Crypto lawyers are betting big on class actions as market lights

As the Biden administration ramps up its scrutiny of the cryptocurrency industry, a handful of small litigation shops are piling up class-action lawsuits against crypto exchanges and digital token issuers, pursuing theories that could shape how decades-old laws apply to the emerging field.

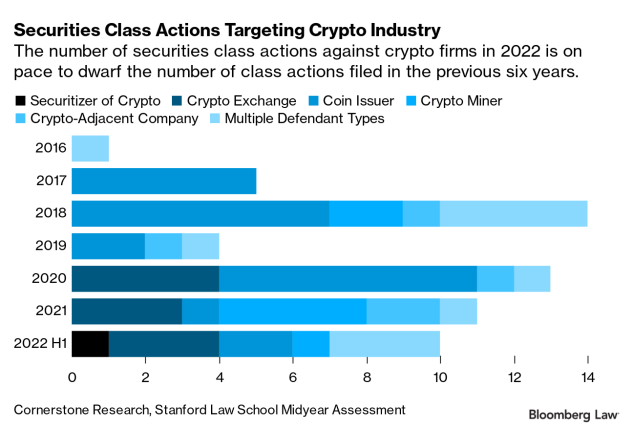

Led by partners from boutique firms, lawyers have filed 58 securities class actions against crypto companies since 2016, according to a report from the consulting firm Cornerstone Research and Stanford Law School.

More than a third landed in the past two years, and the pace picked up in the first six months of 2022, when the industry’s market value fell by $2 trillion before stabilizing.

Many of the complaints — aimed at entities including Coinbase and Binance, two of the world’s largest crypto exchanges — allege that the trading platforms, coin issuers and other firms are escaping disclosure requirements imposed by federal securities laws and should be on the hook for investors. ‘ loss.

“There was a crash and a lot of the excesses and abuses started to come to light,” said John Jasnoch, a partner at the firm Scott & Scott, which is litigating seven proposed crypto class actions.

It is still unclear whether the trial will break any far-reaching legal grounds. Most of a rash of crypto class-action lawsuits filed by two firms in April 2020 were ultimately struck out due to statute of limitations and jurisdictional issues.

“In a way, the space has a ‘more money, more problems’ thing going on, where it’s mature enough that it can attract attention from class action lawyers, whether that attention is warranted or not,” said Jason Gottlieb, a Morrison Cohen attorney who maintains a crypto lawsuit tracker and whose firm represents defendants in two class actions.

“It’s very easy to copy and paste a complaint from one company to another,” he said.

Lawsuits that have survived challenges so far include one filed by Roche Freedman against crypto exchange Bitfinex and affiliate Tether, the company behind the Tether stablecoin. The suit accuses the companies of defrauding investors and causing billions of dollars in losses.

In another, a California state judge in early September tentatively denied blockchain platform Dfinity’s motion to dismiss a proposed securities class action lawsuit filed by Scott & Scott.

A federal judge in New York, meanwhile, is considering whether to green light a lawsuit filed by Selendy Gay and Silver Golub. The lawsuit alleges that Coinbase facilitated transactions of 79 digital tokens that it claims are unregistered securities.

If successful, the lawsuit could potentially expose Coinbase to billions of dollars in damages. It would also undermine the company’s position that no asset traded on the platform is a security or an “investment contract” where a person can expect profits to come from the efforts of others.

In a motion to dismiss the complaint, Skadden lawyers representing Coinbase called the action Selendy’s latest attempt to “fabricate” securities laws.

But James Cox, a Duke University law professor who reviewed the complaint for Bloomberg Law, said the main allegation — that Coinbase failed to register as a broker-dealer or securities exchange — “has some really strong legs.”

“The fact that there were many different coins would not prevent the grade from being certified,” Cox said.

“Cop on the Beat”

The proliferation of private lawsuits comes as SEC Chairman Gary Gensler promises the agency will be a “policeman” protecting investors in the digital asset arena.

The agency filed 20 enforcement actions against crypto companies in 2021 — Gensler was confirmed in April of that year — 80% over the alleged sale of unregistered securities, Cornerstone found.

The SEC then made waves in July by filing an insider trading case against a former Coinbase employee in which it identified several tokens traded on the platform as securities.

Last week, the Biden administration, in a series of reports, asked federal regulators to double down on investigations into illegal practices in the industry. The aggressive push is likely to give additional ammunition to class action lawyers, legal advocates say.

However, most litigation is still waiting for the courts to resolve fundamental questions, such as whether certain cryptocurrencies are akin to traditional stocks and bonds and should comply with securities disclosure requirements.

Unless new legislation is enacted by Congress—a bipartisan regulation bill is now moving through the Senate—the decisions could carry significant weight not only for the industry, but also for how both the SEC and the litigant move forward with the case in the coming years.

Gensler has said his agency has authority over “cryptosecurity tokens” and has repeatedly pushed for companies to comply with securities laws, arguing that most tokens are securities.

Industry advocates have argued that the space needs clearer regulations. Exchanges such as Coinbase have repeatedly refused to offer securities on their platforms.

The law firms taking on these companies are not among the well-known plaintiffs’ shops that often represent a proposed class in a conventional securities action, in part because there are so few institutional investors in crypto, said Kayvan Sadeghi, a Jenner & Block firm. defense attorney.

That has left a door open for upstart firms to seize leadership positions in some of the biggest cases.

Other small shops are making big splashes outside the securities area.

Gerstein Harrow, a two-person civil rights firm launched in Los Angeles in 2021, has formed a crypto consumer protection practice. The firm has filed two lawsuits targeting decentralized finance operators, or organizations that remove banks and other third parties from financial transactions.

The lawsuits target crypto company PoolTogether for allegedly operating an illegal lottery and decentralized finance platform bZx for alleged negligence that caused a theft of $55 million on the platform. (Both have denied the claims and decided to dismiss them.)

“We took the time to study the technology and came to that view [digital asset operators] were operating in an area where they believe they’re free from US regulation,” said founding partner Charlie Gerstein. “Secondly, we noticed that there was a very large volume of money changing hands. It presented an obvious financial opportunity.”

Lesser known players

Companies like Selendy say they act as a “complementary” force to SEC examiners and other regulators who use broader scrutiny.

Launched in 2018 by 10 Quinn Emanuel expats, the firm splits its time between plaintiff and defense cases.

Philippe Selendy and Jordan Goldstein, who have each been involved in the firm’s crypto work, helped the Federal Housing Finance Agency win more than $25 billion in payouts from Wall Street banks after the mortgage-backed securities crisis over a dozen years ago.

Goldstein said he sees parallels between that work and his new focus on alleged fraud in crypto.

“We saw the opportunity to start a litigation shop that would be focused on cutting-edge cases that would not only benefit our clients, but advance the public interest wherever possible,” he said. “The crypto market appeared to provide an opportunity to benefit investors through the legal system.”

Launched in 2019 by lawyers from prominent litigation shop Boies Schiller, Roche Freedman has been the most active firm in the crypto class action, filing more than a dozen lawsuits and serving as lead counsel in many of them.

Some of that work has arrived

The firm, meanwhile, is fighting to remain lead adviser in its action against Bitfinex and Tether.

The past couple of years have seen the industry also invest in legal muscle to fight these actions, suggesting that many cases, both public and private, face a long road to resolution.

Crypto firm Ripple Labs has aggressively pushed back against the SEC in response to a 2020 enforcement action that claims the XRP token is an unregistered digital asset. The case is one of the most important ongoing cases that could help define the broader crypto litigation and regulatory landscape.

Despite some of the recent turbulence, Wall Street has shown a greater interest in crypto this year, creating the double screen of increasing litigation involving an industry that is still aggressively pushing to become more mainstream. And while the decline appeared to flatten out over the summer, the still-steep losses from the top mean the crypto-class action space figures are becoming more crowded.

There wasn’t a ton of interest from plaintiff firms in crypto “as long as the market was going up and up,” said Carol Goforth, a law professor at the University of Arkansas. “Now there are plaintiffs coming out of the woodwork and theories coming out of the market.”