Crypto Group wants clarity on recent banking regulatory measures

Cryptocurrency businesses need banks to move money between devices and access banking services. However, many banks are hesitant to work with these businesses. Due to concerns about money laundering, regulatory risks and the high cost of compliance.

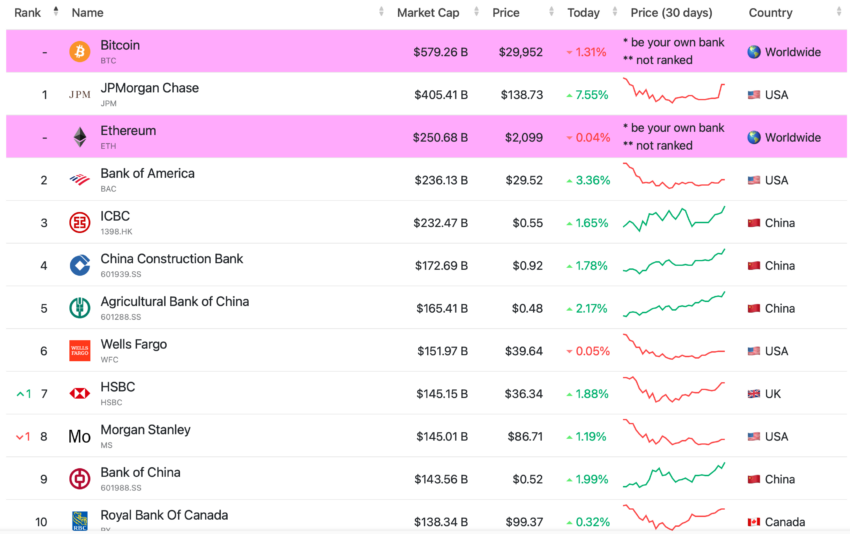

Cryptocurrency has become an increasingly popular asset class, with billions of values traded daily. Despite this growth, many cryptocurrency businesses still need help accessing banking services. The traditional banking system must adapt to the unique characteristics of cryptocurrencies, and many banks are reluctant to work with cryptocurrency businesses.

Such businesses need banks to move money between entities and access banking services. With crypto-friendly banks shutting down, it will be difficult for cryptocurrency businesses to make money where they need it.

Complex relationship between banks and crypto

It is important to understand that cryptocurrency businesses need banks to move money between entities because most people still use traditional banking services to hold their wealth. While cryptocurrencies offer many advantages, such as decentralization, security and anonymity, they still need wider acceptance as payment. This means that businesses that want to convert their cryptocurrency holdings to fiat currency or transfer them to other parties must do so through the traditional banking system.

Banks are also necessary for many cryptocurrency businesses to access essential financial services, such as business loans and lines of credit. These services are necessary for businesses to grow and expand. They may need help competing with other companies with access to these resources.

However, several factors make many banks reluctant to work with cryptocurrency businesses. First, there are concerns about money laundering and other illegal activities facilitated through cryptocurrency transactions. Given the anonymous nature of many cryptocurrencies, it can be difficult for banks to verify the identity of individuals and businesses involved in these transactions. Also to ensure that they do not participate in criminal activity.

Lock horn over control

Second, there needs to be more regulatory clarity around cryptocurrencies, which makes it difficult for banks to know how to deal with them. Countries and jurisdictions have different laws and regulations around cryptocurrencies, and there is no global standard for dealing with them. This means that banks may be hesitant to work with cryptocurrency businesses due to concerns about legal and regulatory risks.

Another challenge for cryptocurrency businesses trying to access banking services is the high cost of compliance. Banks are subject to strict regulations and must conduct strict due diligence when taking on new clients, especially those in high-risk industries such as cryptocurrencies. This can involve costly and time-consuming background checks and ongoing requirements for monitoring and reporting. As a result, many banks may charge higher fees to cryptocurrency businesses to cover these compliance costs.

There are also practical challenges associated with moving money between cryptocurrency and traditional banking systems. Cryptocurrency transactions can be slow and costly, especially during high market volatility. This can make it difficult for businesses to quickly convert their holdings of cryptocurrency into fiat currency, which may be necessary to pay bills or make other transactions.

The decline of crypto-friendly banks

Despite these challenges, some banks have begun to embrace cryptocurrencies and work with cryptocurrency businesses. These banks see the potential for growth in the industry and recognize that they can offer valuable services to these businesses. Nonetheless, banking institutions have closed due to regulatory uncertainty. These shutdowns have created challenges for the cryptocurrency industry as businesses have struggled to find alternative banking solutions.

Silvergate, Silicon Valley Bank and Signature, considered crypto-friendly banks, faced adversity from regulators, leading to the removal of crypto firms from banks. The autumn triggered a number of concerns and questions about these institutions. On April 14, a cryptocurrency advocacy group, the Blockchain Associationfiled several Freedom of Information Act (FOIA) and Freedom of Information Law (FOIL) requests to get more information about the banks’ de-banking of cryptocurrency firms.

The requests target various federal and state agencies, including the Office of the Comptroller of the Currency (OCC), the New York State Department of Financial Services (NYDFS), and the Federal Deposit Insurance Corporation (FDIC). According to a report shared with BeInCrypto, the group seeks to understand:

“…whether the closure of Signature Bank was a result of the bank’s insolvency or a decision to issue an anti-crypto message despite the bank being fully solvent.”

In addition, it questioned the motive for Silvergate’s failure. If it “was the result of a politically motivated decision by the Federal Home Loan Bank of San Francisco, which is overseen by the FHFA, to take the extraordinary and unusual action of withdrawing a loan made to Silvergate just months earlier.”

The group has on various occasions expressed concern about proposals aimed at crypto.

The crypto sector may emerge victorious

De-banking cryptocurrency firms has been a contentious topic in the cryptocurrency industry. Many firms claim they are being unfairly targeted because of crypto’s perceived risk. Some have even argued that de-banking is a form of discrimination against the industry. Still, a few have argued that the collapse of banks only strengthens some users’ faith in decentralized currency.

While time will tell what information the Blockchain Association will obtain through its FOIA and FOIL requests, the move highlights the growing concern within the cryptocurrency industry about the lack of access to stable banking services.

The industry is closely monitoring the responses to these inquiries to see if they provide any insight into the de-banking phenomenon. And how to solve it in the future.

Disclaimer

In accordance with Trust Project guidelines, this feature article presents the opinions and perspectives of industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect the views of BeInCrypto or its employees. Readers should verify information independently and consult with a professional before making decisions based on this content.