Kevin Helms

A student of Austrian economics, Kevin found Bitcoin in 2011 and has been an evangelist ever since. His interests lie in Bitcoin security, open source systems, network effects and the intersection of finance and cryptography.

all about cryptop referances

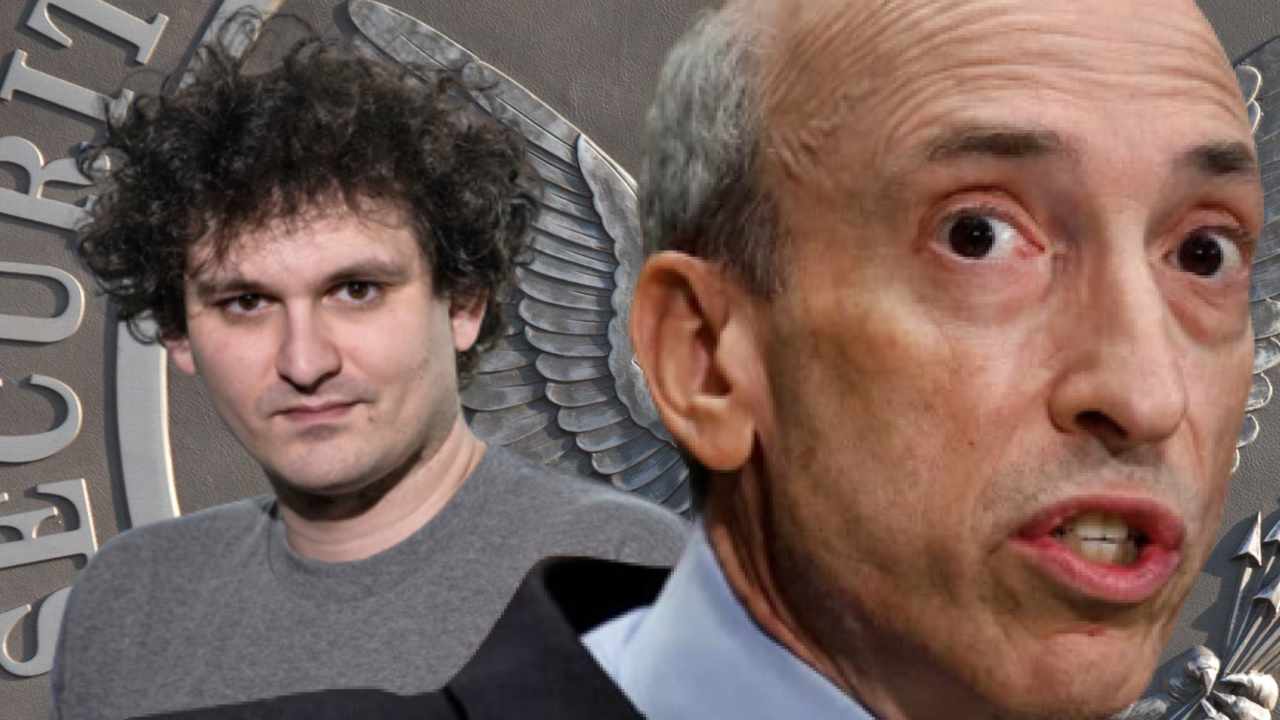

The US Securities and Exchange Commission (SEC) reportedly met with crypto exchange FTX and former CEO Sam Bankman-Fried several times before the crypto firm filed for bankruptcy. SEC Chairman Gary Gensler is rumored to be helping FTX with legal loopholes. However, a new report indicates a contrary point of view.

Following the bankruptcy filing of cryptocurrency exchange FTX, rumors have surfaced accusing the chairman of the US Securities and Exchange Commission (SEC), Gary Gensler, of helping former FTX CEO Sam Bankman-Fried and his bankrupt exchange with “legal loopholes to achieve regulatory monopoly . ” Some people even speculated that the SEC chief was about to issue FTX a no-action letter.

Gensler’s own calendar shows that he met Bankman-Fried in March. According to an SEC meeting memo, “members of Chairman Gensler’s staff met with employees of IEX and FTX to discuss custody of securities in digital assets by special purpose broker-dealers, including the unique risks associated with custody of securities in digital assets and the contingent relief described in the statement.”

However, Fox Business’ Charles Gasparino explained on Twitter Saturday that “contrary to speculation” about Gensler wanting to give former FTX CEO Sam Bankman-Fried a regulatory monopoly on a crypto exchange:

The March meeting between the two sides was described by one attendee as ‘a 45 minute lecture by Gensler’ about what he wants from a crypto exchange.

Not only did the SEC chairman make no promises to Bankman-Fried, FTX and IEX, but he “ordered them to give much more in the way of disclosure, etc. to the SEC about their model,” the reporter noted.

“Follow-up meetings with the SEC continued up until almost the time FTX imploded, but no SEC approval was signaled,” he continued. “House GOP likely to hold hearings on FTX given Bankman-Fried’s Dem political leanings in calling Gensler as a witness, may have to think twice. Sources say Gensler told Brad Katsuyama & Bankman-Fried that he wanted strict oversight, standards and that there was no guarantee of approval.”

Nevertheless, many people have expressed on social media their belief that either Gensler or other SEC employees helped FTX. Some suspected it was because Bankman-Fried is a major donor to the Democratic Party. The former FTX boss was the second-biggest donor to Democrats in 2021-22, donating $39.8 million — second only to George Soros, according to Open Secret’s political donor data.

Referring to the sanctioning of Ethereum’s crypto-mingling service Tornado Cash, privacy activist and whistleblower Edward Snowden tweeted:

The White House is sanctioning and arresting kids for the “crime” of building privacy tools to protect you, while “regulators” are quietly screwing around with the thieves who just robbed 5 million people. The difference? The thieves were major political donors.

Congressman Tom Emmer (R-MN) tweeted Thursday: “Reports to my office allege he helped SBF and FTX work legal loopholes to gain a regulatory monopoly. We are looking into this.”

Last week, during an interview on CNBC, Gensler confirmed that he met with Bankman-Fried. The SEC chairman said: “I think we’ve been clear in these meetings … non-compliance is not going to work, the public is going to be hurt.”

The SEC chief has often been criticized for his enforcement-centric approach to regulating the crypto industry. Gensler has repeatedly said that crypto trading and lending platforms should “come in,” talk to the SEC and get registered. However, Ripple CEO Brad Garlinghouse said last September that instead of working with the crypto industry, “the SEC is using its meetings with companies as lead generation for their enforcement actions.” His company is currently engaged in an ongoing lawsuit with the SEC over the sale of XRP.

In addition, several news outlets have reported that the SEC and the Commodity Futures Trading Commission (CFTC) have investigated FTX for alleged mishandling of customer funds. In May, Gensler warned that crypto exchanges often trade against their customers.

Do you think the SEC and Chairman Gensler worked with crypto exchange FTX and Sam Bankman-Fried on legal loopholes? Let us know in the comments section below.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.