Coinbase: Massive Upside During 2023 Crypto Bull Run (NASDAQ:COIN)

Leon Neal

Coinbase (NASDAQ:NASDAQ:COIN) is my favorite crypto stock to own because I use Coinbase to buy Bitcoin every paycheck and understand how important the company is to the entire crypto ecosystem in America.

However, 2022 has been a tough one year for cryptocurrencies and a lot of negative press led to many crypto newbies losing their money and panic selling.

Several crypto brokers and trading platforms such as Voyager (OTCPK:VYGVQ) filed for bankruptcy, prompting many investors to label crypto as a “scam.”

I made the mistake of placing a buy recommendation on Voyager earlier this year without knowing the company was in trouble.

I also held Cardano (ADA-USD) on the Voyager platform and lost all ADA as a result.

The truth is that these high-profile failures benefit Coinbase in the long run, as crypto holders will search for a trusted brand name rather than attractive high returns going forward.

The good news is that BlackRock chose Coinbase to provide crypto trading services for its clients. This is a big win for Coinbase and the entire crypto industry because BlackRock (BLK) is the largest asset management firm in the world with over $10 trillion AUM.

In this article, I will provide my updated Coinbase stock analysis and share why I believe 2023 will be an important year for the company.

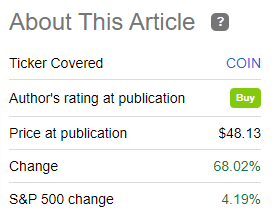

Buying the fear paid off

I published my previous Coinbase article back in May 2022 when the crypto markets crashed and asked my followers to buy the dip. COIN stock was trading at almost $48, so you got a nice 68% gain since then if you bought the fear.

May 2022 Coinbase Article (Seeking Alpha)

We have seen the bottom of the crypto markets and I don’t think things will get any worse than they did during the summer.

Anything can happen, but I don’t expect COIN stock to return below $50 again unless the company does a stock split.

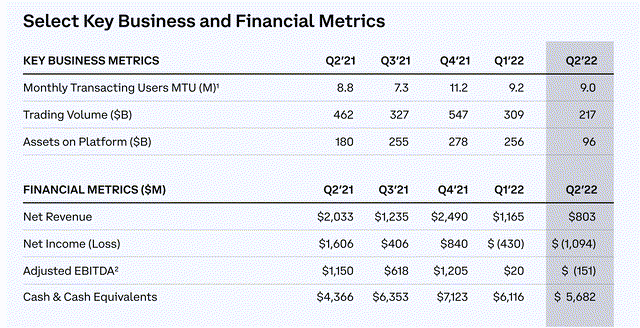

Coinbase’s Q2 2022 was a disaster

Coinbase struggled during the second quarter and so did the entire crypto market with poor results across the board.

Coinbase Q2 2022 Results (Coin base)

Revenue for the second quarter of 2022 was $808 million (down 64% y/y) and the company reported a loss of $1.1 billion (-$4.98 per share).

In general, Coinbase will perform well during crypto bull markets and lose money during crypto bear markets. The company generates the bulk of its revenue from trading fees and needs a lot of buying activity to make money.

There is no need to panic right now and mindlessly dump Coinbase shares. Crypto markets move in 4-year cycles and this is completely normal.

COIN stock trades at a much better price-to-sales ratio of 3, and the price-to-book ratio is around 3 as well.

Coinbase has $6.15 billion in cash on its balance sheet and took several measures to cut costs and save money, such as firing 18% of its employees and shutting down its affiliate program.

Long-term debt is at $3.62 billion, giving the company plenty of leeway in case the crypto winter lasts much longer.

As of June 2022, Coinbase has $427.8 million in crypto assets. Coinbase owns 8,633 Bitcoin and 123,021 Ethereum. Check out these Coinbase stats for more insight into the company’s latest quarter.

Coinbase One is a Game Changer

While I wait for the crypto markets to recover, I am extremely curious about Coinbase’s monthly subscription program called Coinbase One.

Coinbase One (Coin base)

Coinbase One provides subscribers with several benefits, including:

- $0 crypto trading fees

- Dedicated 24/7 Live Phone Support

- $1 million in account protection

- Pre-filled form 894 for submitting taxes

Coinbase One charges a monthly fee of $29.99 as the company tries to diversify its revenue source away from just one-time trading fees.

Competitors like Robinhood (HOOD) offer $0 crypto trades and offer a crypto wallet at no cost. It makes sense that Coinbase needs to offer something special to give users a reason to keep spending money on trades.

Peloton (PTON) CEO Barry McCarthy believes the subscription model business will save Peloton, and we may see more companies like Coinbase rely on subscription revenue in the future.

Coinbase One is a must for crypto investors who have large sums of money on the platform. You get up to $1 million in account protection in case something goes wrong.

At just $29.99, I think Coinbase One will become extremely popular and drive a whole new revenue stream that will help the company maintain strong cash flow during crypto bear markets.

The 2023 Crypto Bull Run is almost here

Crypto rewards patience and I have been quietly waiting for my crypto shares to return.

The good news is that all signs point to a 2023 crypto bull run that could send Bitcoin and other cryptocurrencies to the moon again.

Cryptanalyst Miles Deutscher posted an interesting tweet tracking the price of Bitcoin since 2011.

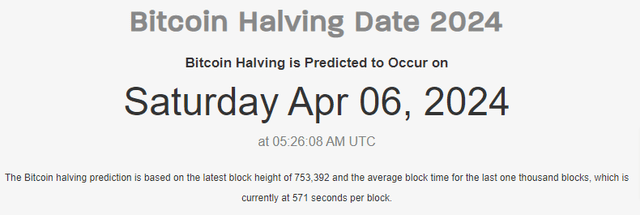

According to his tweet, Bitcoin follows a single 3-year bull run followed by a 1-year bear market. This correlates with the 4-year Bitcoin halving cycle where the number of minable Bitcoin is halved every 4 years.

The next Bitcoin halving will happen around April 2024 and I think many crypto bulls will buy Bitcoin and other cryptos into 2023 in anticipation of the halving event.

Bitcoin 2024 Halving Countdown (CoinWarz)

It is extremely bullish for Coinbase making a lot of money during crypto bull runs.

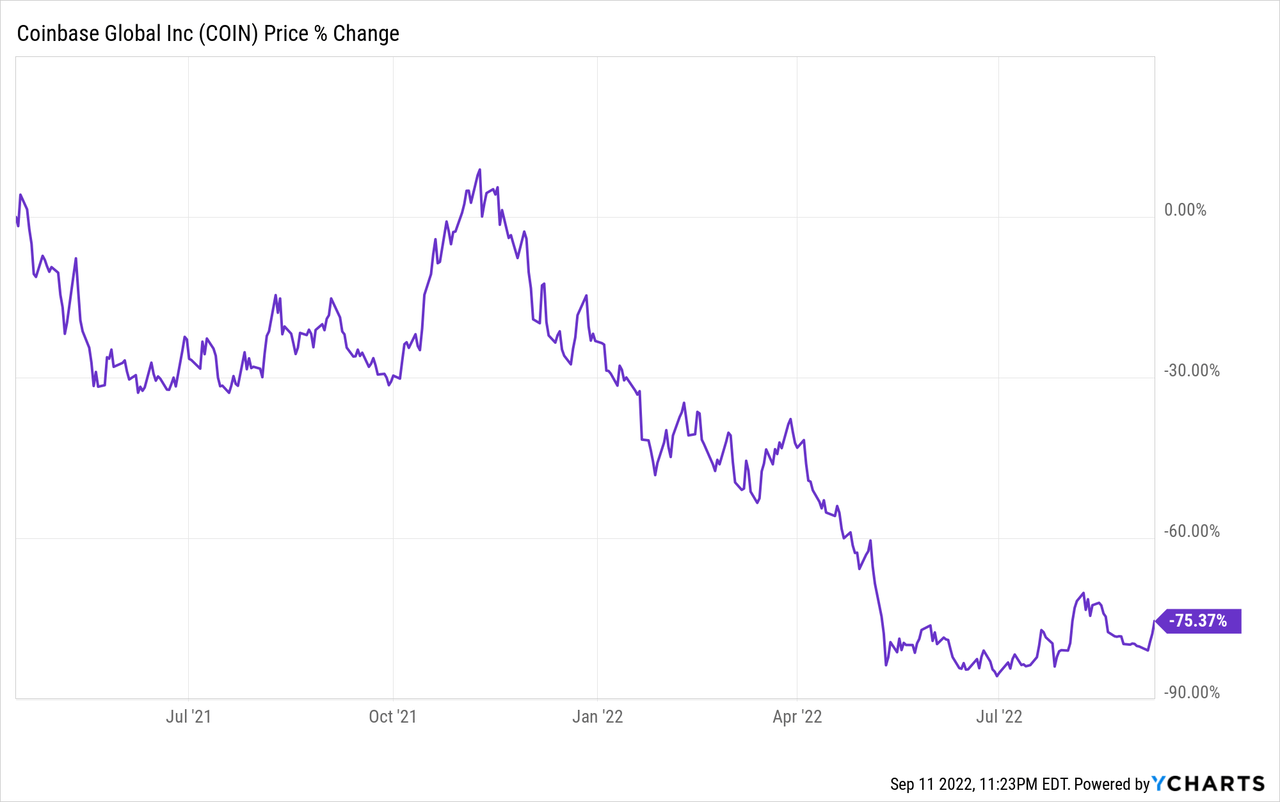

If you bought COIN shares during last year’s IPO, you are down 75% since April 2022.

2023 could be the year that COIN stock recovers much of its losses because Bitcoin’s price and Coinbase stock are positively correlated.

Risk factors

Coinbase has a wide moat with its 103 million verified users, but there are so many things that can go wrong.

- A major Coinbase hack would ruin the company’s reputation and cause users to withdraw crypto from Coinbase’s platform.

- The crypto market never recovers and Crypto becomes just another fad like Beanie Babies or Pokemon.

- Legacy banks and securities firms offer Bitcoin trading accounts and steal business from Coinbase.

- More future lawsuits are affecting Coinbase and helping to tarnish its reputation.

- Coinbase offers more high-yield crypto products in the future and risks bankruptcy if its hedge fund customers default on investment loans.

Conclusion

Coinbase isn’t perfect, but I trust them more than any other crypto exchange in America. The company never offered high crypto interest rates, so it avoided the whole Voyager/Celsius 3 Arrows Capital bankruptcy mess.

Coinbase turned 10 years old this year and is still a super easy and safe way to buy and sell cryptocurrencies.

If you don’t want to bother with owning cryptocurrency, then I think owning Coinbase shares is the next best option.