Crypto and Fintech industry in the UK saw investment dry up in 2022

The crypto industry saw not-so-appealing results emerge last year after several collapses. In line with autumn, investment continues to dry up in the fintech industry in the UK. Other sectors have suffered a similar fate under the new regime in British politics.

The UK economy has faced significant challenges in recent years due to various factors: Brexit uncertainty, global economic downturn and the COVID-19 pandemic. These challenges have negatively impacted several sectors, including fintech investment and cryptocurrency.

According to a report by Innovate Finance, a trade association for the UK fintech industry, fintech investment in the UK fell by 39% in 2020 compared to 2019. The decline can be attributed to several factors, such as the economic uncertainty caused by Brexit, the pandemic, and tightening of the regulations.

Crypto contagion in the Fintech sector

While 2020 was the beginning, last year witnessed a similar outcome – evident in KPMG’s Pulse of Fintech report shared with BeInCrypto by Bloomberg. The fintech sector saw a drop in funding from $22 billion, with 724 deals to $17 billion, and 593 deals in 2022. The report attributes the drop to “higher interest rates, inflation and declines in valuations hitting investor appetite.”

“The divergence highlights the shift in investor sentiment in the face of mounting geopolitical challenges leading to a lack of IPOs, downward pressure on valuations and market turbulence,” said a partner at KPMG.

The decline here mirrored the decline in investment for one of the cohorts – cryptocurrency. Global investment in crypto and blockchain firms fell from $30 billion in 2021 to $23.10 billion in 2022. Unsurprisingly, the crypto contagion sparked by collapses like FTX last year had a ripple effect on the entire fintech domain.

The government has taken a strict approach to centralize the crypto industry. For example, the UK government launched various programs to crack down on crypto-related initiatives. This included ATMs, advertisements, tough regulatory measures and more.

What Could Have Caused the Fintech Investment Fall?

Various experts have blamed the strict government regulations behind the pronounced demise. British startups and investors have raised red flags about existing government laws that appear to be thwarting the country’s ambition to remain a global fintech leader. Some factors include the recent transfer of significant funding to the government-backed industry body, Tech Nation. In addition, a lack of visas to attract start-up talent and the removal of tax breaks for research and development.

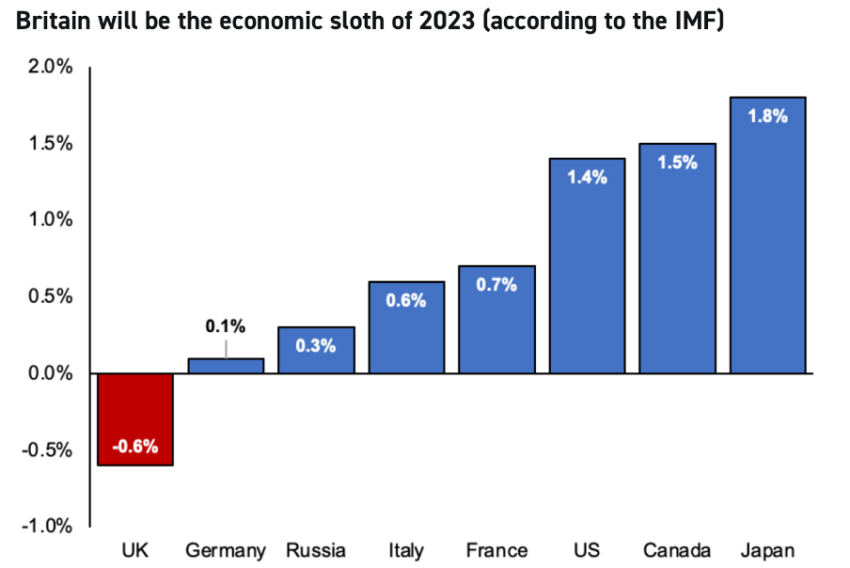

Across regions, the EU is expected to grow by 0.80% and Ireland will grow by 5% in 2023. At the same time, the UK is likely to shrink by 0.60%, according to the International Monetary Fund (IMF).

Even for the downturn in the crypto sector, one of the Redditors stated while talking to BeInCrypto:

“Government policy appears to be causing (crypto) carnage and UKGov not listening.”

Cracks visible across various roofs

Additionally, various locals have voiced a similar concern on Reddit (r/UKpolitics) across various sectors in the UK that saw the same picture – for example the car industry. Citing the apparent risk, more than 22,000 jobs in the UK car industry were at stake. This corresponds to the transition from the traditional regime to the upcoming electively driven cars. The bulk of UK job losses will affect the company’s technical center in Dunton, Essex, which employs around 3,400 workers.

Meanwhile, domains such as the pharmaceutical sector may soon reach a tipping point as firms opt for other regions with a relatively lower tax structure. In 2022, five companies decided on the UK’s voluntary scheme that governs spending on brand-name medicines. The departure of two major firms – AbbVie and Lilly – is a deliberate tactic to signal to the government that the system is not working for the industry, putting investment and access to medicines in the UK at risk.

“I don’t understand the rationale behind this strategy – is this a result of Brexit ideology? It seems less risky to listen to the businesses already based here and support them instead of abandoning the EU oriented companies in an attempt to diversify into India etc. Or is the UKGov simply trying to squeeze every last drop of blood from our existing industries to pay off some of the massive public debt? a Redditor told BeInCrypto.

“Whatever the explanation, it seems like a terribly short-term strategy that will compound Britain’s economic problems as these businesses begin to close.”

Expectations for the current year

Despite the challenges, there are still opportunities for the fintech sector to thrive in the UK. The government has shown support for the industry, and work is being done to create a more favorable environment for fintech investments. In addition, the pandemic has accelerated the adoption of digital technologies, which may lead to increased demand for fintech services.

Digital Economy Minister Paul Scully said that despite global headwinds, ‘British FinTech firms showed great resilience last year and helped boost the UK’s status as a world leader in technology – delivering jobs and huge economic benefits.’

“In 2023, we focus on maintaining our leadership by supporting start-ups, increasing digital skills and making this country an even more attractive destination to establish, grow and invest in technology companies.”

Can this be achieved or will the economy see a bounce back? Only time will tell.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.