CME accelerates crypto rollout

CME Group has introduced one new cryptocurrency product per month this year across benchmark, indexed and marketable products compared to one per quarter in 2021.

On August 29, CME launches Bitcoin Euro and Ether Euro futures, pending regulatory review. Tim McCourt, global head of equity and currency products at CME Group, told Markets Media that Bitcoin Euro and Ether Euro futures are the group’s eighth and ninth crypto contracts.

Tim McCourt, CME

“In 2022, we have introduced one new crypto product per month across benchmark, indexed and tradable products,” he added. “The cadence has increased from one per quarter in 2021.”

McCourt continued that the new contracts are being introduced due to the feedback CME has received from clients, the euro and the US dollar are coming close to parity, and as euro-denominated cryptocurrencies are the second most traded fiat behind the US dollar.

In addition, the EMEA region represented 28% of the total Bitcoin and Ether futures contracts traded so far this year on CME, up more than 5% compared to 2021.

Introducing Bitcoin Euro and Ether Euro futures, a second currency pair on our market leading Cryptocurrency futures. Manage bitcoin and ether exposure in the underlying currency of your choice starting August 29th. pic.twitter.com/rci4NnAfKz

— CME Group (@CMEGroup) 4 August 2022

Edmond Goh, head of trading at B2C2, said in a statement: “The launch of euro-denominated Bitcoin and Ether futures from CME Group will help meet the growing demand for regulated and robust non-USD crypto derivatives.”

McCourt continued that the new contracts will open up trading opportunities in derivatives, exchange-traded notes, exchange-traded funds and CME’s other liquidity pools such as in foreign currencies.

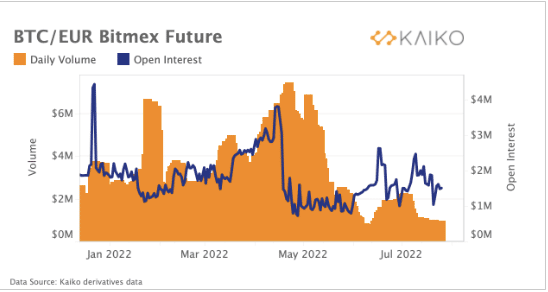

Kaiko, the crypto data provider, said in a report that futures denominated in Bitcoin and Ether Euro are already being traded on the BitMEX exchange. “Daily volumes for the contract on BitMEX are at their lowest levels this year,” the report added.

Source: Kaiko

BitMEX has also announced the launch of crypto’s first ever perpetual currency exchange contracts. Kaiko said: “These currency swaps allow investors to trade the product 24/7, even when the traditional currency market is closed and can be another widely used product in the derivatives market.”

On September 12, CME will also launch options on Ether futures, pending regulatory review.

Looking for a new opportunity to add the flexibility of options to your cryptocurrency portfolio? Meet CME Group’s Ether Alternatives, Launching September 12th. pic.twitter.com/wlKTGNyE5K

— CME Group (@CMEGroup) 18 August 2022

Sam Newman, head of digital asset brokerage at TP ICAP, said in a statement: “With the upcoming Ethereum protocol merger, we expect this new contract to see significant interest from both our traditional clients as well as cryptonative clients.”

Volumes

In its results, CME reported that the second quarter was a record across all cryptocurrency products with average daily open interest (OI) of 106,200 contracts, and was also the second highest quarter for average daily volume at 57,400 contracts.

In the second quarter, Ether futures achieved a record average daily volume of 6,600 contracts, up 27% from the first quarter. CME reported that Ether futures ADV rose to 7,900 contracts in July and open interest rose 7% during June.

McCourt added that volume and open interest have grown across all of CME’s crypto contracts.

“Institutional interest has been unfettered by the fall in valuations with an increase in large OI holdings,” he said. “CME has been a safe haven as volatility has led investors to want access to crypto through regulated venues and products.”

CryptoCompare’s Exchange Review for July, said spot trading volumes across all centralized crypto exchanges fell 1.3% to $1.4 trillion, the lowest monthly trading volume recorded since December 2020.

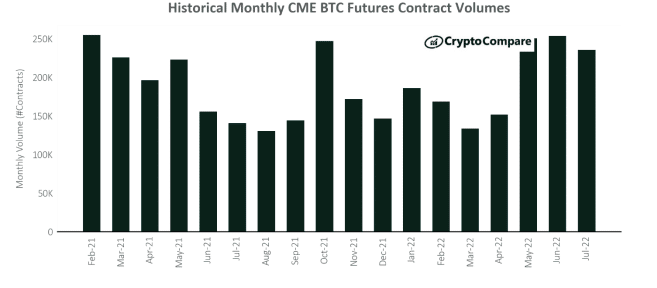

Source: CryptoCompare

However, derivatives trading volume rose for the first time since March, rising 13.4% to $3.1 trillion, which CryptoCompare said indicates an increase in speculative activity as traders believe there is room for further upside in this rally and as traders speculated on the impact of Ethereum. Merge.

In July, CME’s Ether and Bitcoin futures volumes fell 9.9% to $36.5 billion combined, according to CryptoCompare. The report said: “235,730 Bitcoin futures contracts were traded in July, down 7.11% since June. This was the first recorded decline in the number of Bitcoin futures contracts traded on the CME in four months.