CMC: Global Crypto User Adoption Outlook

by Arthur · February 22, 2023

CoinMarketCap sat down with Binance CEO and founder Changpeng “CZ” Zhao to discuss the future outlook for crypto adoption in 2023.

Measuring adoption in an eventful year: 2022

CMC: In 2022 we have seen the fall of many major players – 3AC, Luna, Celsius, Voyager, FTX – how much have these collapses affected the industry in terms of user adoption? And how do you go about measuring crypto adoption in general?

CZ: 2022 is definitely not a good year. A lot of negative things have happened.

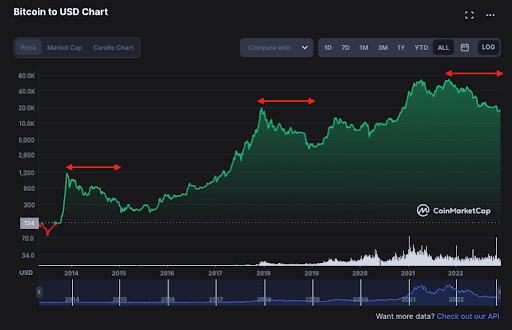

Usually, the way I look at measures of adoption is actually just the Bitcoin price, which is usually a pretty accurate indicator of the industry.

Historically, Binance’s user registration rate, trading volume, etc. have been very highly correlated with Bitcoin’s price: that line actually has the same shape as almost every other indicator we use.

Right now, Binance trading volume is about a third of what it was a year ago, when Bitcoin’s price was near its all-time high [of $68,800]. All these events have slowed down the industry, creating a negative impact.

The entire crypto industry goes through four-year cycles. Every four years there is a bear market. I think we’re in one now: bear markets have historically lasted about a year, and we’re now about a year away from the last all-time high.

Next wave of user adoption

CMC: What do you think the crypto industry can do concretely to bring the next wave of user adoption? It’s about building more user-friendly DeFi solutions? Does the solution regulate more centralized crypto providers? Are there any other avenues you see to get more people on board with crypto next year?

CZ: The more we build applications that people use, the better. It’s that simple. If you look at the internet and how it’s grown, lots of different people are building different apps that take advantage of the internet. Today, we don’t even talk about the Internet anymore: we just use whatever app people use.

It’s a similar thing in crypto with DeFi, CeFi, wallets, faster blockchains, education, regulatory improvements, etc. All these things will help. Regulatory clarity is very important: given the negative cases that happened in the industry, we need to be more transparent and build more trust. I think the industry needs to shift towards a much more transparent system, a system that users can verify.

Given the problems with centralized exchanges recently, more will move to DeFi. But then there will be a hack, there will be a blanket pull in DeFi, someone will have lost a lot of money in DeFi and then people will go back towards centralized exchanges. The industry is gradually moving in many different aspects at the same time.

CMC: If you had to choose which would be more important for adoption – building the new products or increasing regulation and transparency – which do you think is more relevant?

CZ: For adoption, I think products have more influence. For example, how do we make it easy for ordinary people to keep their private keys safe themselves, and more practically: when they become unavailable, how do their loved ones gain access? Regulatory clarity is important, and also helps adoption. But at the end of the day, they are products.

Reconstruction in a bear market

CMC: Binance is like a microcosm of the industry at large – you have retail users with the spot exchange business, you have institutional customers with the futures product, the depository and the venture side. With the different types of clients and users, which area will be the most challenging for the industry to rebuild trust and increase adoption after 2022?

CZ: We have seen that more people are moving to their own wallet. TrustWallet is growing quite fast compared to the centralized Binance.com exchange. The institutional business, Binance Custody, has increased quite dramatically. These two are the more obvious areas where things have grown faster, along with the growth seen on BNBChain.

FTX was a big event. When that happened, Bitcoin’s price was around $18,000. Today we are still at $17,000. Bitcoin’s price didn’t drop that much – and Bitcoin’s price can drop 5-10% on a normal day without any specific event. The industry has been robust.

CMC: We’ve all seen some bear markets. You’ve seen more bear markets than I have. What are the specific differences you’ve noticed in this particular bear market cycle compared to any in the past?

CZ: The whole industry is bigger. In 2022 we have the metaverse, we have GameFi, we have DeFi, we have loans, we have NFTs.

In 2017, there were only ICOs: and with ICOs, there were too many projects that would not make it. In 2013/2014 it was just the Bitcoin industry: only Mt. Gox went down.

Each cycle the industry gets bigger. With this one, we have seen several players go down.

Adoption: A way forward

CMC: Where is the next wave of adoption likely to come from? Would it be from new geographic markets (ie areas like LatAm or Turkey experiencing high inflation), or new solid use cases (ie next generation DeFi products, GameFi etc.), or new entrants (ie large asset manager/sovereign wealth , users of new age groups)?

CZ: At the beginning of 2017, I wouldn’t have said ICO. At the beginning of 2020, I wouldn’t have said DeFi. In early 2021, I wouldn’t have said NFTs. But then six months later all these things happened. It is very difficult to predict exactly which one will make it. It depends on the entrepreneurs who build in this industry. Whatever person or team builds a very sticky product, a very viral product, that sector just drives a lot more users. But overall, everything is moving forward.

I would guess as always that crypto adoption will come from new use cases, which we haven’t really imagined. Institutional crypto adoption has been talked about for years, and it will come. It is already coming, slowly, gradually.

Binance actually has a lot of institutional users, Binance Custody has a lot of institutional users. There is a very clear known use case and the adoption will happen at some speed. The regulations are coming at a certain speed, and those guys will come in.

The use of Bitcoin to hedge against inflation is a very clear use case. More and more people are learning about it and they want to enter, because Bitcoin has a limited supply.

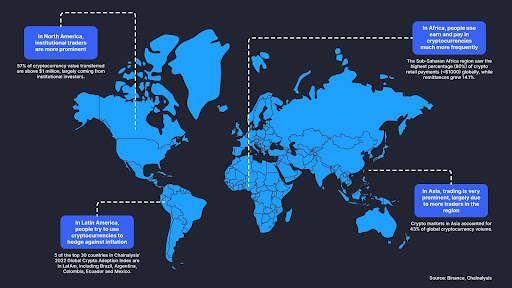

We have seen that different regions have different use cases that are more prominent. In some parts of Asia, trade is very prominent, simply because there are more traders there.

In the North American region, institutional traders are more prominent. In Latin America, people are trying to use cryptocurrencies to hedge against inflation. In Africa, people spend, earn and pay much more in crypto. We see that the geographical distribution is different to a certain extent, but not completely. It’s not black and white, but there are some different emphases.

I always think that the next hot thing is usually the one that people aren’t really talking about and haven’t predicted.

CMC: Do you have any New Year’s resolutions for cryptocurrency next year?

CZ: No, not really. I’m just glad this whole bear market is going to be over and then…we’ll see how it goes.

This interview has been edited and condensed for clarity.