CleanSpark Tops 2023 Bitcoin Watchlist Despite Texas Turmoil (CLSK)

akinbostanci/E+ via Getty Images

There’s a lot to like about CleanSpark (NASDAQ:NASDAQ:CLSK). Simply put, the company’s enterprise value is low relative to its profitable and operational share of the total Bitcoin (BTC-USD) network hash rate. This also applies to the past and estimated future basis. Excludes the liquidity challenged Core Scientific (CORZ), in November CleanSpark remarkably had the highest Bitcoin production of all the major publicly traded miners in the US and Canada. Although its Bitcoin holdings are extremely low, CleanSpark has a relatively strong balance sheet with an enviable debt-to-EBITDA ratio. On a fundamental level, CleanSpark represents value, but macro factors, including interest rate uncertainty and the ongoing energy crisis, limit the stock to the top of my watch list for now.

The article below details CleanSpark’s production outlook, including the latest negative Lancium news. The somewhat dynamic rig and energy cost picture will be covered. It also considers the company’s interesting, and arguably solid, balance sheet and funding strategy. As a conclusion, I will look ahead to next year and the possible peak in interest rate expectations as well as a moderation in the energy crisis and increasing certainty around prices.

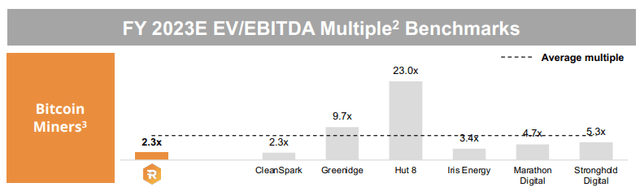

As a precursor to the discussion, consider the graphic below from Riot Blockchain (RIOT) and FactSet. The graphic uses current market data and average analyst estimates to show enterprise values relative to projected EBITDA. Brand Argo Blockchain (OTCQX:ARBKF) and Core Scientific were excluded due to their depressed situations. So when you fairly adjust the market value for cash and debt and then compare that to expected earnings, Riot and CleanSpark represent value.

riotblockchain.com/investors/company-information/presentations

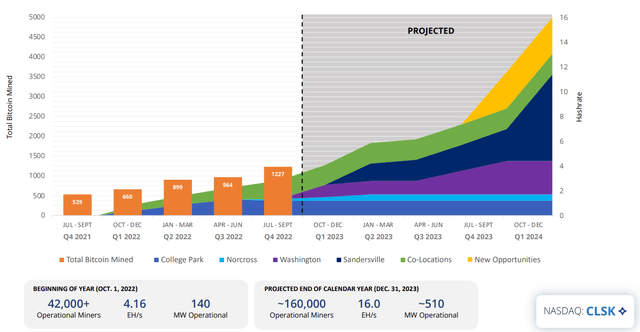

CleanSpark projected growth at owned locations

By 17%, CleanSpark led miners down on Thursday following its earnings announcement and significant hash rate cut for calendar 2023. CleanSpark has a partnership with Lancium, a developer of clean energy campuses in Texas, and had planned to deploy 6.6 EH /s with capacity by mid-2023 at their new host facilities. The implementation of the project is now doubtful and the timeline has been pushed out by at least six months. CleanSpark has lowered its guidance of 22.4 EH/s for the end of 2023 to 16 EH/s. Importantly, note that CleanSpark does not have a deposit with Lancium.

cleanspark.com

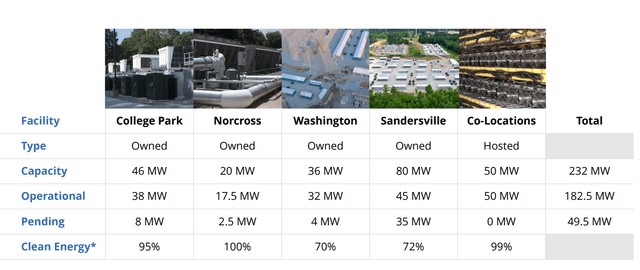

The green shaded area above represents host-based exahash; Note that total is expected to decrease in the last quarter of 2023. The four named locations shown below, and in blue and purple above, are all in Georgia. Interestingly, Georgia has a large nuclear utility component, and Georgia Power is the first in the US to expand its nuclear footprint in the past three decades. Growth and expansion are coming in both Washington and Sandersville, which were recently acquired during the last fiscal year.

cleanspark.com

In August I wrote a piece entitled: Is Riot Blockchain’s Strategy Beating Marathon Digital? The article discussed how Riot moved to a vertically integrated housing and power infrastructure while Marathon Digital (MARA) used a resource light strategy dependent on hosting providers. Of course, Marathon’s plan has proven problematic with continued delays and even the notable bankruptcy of partner Compute North, with significant deposits at risk. While it is not a good thing not to argue that the Lancium partnership is likely, it has generally proven better for the miners with large companies to limit their dependence on hosting partners as well as the complexities of providing hosting services themselves.

CleanSpark rig and energy costs picture

CleanSpark has no outstanding obligations for mining equipment and is in the market for about 95,000 miners to fill its Washington and Sandersville expansions. CleanSpark currently has some high-end MicroBT gear and some premium Bitmain S19 XPs. But they are generally looking to acquire earlier models from the S19 series such as the S19j Pros which have a strong ROI.

By not locking in equipment contracts before securing power, CleanSpark can take advantage of the current market disruption and acquire rigs at a significant discount to its peers. This discount is probably 50-75% in many cases.

What we’re seeing right now from a rig pricing standpoint is that we’re seeing buying opportunities continue to persist into the teens. And we expect to — and what I mean teenagers, it’s in dollars per terahash anywhere from $11 to $19 and most of it on the low end, depending on whether the entities are state side or not. What we expect is that we expect there to be plenty of inventory available, especially in the first six months of next year.

CEO Zach Bradford, Financial results for Q4 2022 – Earnings14/12/2022

On the energy cost front, the situation is more worrying. For the fourth quarter, power prices on a weighted average were above $0.05 per kWh. The cost of revenue, which is primarily the energy component, was $13,500 per Bitcoin, this compared to $11,000 for the entire fiscal year 2022. For reference, other cash costs, such as general and administrative costs, represent another $6,000-$7,000 per coin.

These increased energy costs not only reduce margins, but also have an effect on production. While uptime was still above 90% in the fiscal 4th quarter, spikes in power pricing caused some curtailment of lower efficiency equipment.

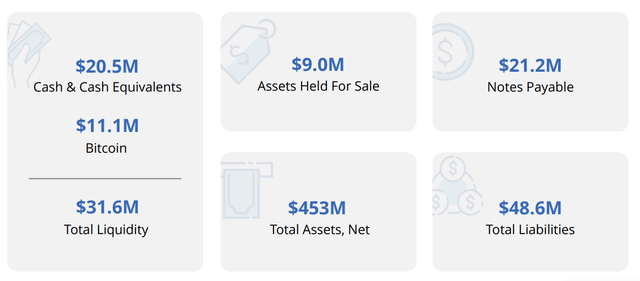

Balance Sheet, Financing Strategy and Dilution

From September 2022 (cleanspark.com)

In part, CleanSpark has a relatively clean balance sheet due to their Bitcoin custody strategy. Bradford explains:

Since last October we have been using our Bitcoin to fund our operations and growth and it has made a huge difference to us. For example, our average selling price per Bitcoin in fiscal year 2022 was over $35,000 Bitcoin.

CEO Zach Bradford, Financial results for Q4 2022 – Earnings14.12.2022 (link above)

Maintaining a low debt-to-earnings ratio is a key for the major miners to survive the current cycle. Core Scientific’s recent debt-related liquidity issues prove some of this significance. Again, Bradford explains:

Our ability to mine Bitcoin efficiently and profitably during a bear market is a direct reflection of our disciplined operations and low leverage.

CEO Zach Bradford, Financial results for Q4 2022 – Earnings14.12.2022 (link above)

But going forward, CleanSpark’s growth will require significant dilution. The company recently filed to renew its initial public offering, and plans to sell up to $500 million of common stock in one or more public offerings over the next three years. My understanding is that the capital expenditures for the Washington and Sandersville developments still require $70 million in financing, and by my calculation the rig purchases discussed above will be another ~$140 million.

We make acquisitions within a specific ROI range, because we expect them to be beneficial for shareholders in the long run. This move allows us to maneuver through a bear market while strengthening our business and establishing a platform for growth.

CEO Zach Bradford, Financial results for Q4 2022 – Earnings14.12.2022 (link above)

Final thoughts: Interest rates and energy prices

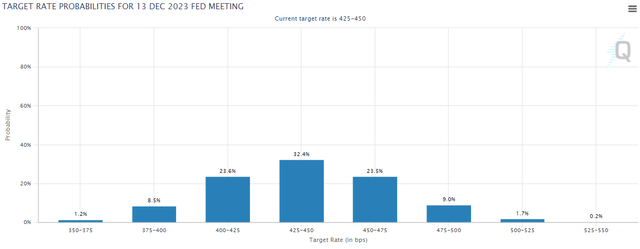

Before moving from a hold to a buy recommendation for CleanSpark, I look at two indicators. First, have we reached a peak and stabilization of terminal rate expectations for the federal funds rate? Interest rate-sensitive assets such as technology stocks, as well as digital assets including Bitcoin, cannot begin to recover in an environment where this expectation is continually shifting up.

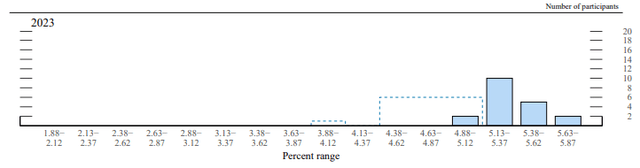

Consider the chart below from the latest projection material provided by the FOMC and other Fed members after the December meeting. The height of the bars represents the number of participants who estimate a given interest rate at the end of 2023, see the right side of the scale. The dashed line shows their September forecasts. Note the significant change in expectations in the chart below.

federalreserve.gov

I look for these projections to stabilize or shift down (left) before fully deploying new funds allocated to digital assets. The next summary of economic forecasts from the Fed will not be available until March 22. But CME has one “FedWatch Tool” which is more complete and follows market expectations in real time. As you follow the link, notice the tabs for each meeting month next year, that you can track the changes over time at the bottom, and that there are differences between the market’s expectations for the Fed and the Fed’s own projections. There will always be fluctuations in the short term, but over time it is necessary that these probabilities stabilize rather than continuously move up (right).

cmegroup.com

The second indicator is related to the energy price picture. Looking ahead, from the March earnings report for calendar Q4’22 we can again calculate the cost of earnings per Bitcoin. Look for some moderation from the $13,500 discussed above, possibly on lower energy prices compared to the third quarter.

CleanSpark actually looks at the prices of natural gas at Henry Hub for its models. Forecasts show that natural gas prices will turn one dollar per million Btu in the spring.

cmegroup.com

A reversal is important; consider the following from Bradford.

… we are actively working to secure agreements to lock in lower rates from a long-term point of view across all our sites. And that’s what we want to bring to the table in this process is our combined purchasing power with three of the four cities we operate in, through MEAG.

And we expect the right time to lock in the best prices will be around the same time we start seeing the declines. So we’re kind of aiming for a spring period to make some of these moves.

CEO Zach Bradford, Financial results for Q4 2022 – Earnings14.12.2022 (link above)

So to summarize the conclusion, I am still in a holding pattern for CleanSpark. The company’s basic production and financing strategy is strong, but macro factors around interest rates and energy pricing are unclear. I’m waiting for a sustained swing in expectations for the peak of the federal funds rate, as well as some reassurances about CleanSpark’s energy costs and that they capture any reversal in pricing.