Crypto Market Review, July 11th

This week may finally bring some volatility back to the cryptocurrency market as US inflation data comes

This week may be more important for crypto than some traders and investors think, as global financial markets prepare for the CPI data release in June. Another unexpectedly high round of inflation data will most likely affect Bitcoin and large L1 blockchains in a negative way, as we saw earlier.

KPI data effect on Bitcoin

The unexpectedly high inflation data prompted the Fed to step up its inflation control game and push the key interest rate to 0.75%, causing an immediate 10% crash in BTC’s price after the 23% retracing caused by the aforementioned CPI data.

If inflation data were higher than expected this week, we would probably see a similar effect on the cryptocurrency market. Given the remaining pressure from the US dollar, which continues to rise against other foreign currencies, it is unlikely that Bitcoin will show any positive movements in the market unless we see an unexpectedly positive CPI release.

Bitcoin’s failed reversal

According to the daily chart of BTC, we can clearly see that the reversal attempt the first cryptocurrency took in the last week has failed as it has returned below the price range $ 21,000 and is now struggling with around $ 20,500.

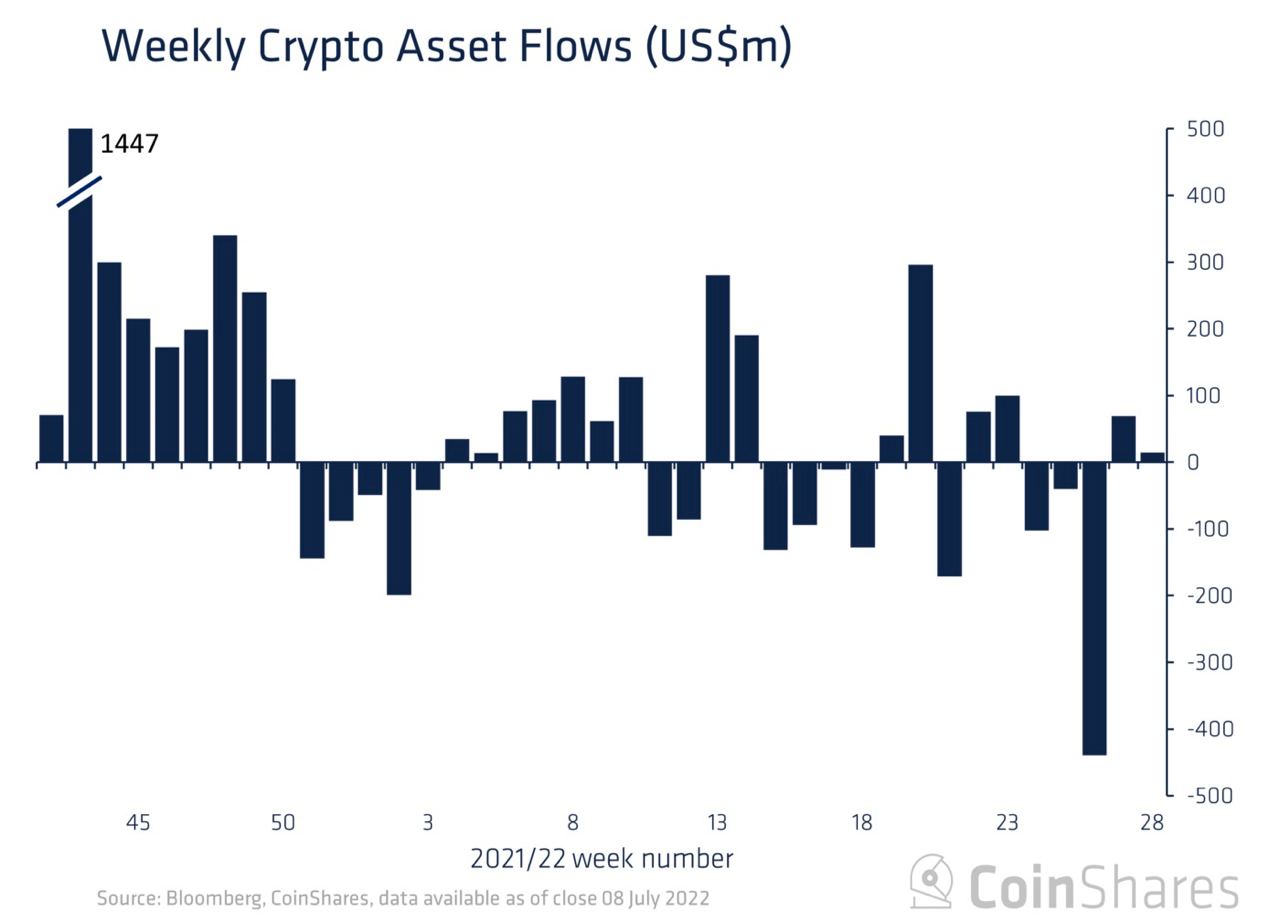

The main reason behind the failed reversal attempt is the lack of inflow and trading volume in the market. The institutional inflow data indicates that funds and companies are not in a hurry to buy more Bitcoin, as the macro environment in the digital asset market remains alienated after the 75% crash.

Compared to last week, when institutional investors seized around $ 65 million in cryptocurrencies, this week’s data suggests that only $ 15 million in digital assets had been acquired by investors.

The aforementioned inflation data and the US dollar rally are key factors that are pushing institutions away from buying more digital assets and fueling a potential recovery rally.

Ethereum, Cardano and others get a hit

The lack of inflow to Bitcoin affects alternative currencies such as Ethereum and Cardano, which have lost around 10% of their value in the last two days.

When it comes to Ethereum, we still see a huge sales pressure in the market as exchanges like FTX offer significantly high interest to anyone who is willing to give their ETH to finance the positions of short sellers.

In addition, Celsius sent around $ 50 million in coins to various exchanges to cover some of their loans. Following the massive liquidation volume of Three Arrows Capital and other institutional investors, Ethereum took a massive 45% loss.

The digital asset industry today is still highly dependent on inflation expectations, interest rate increases and other factors that were not previously linked to the cryptocurrency market in any way. The institutional adoption we saw in 2021 linked the industry to traditional financial markets that still show no signs of improving to this day.