Crypto Market Review, August 18

Bitcoin’s value lags adoption, while meme currencies outperform ‘serious projects’

With record inflation figures in Europe and the strengthening of the US dollar, Bitcoin and other cryptocurrencies have once again come under pressure, with both currencies gaining a few percent in their values.

DXY growth cycle begins

Since August 16, DXY gained around 1.5% in value after bouncing off the 50-day moving average support level, which has been tested four times during this rally. The technical situation on the chart also correlates with market fundamentals.

Despite positive CPI data, the market’s euphoria faded as the Fed still has a long way to go before pushing inflation back to target, meaning the economy will see another cycle of interest rate hikes, with the soft landing in about 2023.

As for the European currency, the USD still prevails over the Euro, causing another 1.1% drop in recent days, making parity between the two assets a possibility for the foreseeable future. Back on July 28, the Euro value officially fell below the $1 threshold for the first time in 20 years.

Bitcoin is not catching up with adoption

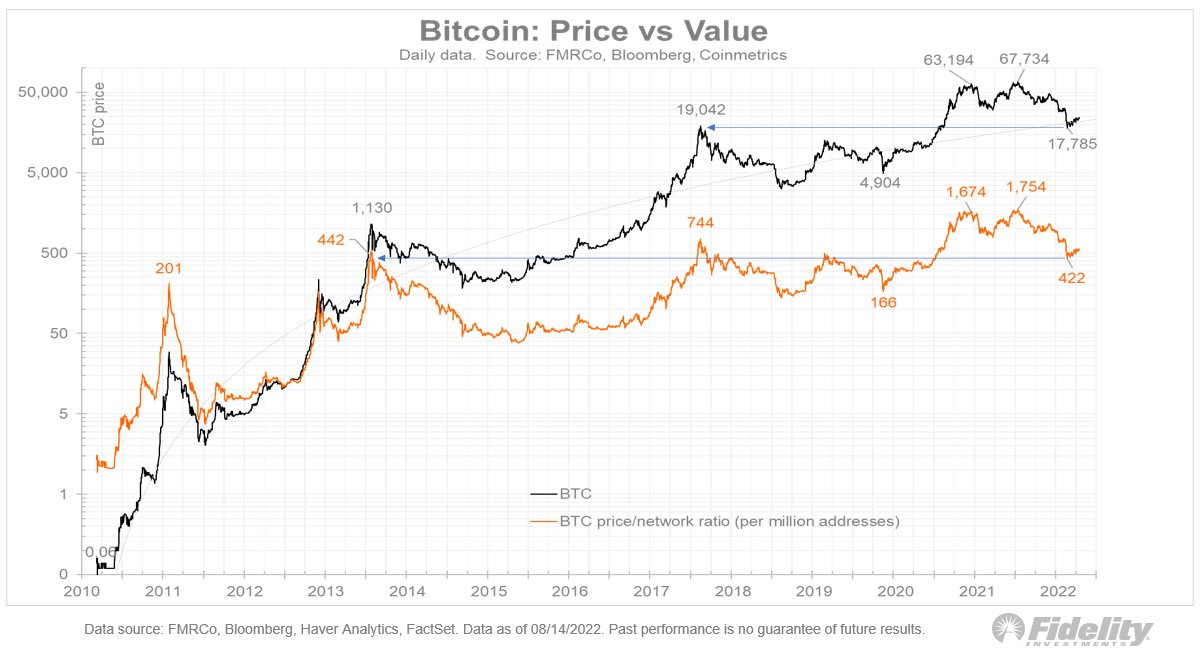

According to data provided by a Fidelity analyst, which we’ve covered in the past, Bitcoin’s adoption rate is well above its market cap, which technically makes it “cheap,” according to many price tags.

With the recent price performance of BTC, the asset has fallen far below the desired growth rate, which technically makes it oversold against the adoption value. The analyst used different price codes, mostly based on the adoption of technologies such as mobile networks and the Internet.

But despite the difficulty of moving toe-to-toe with different pricing models, Bitcoin is still growing exponentially compared to its state just a few years ago. Crypto influencers such as Vitalik Buterin have criticized pricing models for their subjectivity and rigidity. Considering the difference between technologies, eras when they were created and a general shift in technologies, it is difficult to predict a certain adoption rate and the growth of an asset or a technology.

Altcoins are moving sideways

The majority of alternative L1s in the market are still moving sideways or showing a mild bullish trend in the market. XRP has shown record low market volatility, moving in the 2% range over the past 20 days on the market.

Meme currencies such as Shiba Inu and Dogecoin were the most notable assets in the market as the two gained around 20% in value, standing out against an anemic XRP. Unfortunately, the lack of fundamental support behind the rally of Doge and Shib caused a quick reversal, now pushing the possibility of a sped-up rally away from both meme currencies.