Crypto market attracts knowledgeable investors again, says expert

According to well-known analyst Willy Woo, Bitcoin (BTC) has just begun a reaccumulation phase.

This means that the bottom of the cycle has most likely already been reached, and an influx of “smart money” into the crypto market is to be expected.

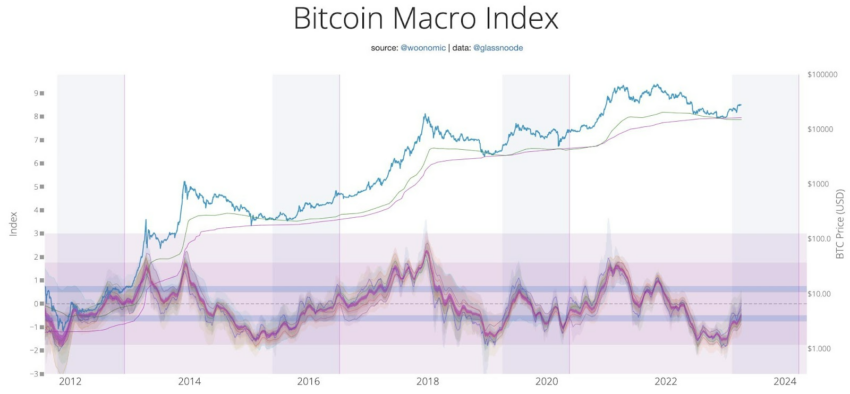

Willy Woo tweeted recently a series of macro charts of Bitcoin, showing the current state of the crypto market. They reveal how the BTC market is gaining momentum, leaving behind the region that has historically correlated with the end of a bear market. Interestingly, the relatively high stability of the BTC price in recent weeks suggests that a move even to the $40,000 range could be in the cards.

Willy Woo suggests the beginning of re-accumulation

The main chart Willy Woo refers to is the so-called Bitcoin Macro Index. The value of this index has just broken out above the lower blue line. According to the pioneer of chain analysis in previous market cycles, this signaled the start of the reaccumulation phase.

This market phase is mainly characterized by a sideways / slightly bullish trend with many corrections still present. It usually lasts a little over a year and is a period when experienced investors (“smart money”) join the crypto market. Also, the BTC price is not generating more macro bottoms and volatility is stabilizing, setting the stage for a future bull market.

Short-term holders lose the entry point

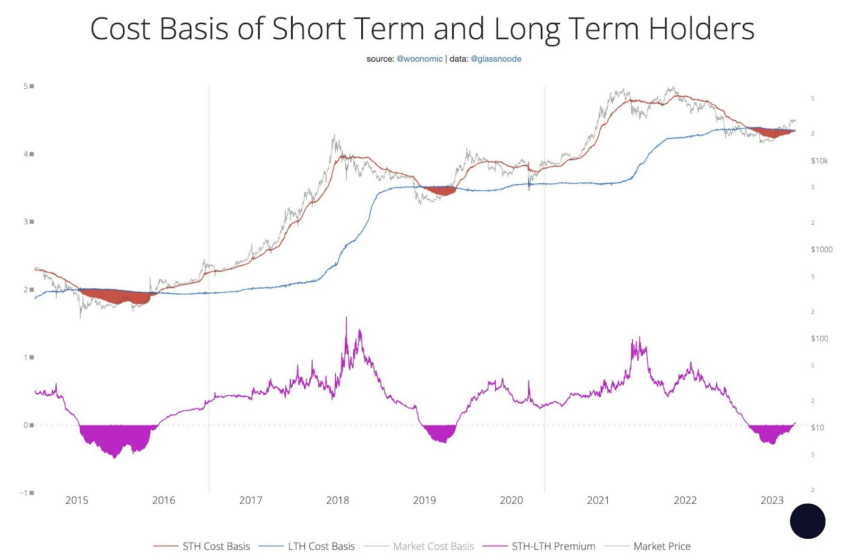

The second chart shows the relationship between the cost basis for short-term and long-term owners of Bitcoin. Willy Woo points out that “bottoms are signaled when short-term owners (recent buyers) came in cheaper than long-term owners.” In the diagram below, this corresponds to the red and pink areas.

In these rare periods, the cost base of short-term owners (red line) falls below the cost base of long-term owners (blue line). This means that the purchase price of BTC for new investors is lower than the price paid by long-term owners. Therefore, this is only possible after major falls in the long-term bear market.

It is worth mentioning that in the previous analysis of this indicator in September 2022, the cost base for short-term investors only fell below that of long-term investors. At the time, this signaled that the bottom of the BTC price in this cycle had not yet been reached. This was also the case, when Bitcoin first hit a macro bottom in November at $15,476. But now – with the opposite signal – Willy Woo notes that the buying window for short-term investors is over:

“We are now moving out of this regime.”

Short-term stability in BTC price could lead to $40,000

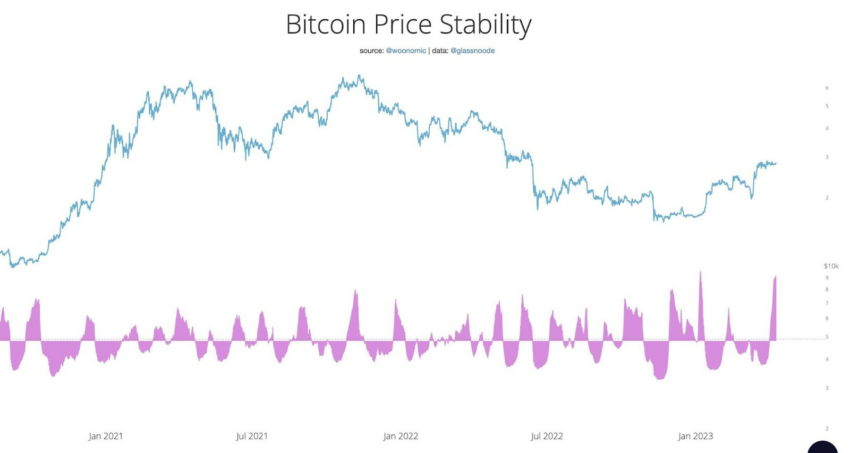

Finally, in his final argument, Willy Woo juxtaposes two diagrams. The first is Bitcoin price stability and the second is order book liquidity. Both suggest that, as the analyst says, “increasing volatility is a near certainty.”

Between March 18 and April 9, 2023, the Bitcoin price was stuck in a narrow range between $26,500 and $29,000. The three-week sideways trend led to a sharp drop in volatility or otherwise increased stability in the BTC price.

This is illustrated by the chart below, which the chain analyst interprets as a “prelude to a big move.” We can see that the current peak of the pink chart is second in size to the peak of late 2022, which led to an increase of around 50%. If the scenario were to repeat itself, a similar rise from the $27,000 price would lead to a peak near $40,500.

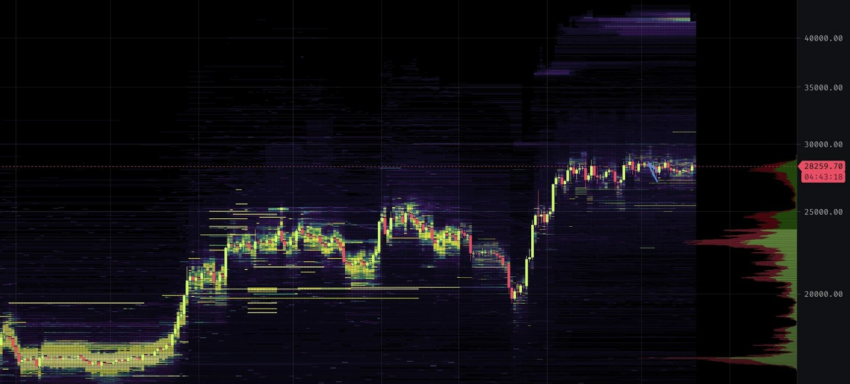

Interestingly, this measure corresponds to a recent chart from Willy Woo, where he illustrates the liquidity order book of BTC traders. There appears to be a “liquidity gap” in the $30,000 – $40,000 range. Increased volatility could quickly lead to the filling of this gap and Bitcoin’s rapid move towards the upper range.

The first step in this direction has already been taken as an increase in BTC volatility was linked to an extraction of the $30,000 level. If the trend continues, the April BTC price prediction in the $40,000 range is realistic.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here.

Disclaimer

In line with Trust Project guidelines, this price analysis article is intended for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, objective reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions.