Crypto in Europe: the final text of MiCA

by Arthur · April 18, 2023

Good news from the crypto world in Europe: after years of waiting, has final MiCA text for regulation in the EU is finally designed, which must be approved by the European Parliament as a last resort.

The text defines the guidelines that operators of cryptocurrency-related services must adhere to in order to be regular.

Let’s take a look together at what MiCA consists of and what the exact indications to the legislators are.

Crypto in Europe: what is MiCA?

These days, the European Commission has prepared the final MiCA text for the regulation of all areas related to the world of cryptocurrencies in the EU, which must be approved by European Parliament to finally come into force.

In detail The MiCA (Market in crypto assets) represents the text that sets out the regulations that EU service providers will have to comply with if they choose to adopt any form of cryptocurrency, either NFTs, stablecoins or cryptographic tokens in general, into their business activities. There are also guidelines for cryptocurrency exchangeswhich must follow certain rules to be regular throughout the EU.

The crypto community has been waiting the final text of MiCA for years: the first draft of the regulation was transcribed by the European Commission in September 2020.

Since then, given the complexity of the topics covered and the difficulty of framing the various cases of tokens linked to blockchain networks, there have been several slip-ups to achieve approval in the final seat.

We have finally reached one turning point for crypto in Europewhere new laws will soon come into force that will allow providers of services related to cryptographic tokens to operate in a fair and transparent manner, without fear of carrying out practices considered illegal.

Therefore, no more gray areas and uncertainty about the future cryptocurrencies in Europe.

This represents a turning point that will probably determine the boom of this sector in the EU, since in recent years many banks, investment funds and companies have chosen not to delve into this world which is already unknown in itself and without precise guidelines at legal level. .

However, even if the European Parliament approves the final text of MiCA, it will must wait another 18 months for the compliance requirement to be triggered.

During this time, the regulation will have to be transcribed into more than 20 official EU languages and then published in the Official Gazette.

The hope is by 2024 cryptocurrencies will no longer be considered illegal, but a integral part of today’s financial system with all the pros and cons attached.

MiCA’s crypto regulation in the context of NFTs, stablecoins and DeFi

If we go into it more closely, we can already get a glimpse of which categories of cryptocurrencies will fall under the MiCA regulations.

In this regard, there is some news regarding the extent of NFTs, stable coins and decentralized finance-related activities (DeFi).

Non-fungible tokens has definitely been the most delicate subject for regulators to deal with, as they had to frame them in the most appropriate waywithout falling into the mistake of confusing them with different financial products compared to what they really represent.

In fact, the previous draft of the regulation divided crypto-assets into three different categoriesnamely e-money tokens, utility tokens and asset-referenced tokens.

NFTs do not fall into any of these categories as they are not tokens used for payments, such as Bitcoin and Ethereum can be, nor are utility tokens and tokens that take back the value of other assets, such as stable coins.

Finally, the European Commission decided that non-fungible tokens representing works of art, digital collections or real estate will not be part of the MiCA regulationwill therefore not be subject to the rules described in the text.

The only note to consider is the fact that if NFTs that are fractionalised or minted in series is issued, the latter will be considered exchange, and therefore suitable as means of payment, ergo de will be subject to requirements.

The same fate has befallen the decentralized financial sector which does not fall under European regulation.

This applies as long as it exists maintaining effective decentralization of platforms where classic DeFi products such as liquidity provision, leveraged trading and lending and borrowing of crypto-assets will be offered.

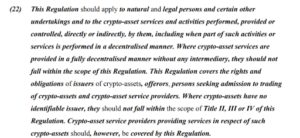

In paragraph 22 of the text, it can be clearly read that:

“where services are provided in a completely decentralized manner and without intermediaries, these rules do not apply.”

If however tokens linked to companies will be created, the latter will be required to obtain permits to be sold in Europe.

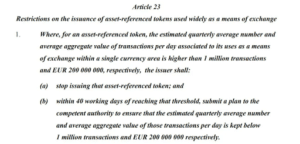

Finally, in the case of stablecoins, these must follow precise rules:

The transaction volumes of stablecoins (not linked to the euro) as a medium of exchange must remain below the quarterly average of EUR 200 million per day and 1 million transactions per day.

But these limits does not apply for trading on exchanges.

If an operator exceeds the thresholds described, it will either have to stop offering such services or submit a plan to bring volumes back to regulatory levels.

New rules in the EU for exchanges and financial service providers related to crypto

When it comes to cryptocurrency exchanges or more generally centralized providers of crypto-financial services, things get complicated.

The latest collapses of exchanges such as The Rock Trading or FTX has warned lawmakers against completely deregulating these types of platforms.

The discriminatory factor for understanding whether exchange falls within the regulations is “active marketing” factor, as described in Article 61.

Seeking to simplify: if service providers such as exchanges will perform sales promotion activities in Europe in order to attract customers within their platforms, they must compulsorily register with one specific registry and report the completion of their operations with OAMas specified by EU Directive 2018/843.

If, on the other hand, the stock exchanges do not want to do any marketing activities in Europe and customers choose to use these services of their own free will, the regulation does not apply.

However, be aware, because this indication is intended to refer to operators based outside the EU.

In fact, there are many exchanges that are based in the US and also operate in Europe, such as Coin base.

If an exchange is legally based in Europe, the previous regulations remain in place.

This represents a very interesting point to think about.

What will exchange based outside Europe do now to increase their user base? Which activities would be considered active marketing and which would not?

Furthermore, what will new entrants who have planned to enter the industry like EU-based cryptocurrency exchanges do?

Will they decide to move their headquarters abroad or will they work to obtain all the necessary licenses to operate correctly and transparently?

This last consideration cannot be answered concretely now.

The future will show us how the situation will develop for the exchange industry in Europe and whether they will be punished by new MiCA regulationprovided that it will be approved by the European Parliament.