Coinbase stock recovers with Crypto Bounce; More upside potential going forward

Coinbase (COIN) is still one of the leading platforms for buying and selling cryptocurrencies. When cryptocurrency values are restored, so does the Coinbase stock. There is still value to be gained in crypto, apparently, since Coinbase is up over 16% today so far.

I remain bullish on Coinbase. Yes, the value of cryptocurrencies has declined, and use cases for crypto in general are still light. But with a recession likely to be on the way – if not already here, depending on who you talk to – conflicting investors should still find value in alternative investments. For most investors, cryptocurrency starts on Coinbase.

The last 12 months for Coinbase have been a wreck, but support the notion that the company has finally found a floor. Back in early November, Coinbase managed the $ 360-marked card, signaling the beginning of the race to the bottom. The company lost over 80% of its value here and there, hovering around $ 63.

Wall Streets Take on Coinbase

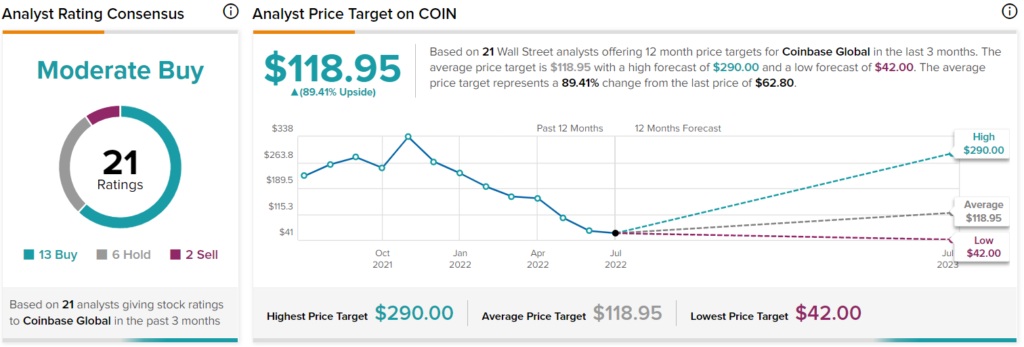

When it comes to Wall Street, Coinbase has a consensus rating for moderate buying. It is based on 13 purchases, six holdings and two sales awarded in the last three months. The average Coinbase price target of $ 118.95 has 89.4% upside potential.

Analysts’ price targets range from a low of $ 42 per share to a maximum of $ 290 per share.

Investor sentiment is mixed

The recent plunge in cryptocurrencies has left exchanges like Coinbase at the back foot. This is clearly the case with investors as well. Right now, Coinbase has a Smart Score of 4 out of 10 on TipRanks, which is the lowest level of “neutral”. This makes it a little more likely than not that Coinbase will perform worse than the wider market.

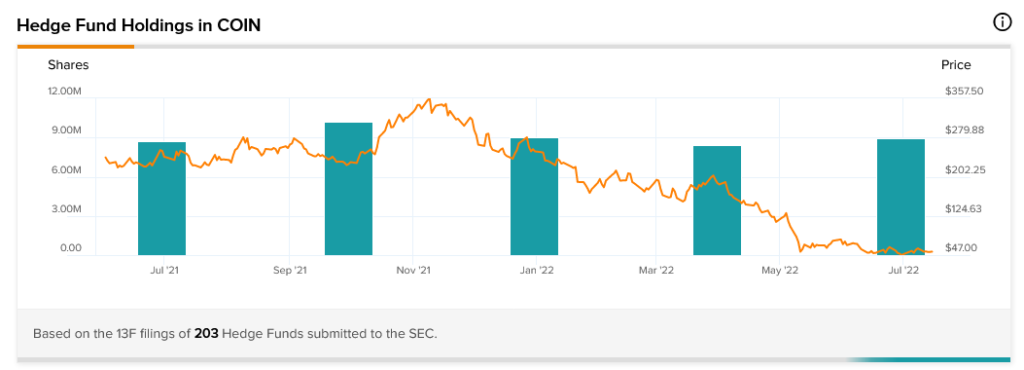

One point that supports the general pessimism surrounding Coinbase comes from hedge funds. Based on the results from TipRank’s 13-F Tracker, hedge funds withdrew, reducing their holdings by 601,500 shares in the previous quarter.

This is after a gain seen in the period between March and June 2022, which was the first increase in hedge fund involvement since the period between June and September 2021.

However, Coinbase insiders clearly have good faith in the company. Insider trading at Coinbase has been heavily weighted by purchases over the past three months. Insiders bought Coinbase shares for about $ 76.8 million in the last three months.

However, this confidence is relatively new, as sales transactions exceeded Purchase transactions by 57 to 28 in the last 12 months.

Meanwhile, retail investors – at least those who have portfolios on TipRanks – have much less faith overall. The number of TipRanks portfolios holding Coinbase shares was down 0.4% in the last seven days and down 0.1% in the last 30 days, indicating that investors are beginning to accelerate the pace of departure.

Then there is the question of Coinbase’s dividend history. It does not exist. This is not very surprising, given that Coinbase has been trading publicly for a little over a year. The company has clearly been focused on growth. For a while, it was a plan that worked well. However, there has been a significant turnaround in recent months.

Problems ahead, but “Diamond Hands” can win

In cryptocurrency, there is an acronym that serves as a saying: HODL. Some people think that this is simply a misspelling of “Hold” which was inflated outside the station. Others, meanwhile, gave it a whole new meaning, declaring that it means Hold (or in some cases “Hang”) on for dear loved ones.

There was a recognition that there would be fluctuations in the value of cryptocurrency. Some of these would be direct wild fluctuations, but this early investment, which would be characterized by volatility for much of its early life, would one day be as stable as the best of blue chips or triple-A bonds.

Admittedly, we are still waiting for that day. But for those with “diamond hands” – that is, the ability to hold on to the tightest – they are still anxiously awaiting the day of justification.

Yes, there are problems going on. Coinbase has been haunted by rumors of insolvency for some time now. This is the last thing anyone wants to hear about, especially if it’s where they store their crypto inventory.

A recent move by the company made investors even more cautious. The company canceled an affiliate program that allowed influencers to use their influence to promote Coinbase.

Coinbase closed the program due to “crypto market conditions and the outlook for the rest of 2022.” It plans to restart the program at some point in 2023, but who knows if it will happen at all.

It is, of course, a cost cut, and although it is a sign of responsible management of the company’s assets, it is also a sign that the company may not have much in the way of assets to keep the program going.

However, it is not all doom and gloom. Coinbase recently received approval from Italian regulators who should let it keep a market. The Italian agency Organismo Agenti e Mediatori sets certain requirements for continuing to offer services in the country. Getting a nod there ensures that one market is not closed.

Plus, even though hedge funds started leaving Coinbase, there are signs that the release is not universal. DNB Asset Management recently bought new shares in the second quarter. When you are part of the largest finance company in Norway, your word weighs a little extra.

Concluding remarks – Coinbase can stage a comeback

Yes, there are problems ahead for Coinbase. There are some potentially catastrophic signs on the way, which will actually make investors skeptical to move on.

A combination of potential insolvency and hectically deviant investors from hedge funds and private markets will be of little help. The fact that Coinbase is currently trading above its lowest price target is also not encouraging.

However, there are also signs that Coinbase may be staging a comeback. It has already yielded significant gains today alone. With some investors coming on board and Coinbase holding its markets in Italy, this is an encouraging point.

Even better, it trades below both the average and highest targets, suggesting that further upside is possible. Recent insider purchases will provide some encouragement to fence keepers.

There is no doubt that Coinbase will continue to be volatile for some time to come. As long as crypto itself is volatile, so will any investment associated with it. Just look at MicroStrategy (MSTR). It is up over 14% today, mostly due to the value of bitcoin (BTC-USD) inventory.

If you have already invested in Coinbase, you have probably stayed through the worst. Cryptocurrencies continue to have value, especially as facilitators of cross-border transactions. Getting companies in two countries to agree on a price in bitcoin is probably much easier than figuring out who needs to convert their currency to what to make a deal.

It will set a baseline for Coinbase, which is why I am still optimistic about this company’s future.

Dissemination