Crypto liquidations rise as a bearish trend takes over the market

Bitcoin (BTC) has fallen by 2.5%, and crypto liquidations have reached almost 140 million dollars in the last 24 hours. But why are traders still greedy?

Bears have bypassed the crypto market, as Bitcoin is down nearly 2.5% to $28,600. While the price of Bitcoin and major altcoins are down, market sentiment has a different story to tell.

Traders greedy despite liquidations

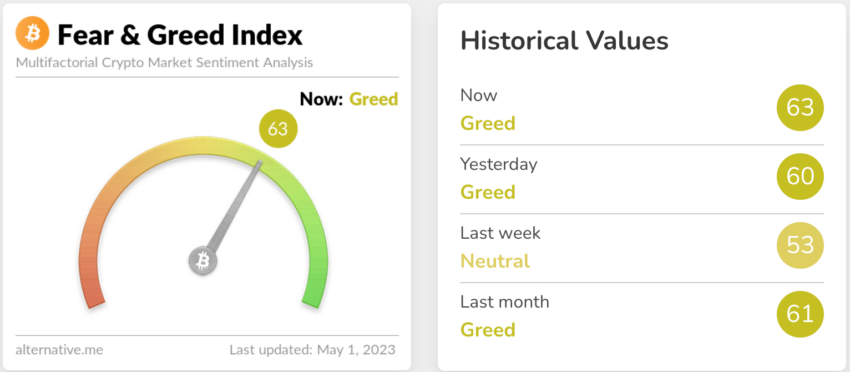

At the time of writing, the Crypto Fear and Greed index stands at 63 points, which indicates a greedy mood in the market. Alternative.me measures the index by analyzing market sentiment and sentiment through multiple sources.

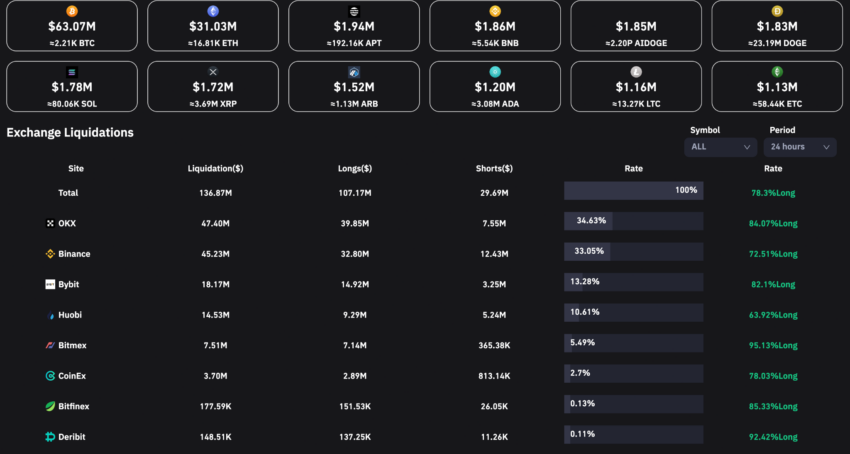

But in contrast, the bearish movement in the market has liquidated $136.85 million worth of trades in the last 24 hours. According to Coinglass, 32,738 traders faced liquidation, while the OKX exchange liquidated a single trade worth $5.62 million.

Of the total liquidations, 78.3% were long positions worth about $107.17 million.

Quantitative Easing Due to Bank Collapses

The US banking crisis has consumed the 14th largest bank in the nation – First Republic Bank. According to Reuters, JPMorgan Chase & Co. purchased assets and certain liabilities of First Republic Bank.

Today, the 84 branches of the bank will reopen as branches of JPMorgan.

Crypto Flus Hitesh Malviya believes there is a great opportunity for quantitative easing due to the American banking crisis. He told BeInCrypto:

First Republic Bank has recently collapsed, making the US banking crisis worse. There is great opportunity for quantitative easing through additional fiat circulation. It makes people stay long in the market as new money in circulation can make a short-term bull case for Bitcoin.

After the collapse of major banks such as Silicon Valley Bank, the Federal Reserve (Fed) injected $300 million to save the banking system. It is also widely expected that the Fed will stop raising interest rates from July.

Robert Reich, professor of public policy, believes: “The sensible thing would be for the Fed to stop raising interest rates long enough to allow the financial system to calm down. In addition, inflation is decreasing, albeit slowly. So there is no reason to risk more financial turmoil.”

Do you have something to say about crypto liquidations or something else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In accordance with the guidelines of the Trust Project, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.