Crypto is booming in China with Hong Kong taking the lead

Chinese state-owned firms support crypto despite its illegal status in China. Gradually, Hong Kong is becoming a proxy market for Chinese entities that want to explore crypto’s potential but cannot legally do so at home.

China, officially the People’s Republic of China, has a strange relationship with cryptocurrencies. The People’s Bank of China banned all cryptocurrency transactions outright in September 2021. This still stands as one of the most sweeping and draconian measures ever put in place, banning crypto transactions in the world’s most populous country.

But with time and innovation, Chinese state-owned entities are supporting crypto ventures, especially in Hong Kong. So, what exactly causes the swing in momentum?

An outright ban

In September 2021, the People’s Bank of China (PBOC) issued an order banning all cryptocurrency transactions in the country. This stands as one of the most significant and restrictive measures ever taken against the digital currency market, which has become increasingly popular worldwide.

The PBOC’s decision surprised many, especially given the country’s past support for blockchain technology and the growing interest in cryptocurrencies among Chinese investors. The ban meant that all cryptocurrency transactions, including trading and mining, were subject to severe penalties.

However, this move was not without reasons. The PBOC cited concerns over financial stability, illegal activities and the potential for cryptocurrencies to facilitate money laundering and other illegal activities.

The ban was a blow to the cryptocurrency industry, as China was one of the biggest markets for digital currencies. The immediate effect of the ban catalyzed a sharp decline in crypto users and the value of cryptocurrencies such as Bitcoin and Ethereum. But over time, the market has shown resilience and the value of cryptocurrencies has gradually recovered.

Many industry experts believed that the ban would be temporary and that Beijing would eventually relax its stance on cryptocurrencies. They argued that the ban was to give the government time to develop driving regulations.

From the ban on supporting crypto entities

Global markets have changed significantly since the ban. Once a dominant global force, the US dollar witnessed cracks within the wall.

Local organizations have now promoted crypto and the underlying innovation to widen the gap to the USD. And at the same time, to close the gap to reach a decentralized room2e.

There could be several reasons why Chinese state-owned entities are now supporting crypto ventures in Hong Kong. One explanation is that China sees the potential of blockchain technology and wants to support its development. China has explored the use of blockchain in various industries, including finance, logistics and healthcare. And even created its own digital currency, Digital Yuan.

Another reason could be that China wants to maintain its influence in Hong Kong, a special administrative region of China. Hong Kong has been a hub for international finance and trade, and supporting the development of blockchain technology in Hong Kong could help China maintain its position as a regional economic powerhouse.

In addition, the Chinese government can use these state-owned entities to indirectly invest in cryptocurrency, in the face of strict regulations on cryptocurrency trading and mining.

Could Hong Kong be a crypto hub?

Hong Kong wants to position itself as a hub for cryptocurrencies and blockchain technology by introducing new regulatory measures. The territory’s measures contrast with those in mainland China, where crypto-related transactions are banned. Hong Kong is becoming a proxy market for Chinese entities that want to explore crypto’s potential but cannot legally do so at home. Local authorities have taken steps to welcome the influx of such providers. Including setting clear rules and regulations for crypto, even Web3, to flourish.

In November 2021, the Hong Kong government proposed a new licensing framework for virtual asset service providers (VASPs) to regulate and monitor crypto exchanges and related businesses. Under the framework, VASPs must obtain a license from the Hong Kong Securities and Futures Commission (SFC) and comply with various requirements, including operational, financial and security standards. In addition, Hong Kong recently proposed rules that would allow retail investors to trade specific “large-cap tokens” on licensed exchanges.

The new regulatory measures are a positive development for the cryptocurrency industry in Hong Kong as they provide a clear legal framework for crypto businesses to operate. This move could attract more blockchain and cryptocurrency companies to Hong Kong, potentially spurring innovation and investment there.

The realities do not live up to expectations. This increases Hong Kong’s potential as a crypto hub.

Take the lead

This year, reports have shown the region’s commitment to the underlying technology: blockchain. Hong Kong-based Global Shipping Business Network (GSBN), a nonprofit consortium focused on blockchain trade applications, took the lead in the blockchain logistics industry.

In recent days, state-owned Chinese Pacific Insurance joined Waterdrip Capital to launch two crypto funds in Hong Kong, Pacific Waterdrip Digital Asset Funds I and II. Crypto is booming in Hong Kong, with ProDigital Future launching with $30 million in commitments and the territory’s first crypto ETFs launching last December.

Banking institutions gave green light to crypto. Zooming in on the latter, the Chinese version of TikTok, “Douyin”, with 600 million users, featured a significant change.

When users search for Bitcoin, the current day, high, low, today’s open and yesterday’s closing prices are displayed. In the same way this is case with Ethereum (ETH) per crypto Twitter comments. “This move shows the enthusiasm of the Chinese society and private enterprises for cryptocurrencies. But the Chinese government still strictly bans the crypto, except to allow Hong Kong to develop,” crypto analyst Colin Wu claimed.

Clifton King, co-founder of ATX DAOtold BeInCrypto:

“HK (Hong Kong) Leans into Crypto, Likely in Reaction to US Breakdowns.”

At the same time, Jupiter Zheng, director of research at HashKey Capital, observed to BeInCrypto:

“Hong Kong’s expanded support for virtual assets since October has been further enhanced with the new licensing regime and consultation.”

Such stories can help the asset class to reach new heights, and further realize a decentralized financial market. It will be interesting to see if other regions join Hong Kong. Such a development could have a massive impact on the crypto industry.

What would crypto success mean?

The success of crypto in Hong Kong may have implications for market reforms in China. Hong Kong has been a center of crypto activity and innovation in the region, with a thriving ecosystem of exchanges, traders and investors. This could serve as an example to policy makers in China, who have been more conservative when it comes to crypto and other disruptive technologies.

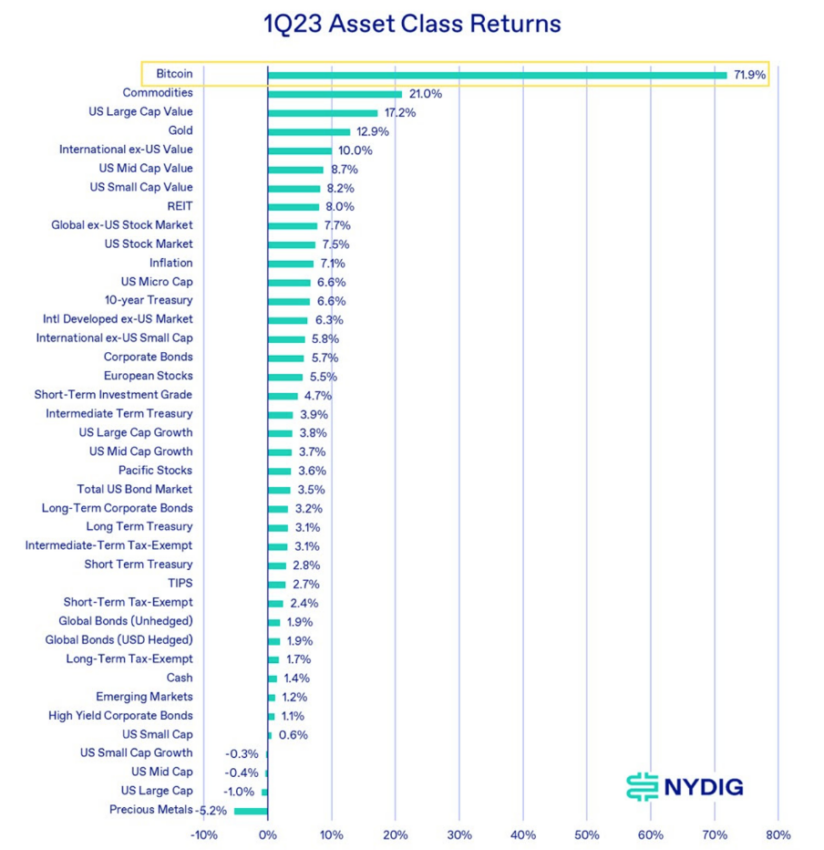

Still, reduced exposure to the USD and Hong Kong’s crypto-friendly play has helped Bitcoin in the short term. The price of Bitcoin has broken through $30,000, the highest level since June 2022, with a 24-hour gain of 7%.

Users in Nanjing have opened more than 310,000 personal digital yuan wallets. Other cities and regions post similar numbers. Time will tell how Beijing’s rulers will interpret, and act on, the growing popularity and availability of digital currencies.

Disclaimer

In accordance with Trust Project guidelines, this feature article presents the opinions and perspectives of industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect the views of BeInCrypto or its employees. Readers should verify information independently and consult with a professional before making decisions based on this content.