Crypto markets to experience a last sale

- Bitcoin price continues to consolidate around $19,000 to $20,000 levels for the second week.

- Market participants should be prepared for a sweep to $17,593 if the $18,800 support level does not hold.

- A breakdown of the $15,551 support level would signal an invalidation of the bullish outlook.

Bitcoin price has been in a steady consolidation for more than two weeks and shows no signs of directional bias. However, the Non-Farm Payrolls (NFP) announcement on October 7 could trigger a volatile episode for BTC that could resolve the range tightening and establish a directional bias.

Bitcoin price and the big picture

The Bitcoin price remains above $19,157, which is the highest traded volume level for 2022, also called the Point of Control (POC). As mentioned in the previous article, buyers are safe as long as BTC remains above POC; however, a breakdown could result in a steep correction to the next high-volume node at $15,551.

Beyond this support floor, there are two crucial levels at $13,575 and $11,989, where a macro bottom could occur for BTC. Not much has changed on this three-day chart for Bitcoin, but investors need to keep an eye on the POC at $19,157 and the immediate support level at $15,551.

BTCUSDT 3-Day Chart

The next important chart is the eight-hour chart of the Bitcoin price combined with the Relative Strength Index (RSI), which has accurately predicted the local top and bottom formation since May 30.

After a brief consolidation between the $18,000 and $19,000 levels, the Bitcoin price shot up to $20,400 and the RSI also broke above the 43 to 46 barrier, turning it into a support level. The rally that occurred here formed a local top at $20,500, which coincided with the RSI forming the seventh top at the 65 to 72 barrier.

A closer look at the Bitcoin price shows a bear flag in play. As the name indicates, this technical formation contains a flag bar, which was formed when BTC crashed 18% between September 12th and 19th. The consolidation in the form of a rising parallel channel resulted in the flag formation.

A breakdown of this technical pattern predicts an 18% decline to $15,800, achieved by adding the flagpole height to the breakout point of $19,417.

BTCUSDT 8 Hour Chart

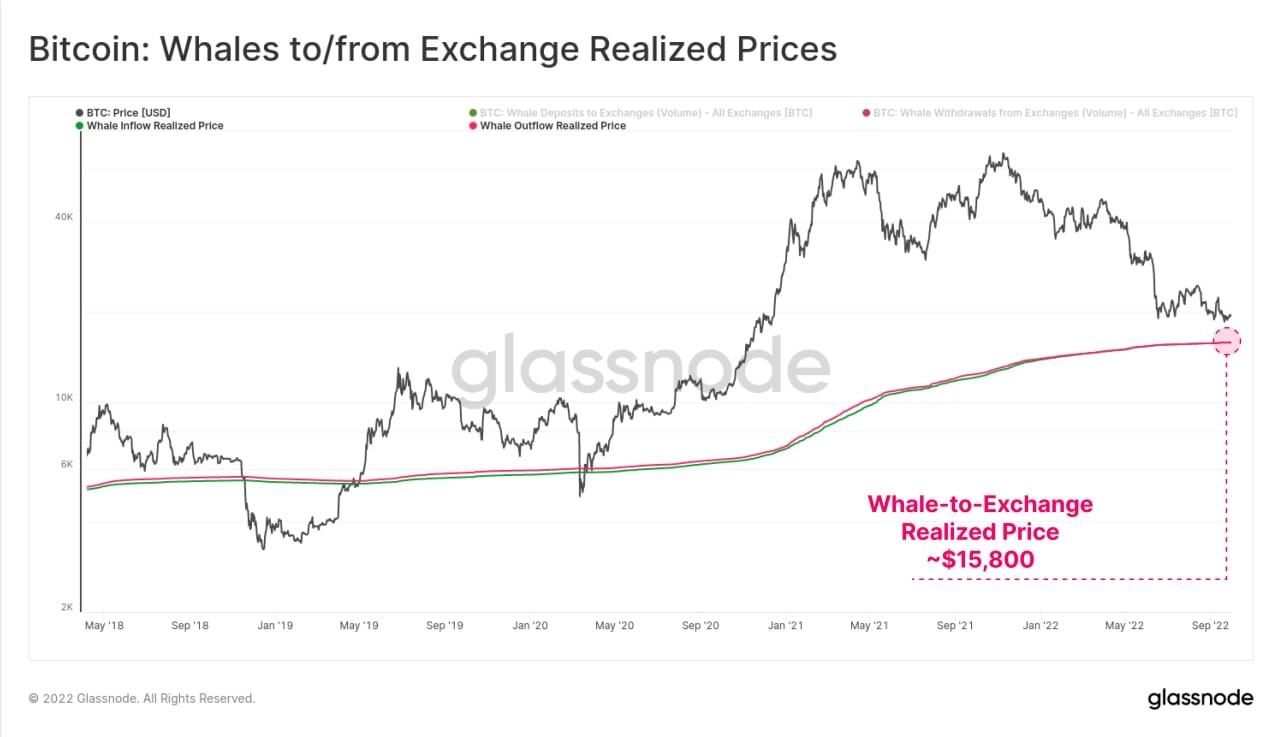

Additionally, the realized price of whales holding more than 1,000 BTC is around $15,800. The realized price of these BTCs is calculated by taking into account the volumes flowing in and out of exchanges and the Bitcoin price at that time.

Interestingly, this number coincides perfectly with the technical forecasts, giving more credence to the possibility of a steep correction to $15,800.

BTC Realized price

Although the initial outlook for the Bitcoin price may seem bearish from the explanation above, investors should view this potential crash to $15,800 as an opportunity to accumulate BTC and altcoins at a discount.

An increase in buying pressure at this level resulting in a reversal could be the best buying opportunity before the Bitcoin price kicks off a run to fill the CME gap, extending from $27,365 to $28,740.

These gaps form in the Bitcoin price when the Chicago Mercantile Exchange (CME) halts trading over the weekend. Therefore, a rebalancing of these inefficiencies could be another key driver triggering a $15,800 reversal.

BTCUSD CME 12 Hour Chart

On the other hand, if selling pressure continues to build on the back of rising geopolitical tensions and worsening economic conditions, the Bitcoin price could crash to $15,800 and not recover. If this decline pushes BTC to turn the $15,551 support level into a resistance barrier, it will invalidate the bullish thesis described above.

In such a case, market participants should prepare for a potential crash to $13,575 and $11,989.