Coincub Announces 2022 Worldwide Crypto Tax Ranking

-

Coincub teams with crypto tax specialists, ACCOINTING, for crypto tax ranking

-

Belgium worst mainstream economics for crypto income taxation

-

Germany best mainstream economy for long-term crypto investors

-

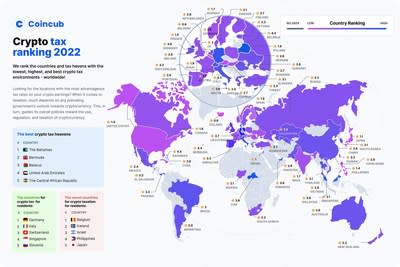

Bahamas, Bermudaand Belarus top list of crypto havens

DUBLIN, 8 September 2022 /PRNewswire/ — Cryptocurrency demands and expectations are always changing, and governments are continually adapting their tax strategy accordingly. Crypto tax specialist Accointing sees an ever-increasing demand for crypto investments and is directly behind Coincub’s efforts to bring ever-greater clarity to the worldwide crypto industry.

One of the consistent findings in Coincub’s quarterly rankings of the world’s leading crypto-economies is that many countries are still developing the regulatory requirements placed on their citizens investing in crypto-assets. Crypto winnings can fall under a variety of reporting requirements, and each country has its own tax rules. In some countries crypto gains form part of the standard income tax reporting requirements in others they require special treatment subject to additional criteria.

Germany – a mainstream economy with generous crypto tax concessions

In the ranking of traditional “tax-based” economies, Germany tops the list as the best place for cryptocurrency investors – anyone who holds their cryptocurrency for a minimum of a year will not incur capital gains tax on the sale or conversion of their cryptocurrency. This tax-efficient incentive rewards its own citizens and not just non-doms and foreign investors, as is the norm in classic tax havens. Following the top five mainstream economies that have the most favorable tax policies for their citizens Italy, Switzerland, Singaporeand Slovenia.

Countries with the highest tax requirements

Coincub.com’s ranking also points out the places that are less favorable for crypto investors (these countries show the highest negative scores in the entire ranking list). Belgium leads the top five countries for the least accommodating tax policies towards crypto with gains incurring 33% tax, plus progressive tax rates of up to 50% for professional traders. Bringing up the next four spots in the top five is Iceland, Israel, The Philippinesand Japan all with higher than average income tax on crypto gains.

NB – we make a point about Indiawhich is at number six, as the country has recently introduced a highly controversial (at least for crypto investors) crypto transaction tax of 1% on crypto transactions exceeding INR 50,000 (approx. $600) in a financial year – a fairly low threshold for ordinary investors. There is also a flat tax rate of 30% on all profits or income from cryptocurrency to boot. Many countries, The Philippines among them, watching to see if this stifles the cryptocurrency industry.

The tax havens are still going strong

When it comes to classic tax havens, as opposed to traditional “tax based” economies, we see the usual suspects emerge. In the top five tax havens worldwide where tax breaks are generously applied to foreign investors, crypto is no exception. At the top of our top three – with not much to choose from – is The Bahamas, Bermudaand Belarus. At number four is United Arab Emirates with zero duty across the country’s so-called ‘free zones’. A newcomer to this ranking is The Central African Republic which recently classified bitcoin as legal tender and also has big plans to market itself as a crypto hot spot with very favorable tax breaks on crypto gains to foreign investors as a means of boosting the economy.

The evolution of crypto tax laws

Conversely, tax legislation is clearer and more defined in known tax havens that mainly cater to specialized foreign investors. In traditional “tax-based” economies, the result can often be a lack of understanding among casual or even professional investors who are uncertain or perhaps careless about their tax position.

The first step, for ACCOINTING.com, is to help demystify this apparent confusion, especially with the demand for crypto tax planning set to grow as crypto assets increasingly form part of mainstream investment options.

According to ACCOINTING Marketing Director, Rodrigo Mayen:

“Our focus is centered in Europe and North America where crypto tax rules and adoption are already in place. However, there is still a lack of guidance to address more complex topics such as NFTs, staking and the Metaverse. Transactions such as exchanges, lending and borrowing, yield farming and other transactions in the DeFi space are some of the issues to be navigated. We can’t all live in Lichtenstein”

Coincub has been issuing quarterly rankings based on a broad set of criteria for a few years and is now one of the leading crypto ranking websites. Tax is only one of the ranking categories, but one of the most important.

See the full crypto taxation ranking HERE.

Consult

Sergio Hamza – CEO Coincub

[email protected]

(+353) 871756897

5th Floor, Mescal Road 40, Dublin 4, Dublin D04C2N4, Ireland

Photo: https://mma.prnewswire.com/media/1893691/Coincub_crypto_tax_ranking_2022.jpg

View original content to download multimedia: https://www.prnewswire.com/news-releases/report-coincub-announces-worldwide-crypto-tax-ranking-for-2022-301619645.html

SOURCE Coincub.com