Crypto games that are least affected by the bear market, VC investments remain strong

Crypto-based games to make money and game-related non-fungible tokens (NFTs) constitute the least affected sector in the entire crypto under the current bear market, with venture capital investments continuing to flow into the sector, a new report from the decentralized app tracking site DappRadar have found.

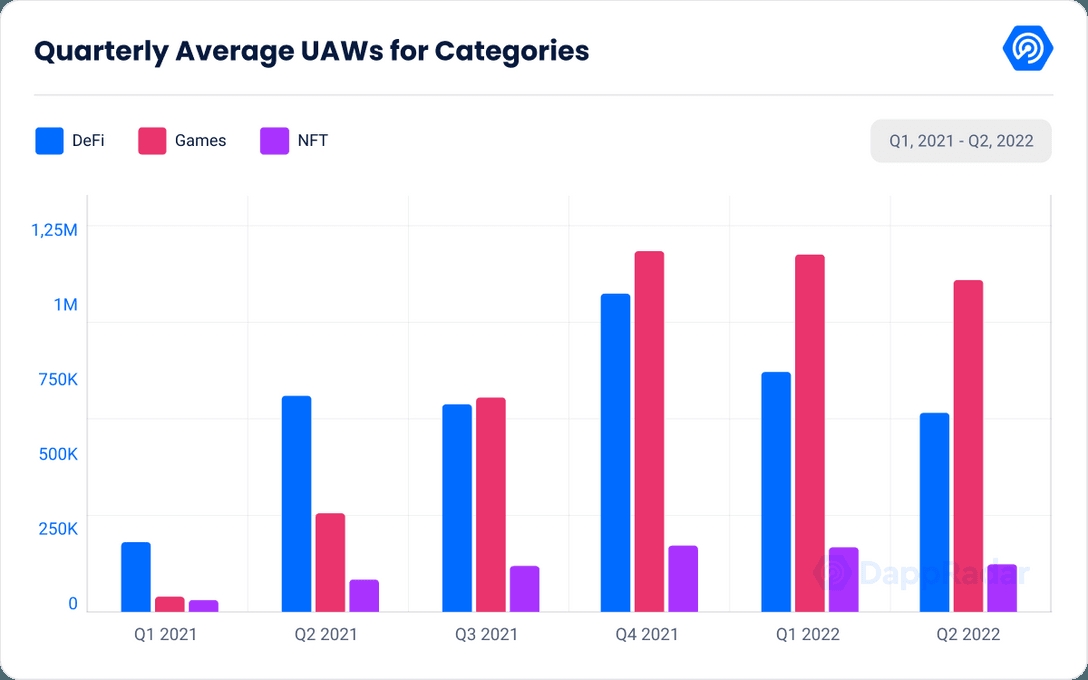

According to the report, the gaming sector in crypto reached a peak as late as June this year, when it finally experienced a decline measured by the number of unique active wallets (UAW).

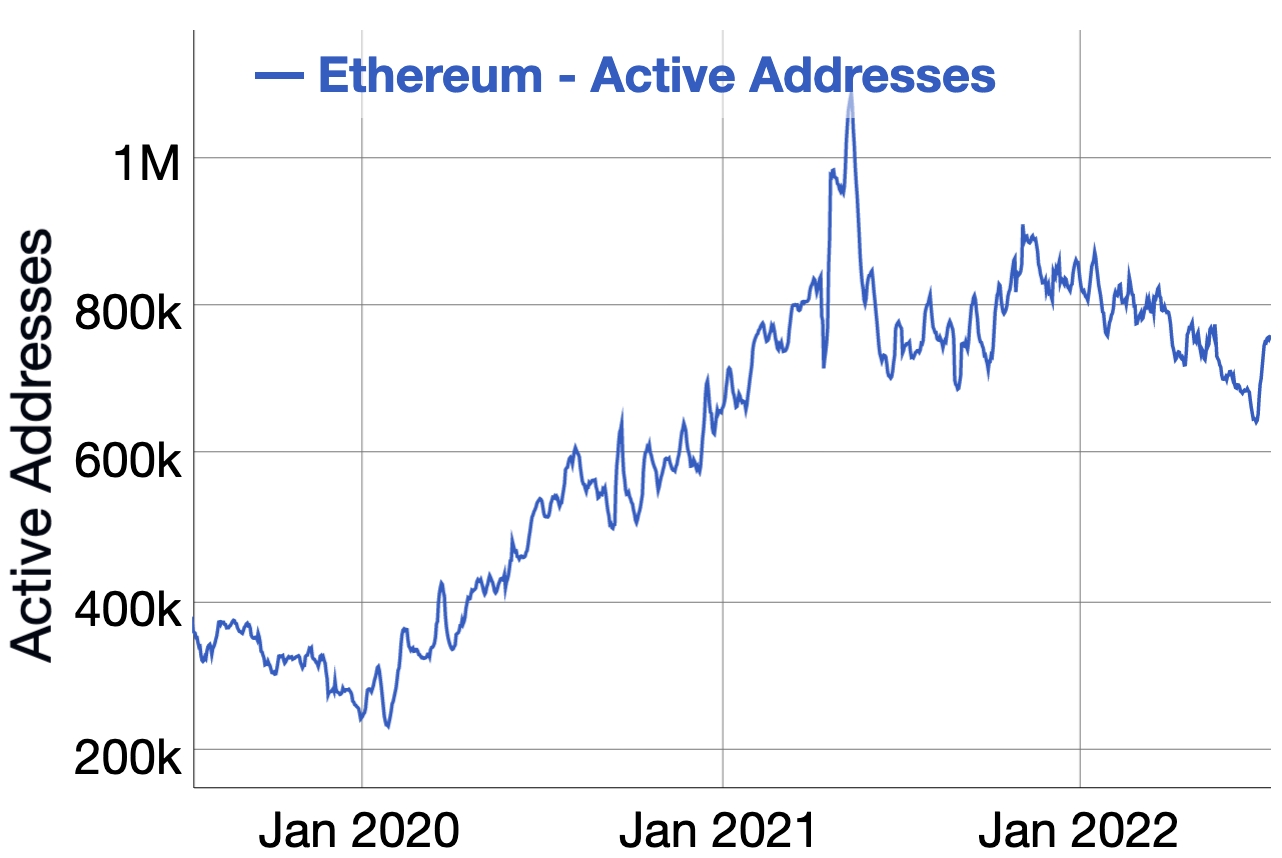

In comparison, the number of daily active wallets on the Ethereum network (ETH) as a whole peaked at well over 1 million in May 2021, which it has not yet surpassed.

The high usage implied by the number of active wallets was interpreted by investors as “a bullish signal to continue investing in blockchain games,” DappRadar wrote.

It further noted that the second quarter of this year saw venture capital investments of USD 2.5 billion flow into the sector, which it said maintained the pace set in the first quarter, and “already exceeded the annual milestone of [USD] 4 billion set in 2021. “

Pointing to a new $ 4.5 billion cryptocurrency fund from the VC giant Andreesen Horowitz as an important source of future investment in space, the report claimed that,

“At this rate, we are estimated to have a volume of 12 billion invested by the end of the year.”

Among the areas in the gaming sector that stood out the most were virtual world-related NFTs, which saw their trading volume increase by 97% since the previous quarter.

Meanwhile, it was the most popular game in the sector Splinterlandswith a daily average of 283,729 unique active wallets during the quarter, according to DappRadar.

Another bright spot that was pointed out in the report was Alien Worlds, the second highest ranked game with unique active wallets. The game’s player base remained “more or less stable” over the quarter, with the number of active wallets falling only 4% in the second quarter compared to the previous one.

As for the things that have not gone so well for the sector, the report pointed to games to make money Axie Infinity (AXS). The game has lost 40% of players since the first quarter, mainly due to the large Ronin bridge notch and the weakening of the game’s SLP token.

The Ronin Bridge is a cross-chain bridge used to transfer assets from the Ethereum blockchain to Axie Infinity’s specially built blockchain Ronin.

That said, in a comment on the findings of the report, Pedro Herrera, head of research at DappRadar, said that blockchain gaming has become “one of the most promising sectors of Web3.”

He added that the amount of capital raised, along with an “exodus of talent shifting from the leading traditional gaming companies to web3 gaming startups,” are other positive signs for the sector going forward.

“We are gradually seeing how Immutable-X, Gala gameand other networks are positioning themselves to lead the rising category in the years to come with impressive partnerships already in place, Herrera said.

____

Learn more:

– Blockchain Games strongest category in the middle of the downturn in the crypto market

– Axie Infinity shows new signs of life, despite still falling NFT sales

– VC Play-to-Earn investors now ‘more cautious’, gaming engagement remains strong – Animoca Brands

– The Japanese VC company misteltein strengthens cryptofocus, says Web3 will spread to all industries

– Blockchain Games See a decline in users and volume after strong performance in May

Top 5 Games to Make Money on Ethereum