Crypto Liquidations Surpass $250 Million As Fed Raises Rates

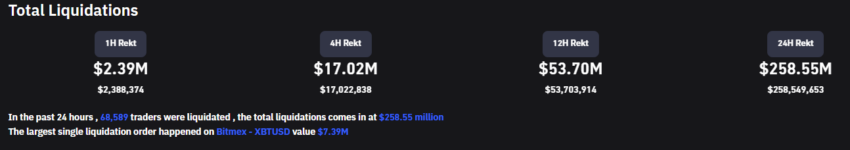

Crypto traders had a whirlwind day after nearly 68,000 positions were liquidated in the past 24 hours. Total crypto liquidations passed $257 million.

The news comes amid an interest rate hike by the US Federal Reserve and the SEC’s regulatory action against crypto companies.

Coinglass data revealed that liquidations on Bitcoin, Ethereum and XRP dominated the trend during the period.

BTC Crypto Liquidations Exceed $130M

Total Bitcoin liquidations were close to $132 million, while Ethereum traders lost $51 million at press time based on market capitalization. Around $8 million in liquidations came from XRP positions.

Coinglass notes that the largest single liquidation order worth $7.39 million was executed on Bitmex.

The figures come after the US Fed raised interest rates by 25 basis points. Several analysts believed that the apex bank could stop the tightening of monetary policy amid the turmoil in the banking sector. But with consumer inflation moderating to 6.0% year-on-year, according to the latest government data, the Federal Reserve didn’t budge.

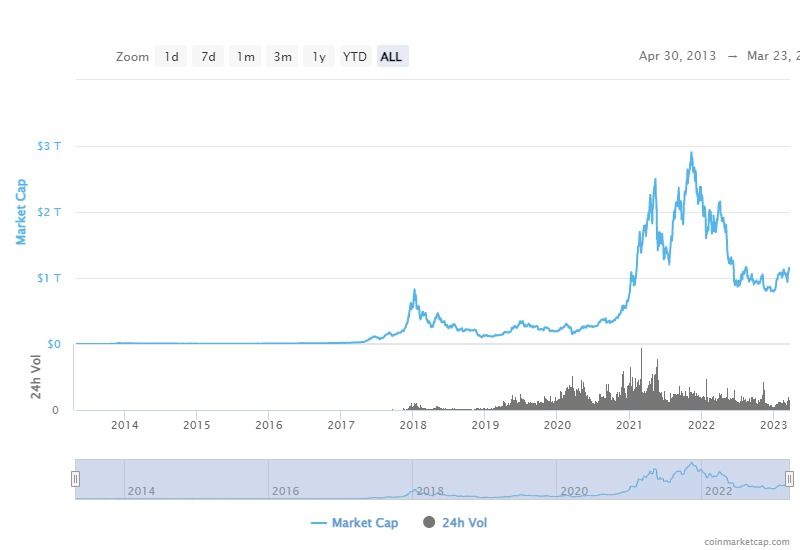

Meanwhile, the global cryptocurrency market cap has fallen by 2% in the last 24 hours. However, the cumulative capitalization is still over $1 trillion. Bitcoin has also lost value in the same range, but remains floating above $27,000 at a multi-month high.

The Digital Asset Fund Flows Weekly Report by CoinShares also recorded outflows for six consecutive weeks. Based on the report published on March 20, digital asset withdrawals were close to $500 million in the period. Bitcoin led the trend with outflows of $113 million in the past week.

According to CoinShares, the outflow caused by the need for liquidity during this banking crisis is more than a negative outlook. It mentions that a comparable scenario was observed when the COVID panic first broke out in March 2020.

Regulators single out crypto businesses, influencers

Large liquidations also come in the midst of strict action from the securities supervisory authority. The US Securities and Exchange Commission recently sued crypto mogul Justin Sun, TRON Foundation, BitTorrent Foundation, Rainberry Inc, Austin Mahone and Deandre Cortex Way for selling unregistered securities.

Meanwhile, several celebrities are also part of the securities violations allegations. Eight celebrities, including Lindsay Lohan and Jake Paul, are being held for promoting illegal crypto-based products, a release from the agency confirmed.

The SEC has also issued a Wells Notice against the largest US crypto exchange, Coinbase. The securities regulator filed an enforcement case against Coinbase Global Inc for some of the products it offers.

That said, there is a positive outlook among many in the industry. Ark Invest’s Cathie Wood told Bloomberg that Bitcoin’s resilience amid the banking crisis could make way for institutional investors to return to the system.

She noted,

“The fact that Bitcoin moved in a completely different way than the stock markets in particular was quite instructive. We think that the behavior of the price through this crisis is going to attract more institutions.”

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.