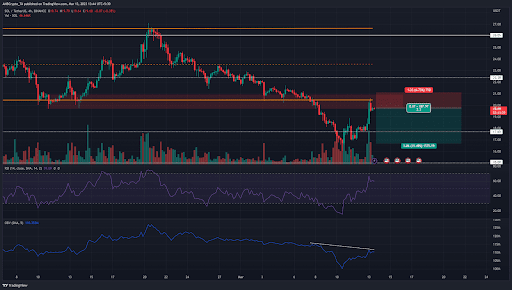

The price of XMR gave its ongoing correction a definite direction. The coin’s price has actually rebounded several times from converging trend lines, indicating that market participants are strictly following the so-called wedge pattern.

A wedge pattern shows a directional rally that resonates between two converging trend lines. If the price of the asset crosses one of the trend lines, the price action can further extend the post-breakout rally.

Therefore, here is how the XMR price may react to the completion of this pattern. The price of the Monero coin began its ongoing correction phase when it fell from its peak $187.5 on 30 January.

The subsequent five-week drop saw the altcoin plummet 28.5%, reaching the overall support of $134.52 and the support trend line of a descending wedge pattern.

In theory, the most common result of this pattern is to encourage a bullish reversal once the price has reached the support trendline, which eventually produces a bullish breakout from the resistance trendline to resume the bullish rally.

Therefore, today the Monero coin bounced back from a lower trendline with a bullish candle showing a 4% jump. This bullish reversal is expected to increase the coin’s price by another 5% to reach the overhead trend line.

Until this pattern is intact, the XMR price will extend its current correction phase. Conversely, a bullish break from the pattern’s resistance trendline would signal a first sign of a trend reversal and revive the recovery phase.

Solana Whale deposits $10 million on Coinbase

Recent data shows that a Solana whale has deposited 10.2 million dollars in SOL in the cryptocurrency exchange Coin baseas the price of the asset rose 16% today.

According to data from cryptocurrency transaction monitoring service Whale alert, a large transfer of SOL was discovered on the blockchain during the last 24 hours. The transaction involved the movement of a total of 537,352 tokensworth around $10.2 million, when the transfer was made.

Since then, the price of cryptocurrency has increased further, so the same stack of coins is worth more than 11.1 million dollars at the latest exchange rate. Since the amount involved here is large, the sender behind this transfer was likely a single whale or an entity of larger investors.

Consequences of cryptowhale movement at Solana

Sometimes the movements of these huge holders can cause huge effects on the market due to the scale of the currencies involved. For this reason, whale transactions may be something to be aware of.

How such a transfer will affect the price depends on the exact purpose the whale had in mind when it made it. In any case, the sender address in this case Solana whale the transaction was an unknown wallet.

Such addresses are not connected to any known centralized platform, meaning they are likely to be personal off-site wallets. On the other hand, the receiver was attached to a Coinbase wallet.

Transactions like these, where coins are moved from personal wallets to exchange platforms, are called “inflow exchanges”. One of the main reasons why an investor can deposit their coins on a platform like Coinbase is for purposes related to sales.

For this reason, inflows can hurt the price. Since the inflow of the Solana exchange in this case was quite large, it could lead to a visible bearish effect on the value of the asset.

This is of course only assuming that the whale intends to sell the coins with such a move. Considering the move happened when Solana was enjoying a slump bullish trendthere seems to be a good chance that the whale intends to cash in on this profitable opportunity with the deposit.