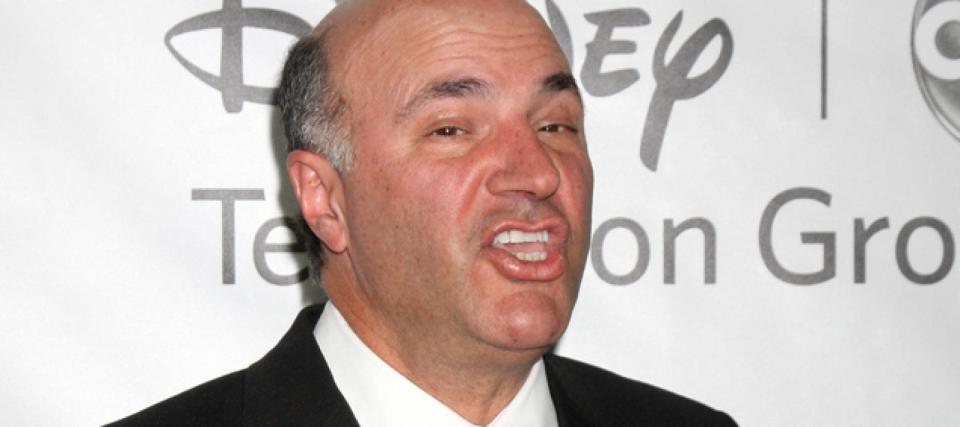

Crypto has crashed – so why do Kevin O’Leary, Edward Snowden, Snoop Dogg, Mike Tyson and more still believe in it?

It’s been a tough year for Bitcoin. After reaching an all-time high of $68,789 in November 2021, it is down to about a third of that value.

Some analysts say it’s just a correction for this speculative and volatile asset, while others are much more damning, likening it to a house of cards built on shaky foundations.

And yet many well-known US investors continue to believe in crypto, with celebrities from all walks of life such as Kevin O’Leary, Edward Snowden, Snoop Dogg and Mike Tyson all encouraging investors to stay positive through the bear trend.

“It’s like a wildfire,” NSA whistleblower and former CIA contractor Edward Snowden told an audience at a conference in mid-June. “Once the ground is cleared, things will grow again.”

But some experts aren’t so sure what we’ll find when the ash disappears.

Don’t miss out

There is still great enthusiasm

Celebrity investor Kevin O’Leary is particularly bullish on crypto. In an interview with CNBC in June, he claimed that the asset has “so much intellectual capacity” and that the “next brilliant idea” will come from the blockchain community.

“If you go to any graduating class, go to engineering, a third of them want to work in the chain. They don’t want to work in the 11 sectors of the economy, they want something new,” said the Shark Tank investor.

O’Leary also reminded viewers that Amazon once saw corrections of up to 50% on a daily basis for 12 years before transforming into the behemoth it is today.

Jacob, a crypto enthusiast who goes only by his first name, is a perfect example of the engineers O’Leary refers to who are eager to work on the chain. He works as an engineer on both Web2 and Web3, or the version of the internet most people know and its next decentralized iteration where applications run on the blockchain or through peer-to-peer systems.

What Jacob says fueled his interest in cryptocurrency is its many uses for the average person, such as “real-time money transfers, low transaction fees, high-risk but attractive investment opportunities, public investment in Web3 companies, and most importantly, digital ownership.”

So why is crypto’s value tanking?

Even with celebrity backers and ordinary Americans behind it, there’s no doubt that crypto has fallen this year. Patrick Thompson, host of the blockchain and digital asset podcast “More Than Money”, sees some reasons for this.

The first is inflation. And the changes in economic policy governments around the world have adopted to combat it “probably triggered the first sell-off of all risk assets,” says Thompson.

And with more and more signs pointing toward the possibility of a recession, these risky assets have become unpalatable to even some moderately risky investors.

This financial instability has also highlighted some flaws in the cryptocurrency industry. Acknowledging it’s a “house of cards,” Thompson adds, “It’s an industry built on an extremely shaky foundation.”

“Many of the biggest companies in the cryptocurrency space had extremely high-risk business models and were overleveraged,” Thompson.

But Merav Ozair, a blockchain expert and FinTech professor at Rutgers Business School, says what makes this crypto winter different from previous downturns is that its speculative nature isn’t entirely to blame.

“Today, the crypto market is very correlated and in line with everything that is happening in the economy and with other asset classes,” says Ozair. “So if everything suffers, the crypto market will suffer too.”

Thompson adds that it provides important context for why investors pulled a staggering $453 million from their Bitcoin holdings in a single week in June.

“Why would anyone want an asset that is most likely to decline in value in the short term?”

“Sometimes you have to cut off your finger to save your hand, to sell assets now so your total losses aren’t as damaging as they could be,” he says.

That does not deter investors

Still, Thompson would still describe himself as “optimistic” about crypto — and he’s not alone.

A survey by Voyager Digital shows that roughly 64% of Americans believe crypto will gain value in 2022, with 37% saying they are moderately or very likely to buy cryptocurrency this year.

About half of the participants believe that crypto will become more widely accepted in the next three years.

While blockchain technology has only been around since 2008, Ozair points out that “this has happened in every technology sector at the beginning,” citing the Internet bubble and Dot Com crash.

She expects the crypto industry to take a similar growth pattern as the tech sector once did when thousands of companies disappeared only for big challengers like Google, Amazon and Facebook to emerge as the victors.

“[Speculators] probably have confidence that this time will be no different, says Thompson.

Innovation from crypto wins hearts and minds

When asked what he sees in crypto and the underlying blockchain technology, Thompson sees great potential for growth.

“I’ve seen companies use blockchain in their technology stacks to create solutions that were later sold to legacy industries,” he said.

An example of this he points to is Moody’s recent acquisition of 360kompany AG (better known as just Kompany), a platform for global business verification. The move is expected to increase Moody’s “Know Your Customer” capabilities, giving it even more information about its customers and their individual risk profiles and financial positions.

But not everyone sees the same potential.

Paul Krugman, a Nobel Prize-winning economist and New York Times columnist, has long been a vocal Bitcoin skeptic. Last year, he claimed in a NYT column that 12 years later, Bitcoin has failed to live up to the hype.

“When a technology becomes as old as cryptocurrency, we expect that it has either become part of everyday life or has been given up as a non-starter,” Krugman wrote.

The crash makes a reset possible

Whatever happens next with this controversial and versatile asset, Ozair says this crash offers a chance to return to crypto’s original purpose.

“It was meant to help the underserved communities,” she says. “So let’s go back to the roots. Let’s think about how we can create a technology that can help society that can really create a social impact for real this time,” she added.

And she is not alone in that hope.

“To me, crypto is the last frontier of the American dream for people trying to find socioeconomic mobility in a country where inflation outpaces the minimum wage,” says Jacob.

“People forget that crypto was born out of the Occupy Wall Street era’s distrust of the banks and governments to properly manage our money supply – that is, without cooperation.”

Jacob continues to believe in crypto despite losing 80% of the crypto network multiple times.

“I’m still making more money with the market being down in Web3 than I would if I was still working in Web2,” he added.

What to read next

-

Sign up for our MoneyWise newsletter to receive a steady stream of practical ideas from Wall Street’s best firms.

-

The World Bank president just warned that white-hot inflation could last for years – get creative to find strong returns

-

“There’s always a bull market somewhere”: Jim Cramer’s famous words suggest that you can make money no matter what. Here are 2 strong tailwinds to take advantage of today

This article provides information only and should not be construed as advice. It is supplied without warranty of any kind.