Crypto funds hit record outflows last week, wiping out all inflows

Cryptocurrency investment products last week suffered their biggest outflows ever as investors pulled money out of bitcoin and Ethereum funds, CoinShares reported on Tuesday.

Bitcoin posted a strong weekly outflow for the 5th week in a row as institutional investors continued to pull money out of cryptocurrency products and funds amid an ongoing price decline.

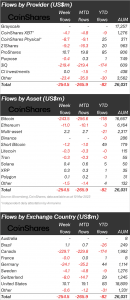

CoinShares’ weekly survey shows a hefty $225 million in net outflows for crypto investment products last week. The figure represents 1 percent of total assets under management (AuM) and was 10 percent lower on a weekly basis. The outflows also obliterated all the inflows seen this year, bringing total outflows in this five-week period to $82 million.

Bitcoin led the tally with $244 million in outflows during the week, the largest weekly outflow since May 2019. With the general mood in cryptocurrencies turning cautious as the digital asset’s 2023 rally hit a wall, CoinShares writes that it is difficult to determine the exact the reason for this other than the hawkish rhetoric from the Federal Reserve and the latest price decline.

Short bitcoin funds also saw outflows totaling $1.2 million, although it is now the investment product with the largest inflow to date at $49 million. Regionally, the outflows were fairly evenly distributed between North America and Europe as the negative sentiment was broad.

“Although the payouts are the largest on record, they are not expressed as a percentage of total assets under management, that record was in May 2019 when it saw $51 million in payouts, representing 1.9% of assets under management. It highlights how much total assets have increased since May 2019 (816%),” the report says.

The decline in March, the asset manager noted, marked a reversal of the recent trend that included two straight months of inflows, and marked the fastest pace of withdrawals in at least a year. The drop came as crypto prices have closely followed declines in stocks over the past two weeks as investors unloaded assets seen as speculative and higher risk. There has been more alignment between crypto stocks and US stocks, especially technology companies, because investors treat both assets as riskier investments with higher growth potential and risk.

In addition, other assets, including Ethereum, saw outflows of $11 million, entering their fifth week of outflows, but to a much lesser extent of $3 million so far this year.

The AUM of the second largest cryptocurrency by market capitalization was $6.6 billion. Total assets under management were $26 billion last week, returning to early 2023 levels.

Breaking down the latest statistics, Coinshares said it saw smaller inflows into some altcoin investment products. Solana and XRP were the top performers with inflows of $0.4 million and $0.30 million respectively.