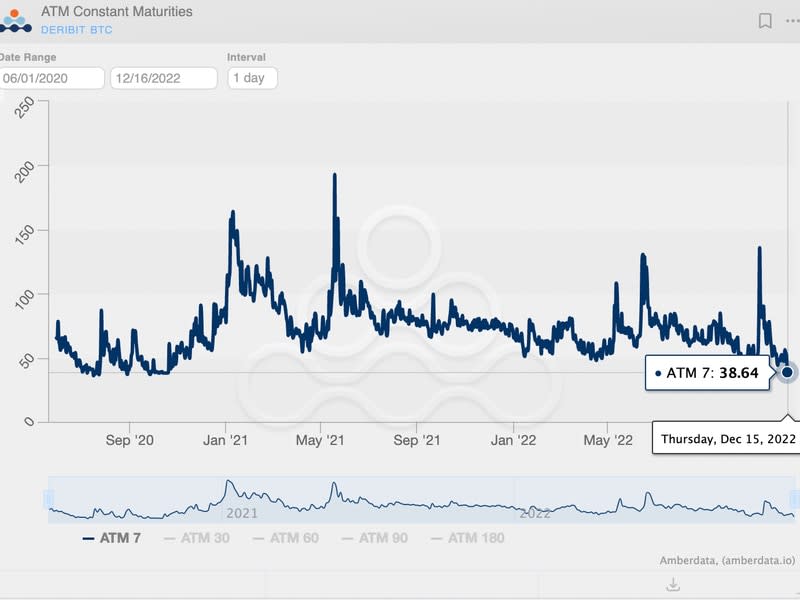

Confusing calm? Bitcoin’s implied volatility is at its lowest since October 2020

There is an eerie sense of calm in the bitcoin (BTC) market despite persistent fears of FTX contagion and macroeconomic uncertainty. Analysts are trying to explain the puzzling calm.

Bitcoin’s annualized seven-day implied volatility (IV), or the options market’s forecast of a likely move in the underlying asset, has fallen to a two-year low of 38.2%, according to data source Amberdata.

The metric – often equated with the degree of uncertainty or fear – peaked at 145% on November 9 and has been falling since, although FTX infection spreads and experts fear a wave of miner bankruptcies.

For Markus Thielen, head of research and strategy at Matrixport, the falling volatility is not surprising.

“Volatility expectations will continue to fall. Lower volatility is one of my favorite trades for 2023,” Thielen told CoinDesk. “The macro outlook is extremely constructive, with inflation falling like a rock and the recent decline in oil making the Ukraine war less relevant.”

Thielen added that the FTX headlines will now have less of an impact on the market, with research doing the dirty work in the background, and cited China’s recent decision to ease inflationary COVID-19 restrictions as a source of downward pressure on implied volatility.

Negative headlines have had less of an impact on bitcoin’s price lately. The cryptocurrency has risen 9% to $17,700 since crypto lender BlockFi filed for bankruptcy on November 28. Dominant crypto exchange Binance’s health came under extra scrutiny early this week, with clients withdrawing large sums of their coins. Bitcoin has managed to extract a 3% gain for the week.

Perhaps traders have moved on from the FTX collapse, having bought options to hedge their exposure after the FTX debacle, pushing the implied volatility higher at the time.

“Market participants have already hedged contagion implications, which are still relevant, but the hedging happened when the market was in a more fearful state, causing hedging costs to increase,” said Vetle Lunde, research analyst at Arcane.

“The current low IV regime reflects that traders are satisfied with current exposure (hedges already in use) and expectations of less volatility in the foreseeable future,” Lunde noted.

Options activity picked up in mid-November as traders bought ether, solana and bitcoin put options to hedge downside risk, while users with funds locked up on FTX switched to trading futures on other exchanges.

Or maybe crypto traders just had their fill of 2022 already.

Volumes in both the spot and derivatives markets have crashed since then, indicating stagnation in the market. It is typical for the break before the holidays.

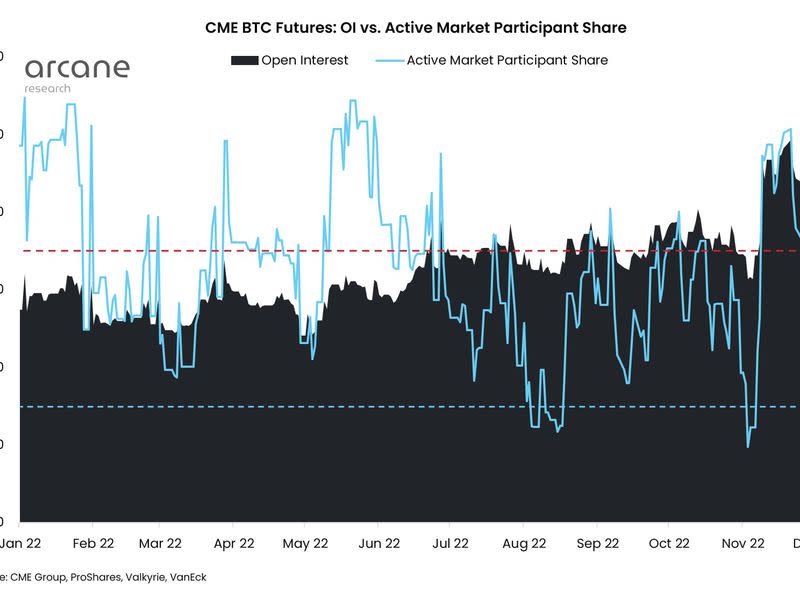

Institutional interest has waned, as evidenced by the decline in active bitcoin futures contracts on the Chicago Mercantile Exchange (CME). The so-called futures open rate has fallen to 69,000 contracts, the lowest since October.

The share of non-exchange-traded funds (ETFs) in the open interest has reached a record low of nearly 41%.

“In light of subdued activity and expected slow times ahead, volatility is likely to continue to compress, which in turn is reflected in options,” Lunde said.