Could Bitcoin Be Your Financial Lifesaver?

Big banks like Credit Suisse falter and call for bailouts, which begs the question: Is your money really safe in traditional banking systems during a banking crisis? With Bitcoin and other cryptocurrencies gaining popularity, it is time to consider the role of these digital assets as potential safe havens.

But what are the opportunities and risks of storing wealth in Bitcoin during banking crises?

The shaky ground of traditional banks

The global financial ecosystem is in a precarious state. The collapse of Credit Suisse, a global systemically important bank (G-SIB), has set off alarm bells around the world.

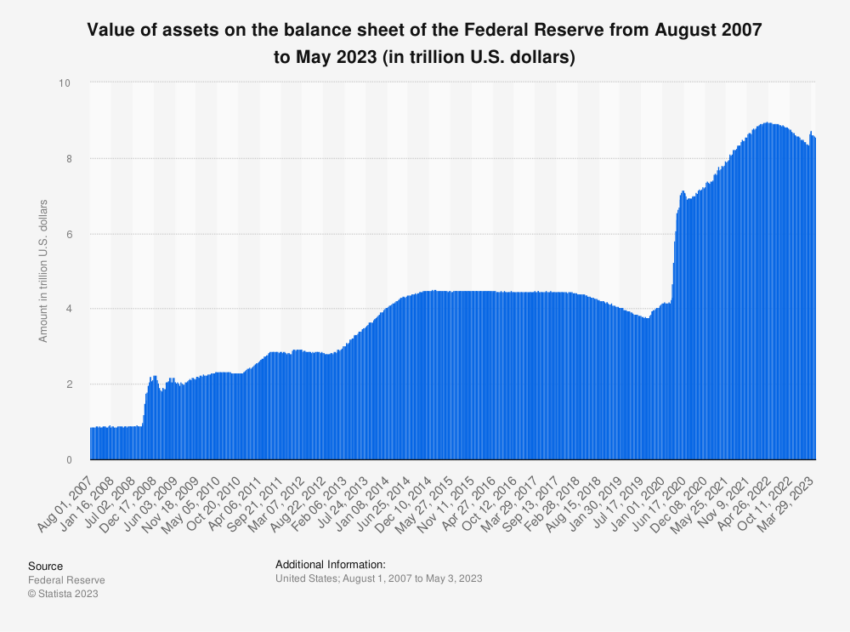

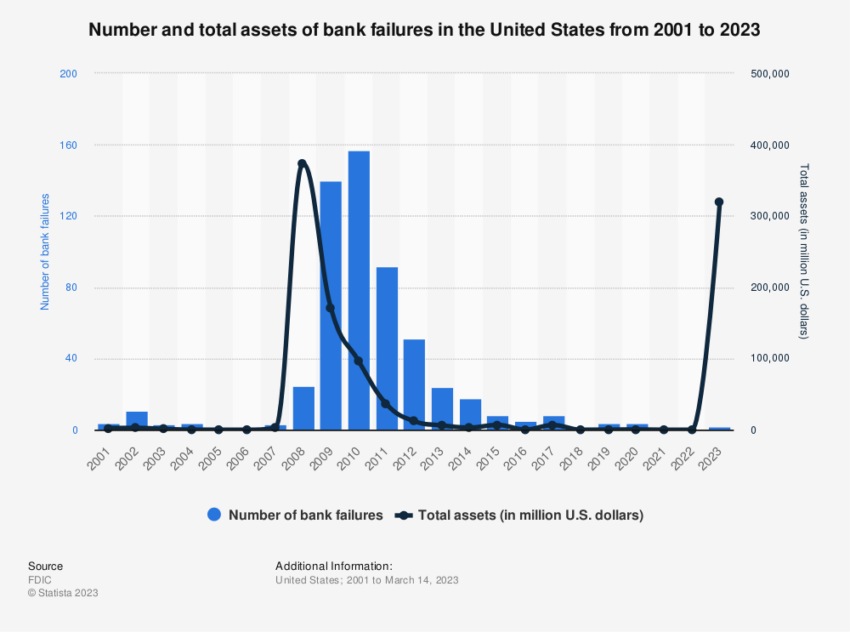

This failure, combined with the fact that no banks failed during the last decade of quantitative easing (QE), makes one question the stability of our banking systems.

Historically, bank failures were a natural part of free markets, helping to remove excess risk. But with governments and central banks expanding the money supply like never before, bank failures have become a rarity.

Is this a result of safer banking practices or just a by-product of money printing and government bailouts that have shifted risk off the bank balance sheet?

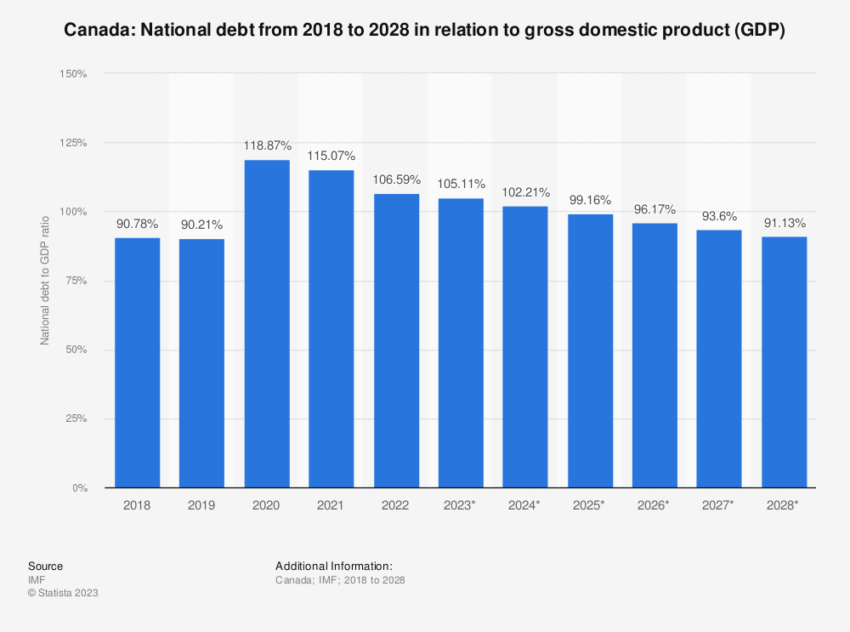

Countries like Canada have followed the G20 consensus, engaging in QE and issuing debt to finance deficit spending. Such practices have led to an increase in public and private debt in relation to GDP.

This trend can potentially inflate asset bubbles and contribute to economic instability.

Economist Joseph Barbuto has highlighted the high Canadian debt to GDP ratio. He has drawn comparisons with the United States’ debt-to-GDP ratio during World War II.

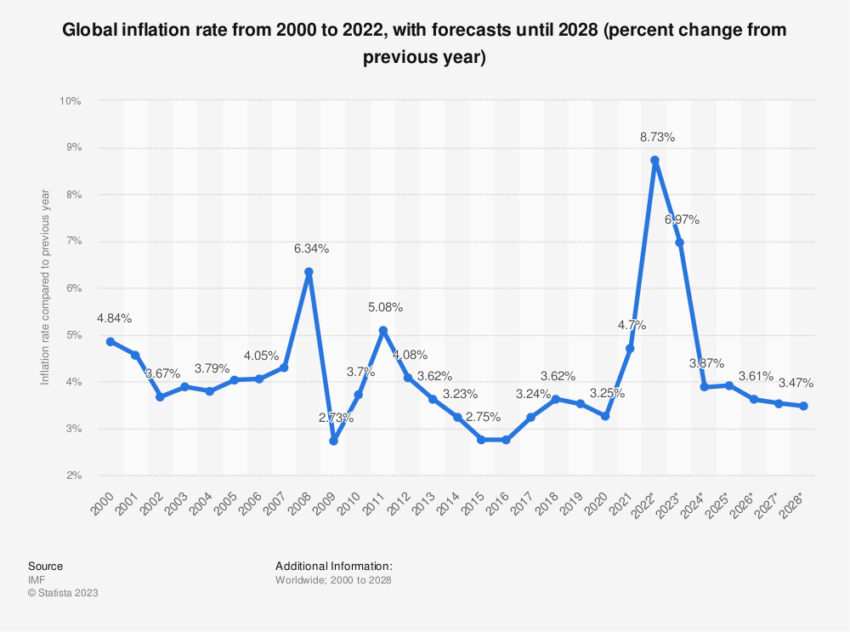

This alarming rise in debt levels has sparked a debate about the effectiveness of QE. Many economists accuse central banks of artificially manipulating interest rates and contributing to inflation.

The big retreat – a sign of lost confidence

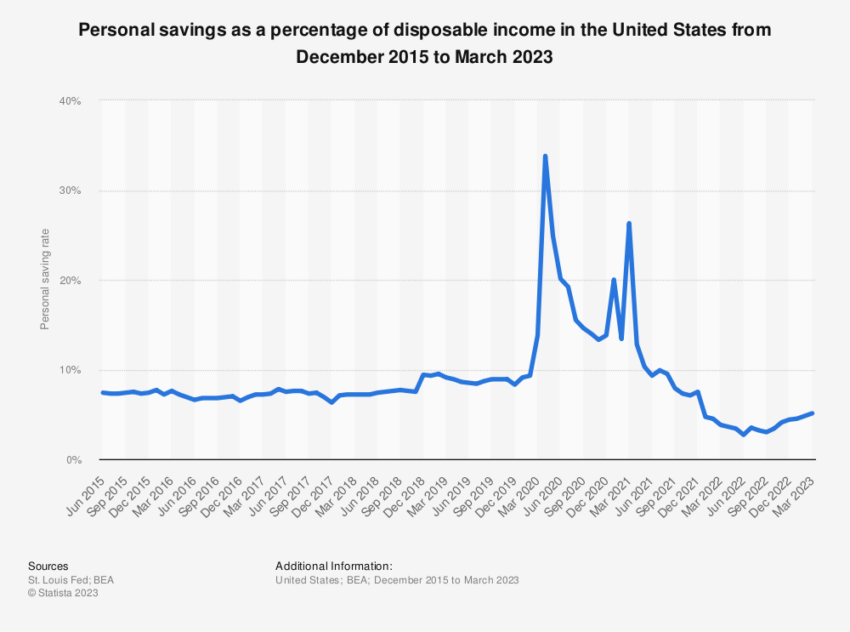

As trust in banks declines, people are increasingly withdrawing their money. High interest rates are another contributing factor that encourages depositors to seek higher returns in alternative investment instruments.

This trend has led to the emergence of digital banking runs, with record-breaking withdrawals from traditional banks. For this reason, the banking industry’s practices are under scrutiny.

For example, banks receive roughly 5% interest on the money they park in the central bank after buying government debt under QE. Meanwhile, depositors get a savings rate of roughly 0%.

This unfair discrepancy is causing people to transfer their savings to other assets, including Bitcoin.

The banking crisis has resulted in three of the largest bank failures in US history, with Silicon Valley Bank, Signature Bank and First Republic Bank falling victim.

These failures have led to a series of emergency measures by the Federal Reserve, including bailouts and lending programs designed to prevent the realization of losses on US Treasuries.

However, intervention by central planners in the price mechanism of the free market has caused concern. The Federal Reserve now acts as a “loan shark” for small and medium-sized banks, potentially exacerbating the crisis.

Bitcoin – a safe haven in the middle of the banking crisis?

While traditional banking systems are under pressure, Bitcoin is emerging as a potential safe haven.

Despite its volatility, Bitcoin provides a decentralized and secure alternative to traditional banking. The digital asset is immune to inflation and government interference, making it an attractive alternative during banking crises.

However, the transition to digital assets is not without risk. Like any investment, Bitcoin’s value can fluctuate, and it is critical to understand these risks before transferring wealth to digital assets. Still, Bitcoin can offer a degree of protection in times of banking uncertainty.

Its decentralized nature allows it to operate independently of central banks and government control. This could offer a financial haven for those looking to escape a potential banking crisis.

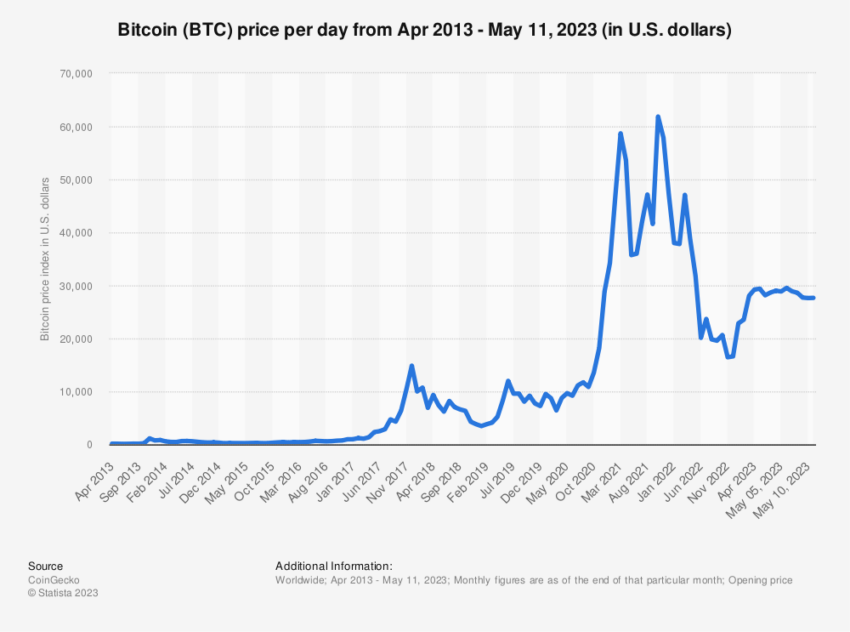

Although Bitcoin’s price is volatile, its value is not directly correlated to any specific economy, which can be beneficial when traditional financial institutions are unstable. Additionally, while governments can print more money and cause inflation, Bitcoin’s supply is limited, providing a degree of protection against currency devaluation.

Bitcoin’s potential as a safe haven during banking crises is not purely theoretical; real-world events provide valuable insight.

For example, during the economic crisis in Venezuela, Bitcoin usage increased as citizens sought to protect their wealth from hyperinflation. Similarly, Bitcoin’s price rose significantly after the 2013 banking crisis in Cyprus as investors looked for safe havens.

While these cases do not prove Bitcoin’s absolute safety, they highlight its potential role as an alternative financial refuge during banking crises. However, it is crucial to remember that Bitcoin carries its own risks, such as price volatility and regulatory uncertainty.

Is your money safe in Bitcoin?

Investing in Bitcoin as a hedge against banking crises is not a one-size-fits-all strategy. It depends on individual circumstances, risk tolerance and understanding of cryptocurrencies.

While Bitcoin may offer potential benefits such as inflation protection and independence from traditional banking systems, it also carries significant risks.

Therefore, for those considering Bitcoin as an alternative to traditional banking, it is important to understand the dynamics of the crypto market, the technology underlying Bitcoin, and the potential legal and financial implications.

The safety of money in Bitcoin during a banking crisis largely depends on how one defines “safe”. If security means preserving the purchasing power of one’s wealth amid rampant inflation and banking instability, Bitcoin could potentially serve as a viable refuge.

But if security means maintaining a stable investment value, Bitcoin’s volatility can pose a significant risk.

While Bitcoin can offer a financial haven during banking crises, it is not a guaranteed solution. It is a relatively new and rapidly developing asset class that should be approached thoroughly and carefully, taking into account the associated risk.

Disclaimer

In accordance with Trust Project guidelines, this feature article presents the opinions and perspectives of industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect the views of BeInCrypto or its employees. Readers should verify information independently and consult with a professional before making decisions based on this content.