Crypto did not cause the collapse of the signature bank: NYDFS

The New York State Department of Financial Services has spoken out about the role of crypto in Signature Bank’s downfall. Unlike the current wave of attacks on US industry, it’s not all bad news.

Speaking at a crypto industry conference on March 5, NYDFS Superintendent Adrienne Harris confirmed that crypto was not the reason for the closure.

Federal regulators shut down Signature Bank in mid-March, citing concerns about systemic risk posed by the crypto-focused bank. However, the mainstream media blamed crypto in its usual amount of FUD after the events.

Harris confirmed that the action was due to the bank’s liquidity, not because it had customers with digital assets.

Furthermore, she described the events that led to the fiasco as “a new-fashioned bank run”. Signature had a high percentage of uninsured deposits and lacked liquidity management protocols to meet withdrawal requests, she said.

Signature Bank had about $4 billion in deposits related to its crypto-asset banking business, according to the Federal Deposit Insurance Corp (FDIC).

Don’t blame Crypto for Signature Bank

US regulators have been heavily targeting crypto this year following the collapse of FTX in November. Decentralized forms of money pose a threat to the traditional banking system, and financial regulators are trying to protect this institution.

However, Harris is one of the few who does not see crypto as the root of all evil. According to the WSJ, she said:

“The idea that the takeover of Signature was about crypto and this is ‘Choke Point 2.0’ is really ridiculous.”

“Operation Choke Point 2.0,” refers to the idea that regulators plan to kill crypto and cut it off from the banking system.

Harris had a more positive view of crypto than other heads of regulatory agencies. However, she said the sector lacks maturity.

“There is still a lack of maturity around the Bank Secrecy – Anti-Money Laundering Act [compliance] and cyber security. We look forward to the day when these systems mature and scale as the business side does.”

On March 5, BeInCrypto reported that there were no links between stablecoin issuer Tether and the fall of Signature Bank.

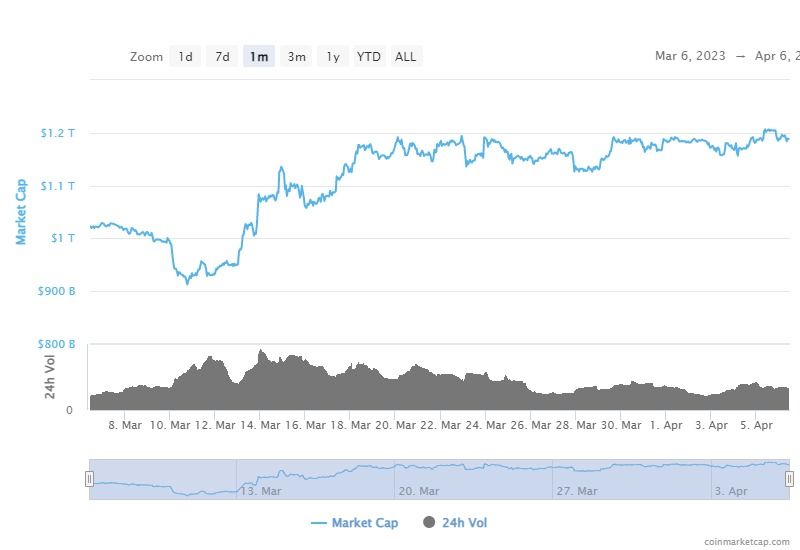

Crypto Market Outlook

Markets have fallen slightly today, with a 1.3% decline in total market capitalization. As a result, the number is currently $1.19 trillion.

Bitcoin (BTC) has fallen 1.5%, falling to $28,132, while Ethereum (ETH) is marginally down at just under $1,900.

However, the weekly outlook remains range.

Disclaimer

In accordance with the guidelines of the Trust Project, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.