Coinbase Stock: Don’t Be Too Worried About Crypto Winter

Leon Neal

Thesis

Coinbase Global, Inc.’s (NASDAQ:COIN) The results announcement for the 2nd quarter did not surprise us, although the media and some investors were disappointed. The market already knows that Coinbase is going through the crypto winter and the results will be underwhelming for a while.

Moreover, we are increasingly confident that COIN had already formed its medium-term bottom in June (as we discussed in our previous article), as short-term crypto market pessimism reached its heights. But the market is future-oriented, and we believe long-term crypto investors understand that the current cycle will not sink Coinbase, the way it has experienced over time. Therefore, investors who took advantage of the significant pessimism in June to add more positions were rewarded as COIN had a massive momentum spike pre-earnings (after the BlackRock announcement).

Bitcoin (BTC-USD) and Ethereum (ETH-USD) have also climbed out from the June nadir, helping to further lift Coinbase’s buy sentiment. Although we remain cautiously optimistic about medium-term projections, we believe that the short-term upside has been sufficiently reflected.

As a result, we are revising our rating from Speculative Buy to Hold.

Coinbase’s Q2 earnings were poor. But was the market surprised?

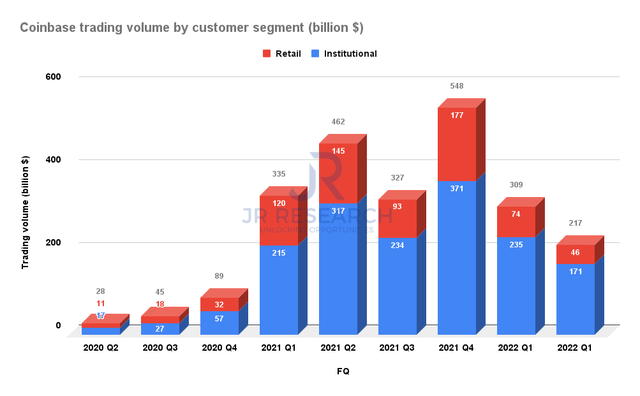

Coinbase trading volume by customer segment (Company documents)

Some analysts, investors and even the media slammed Coinbase’s Q2 card as underwhelming, as Coinbase’s trading volume suffered as retail and institutional investors retreated. The redirection of market makers’ volume to competition from offshore exchanges also hit Coinbase, further exacerbating the decline in trading volume.

As a result, Coinbase’s trading volume fell to $217B, hitting both customer segments, as shown above. It also represented a 29.8% QoQ decline from FQ1, when the crypto market cratered in June. Furthermore, management guided that the retail base (Coinbase’s most crucial customer segment) remained tentative in July as retail investors were wary of re-entering the fray given the current macroeconomic headwinds.

We believe management’s cautious guidance is reasonable. Private investors’ positioning in risky assets has been cautious even though our analysis indicates that the stock market bottomed out in June. Therefore, it is only reasonable to expect investors to reflect their concerns about the crypto market, given the credit/default events we observed across the crypto space.

Therefore, we believe that retail investors may avoid aggressively increasing their exposure to crypto assets in the short term until the crypto market has recovered most of its losses. As in late 2021, the retail hype was more pronounced towards the end of 2021 as crypto assets hit new highs. We believe that similar moves should play out in 2022/23, as aggressive buying sentiment among the retail base may not return until we are closer to Bitcoin’s previous highs ($69K). Therefore, we believe it is reasonable to expect a longer winter for Coinbase, given its significant transaction revenue exposure to its retail base (94% transaction revenue share).

Despite this, Coinbase highlighted that it could likely meet its adjusted EBITDA loss guidance of $500B for FY22 if the decline in crypto market capitalization did not worsen through H2’22. However, the fallout in the crypto credit community continues to keep management on their toes, despite improving crypto prices since June lows. Management articulated:

Based on the spending initiatives we took in Q2, we are cautiously optimistic about our ability to operate within this [$500M] Railing. This optimism is conditional on the crypto market cap not deteriorating meaningfully below July 2022 levels and we not seeing another significant change in the behavior of our customers. We are looking at the headwinds of continuing to see some fallout in the crypto credit community. And so I think that we need to see some stabilization there, as well as we want to have more certainty in the regulatory market, and that all affects what we expect for the second half of the year.

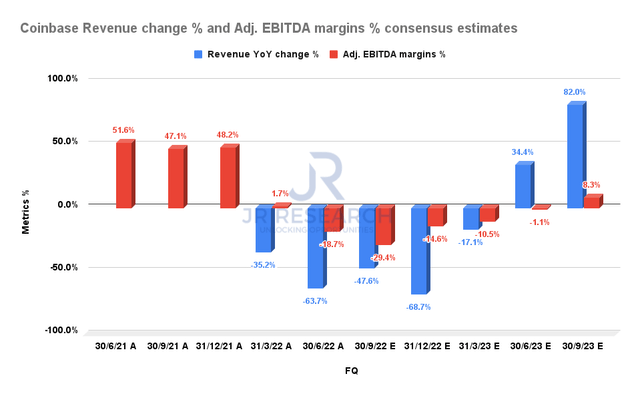

Coinbase Revenue Change % and Adjusted EBITDA Margins % Consensus Estimates (S&P Cap IQ)

The revised Street consensus (bullish) suggests that Coinbase’s results are likely to continue to come under pressure through H2’22 as it moves through the crypto winter. However, The Street is also bullish on management’s loss guidance as it projects an adjusted EBITDA loss of $477 million for FY22. In particular, Coinbase’s revenue growth and profitability are expected to recover from the nadir in FY23.

However, we must caution investors that the consensus estimates are generally formulated based on management’s guidance. In addition, our previous analysis of COIN has also shown that Coinbase’s inherent revenue volatility (due to its huge retail transaction revenue base) significantly affects revenue visibility.

As a result, it simultaneously bears risk to its adjusted EBITDA estimates, leading to significant earnings volatility. Therefore, we encourage investors to continue to monitor the uptick in retail investor sentiment as a proxy to determine the reliability of revenue and earnings estimates, as we expect crypto market volatility to continue in the near term.

Despite this, the management is convinced that they can continue to gain share in the midst of the crypto rout that has hit several of the competitors. It is optimistic that its ability to navigate the crypto fallout will cement its leadership and the confidence of crypto investors as the market emerges from the crisis. CEO Brian Armstrong highlighted:

This is probably the fourth crypto cycle we have gone through. And they always seem a little scary, especially if people haven’t been through them before. But we’ve seen all of this before. We were selected by BlackRock and Meta as their partners as they develop their crypto offering. This is actually a very big deal for several reasons. BlackRock is the largest institutional asset manager in the world. It took several years of diligence to go through with them and close this deal. I think it really shows that Coinbase is uniquely positioned to be the partner of choice for the biggest companies in the world looking to integrate crypto into their offerings.

Is COIN stock a buy, sell or hold?

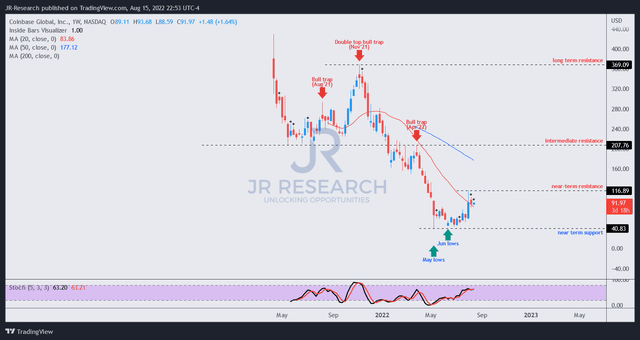

COIN Price Chart (Weekly) (TradingView)

COIN stock had a notable bottom in June, as we assumed. It rallied almost 92% from the buy point in our previous article, brutally taking out the short sellers. Although the momentum has slowed since the unsustainable increase, we are not surprised.

However, we believe the upside in the short term has already been reflected and believe a period of sideways consolidation is expected.

Therefore, we revise our rating from Speculative Buy to Hold. New investors are encouraged to wait for a meaningful retracement before considering adding more positions. Current investors are encouraged to use the recent momentum top to cut exposure and take some profits if they added to the June lows.