Cipher: The Fastest Growing Bitcoin Miner (NASDAQ:CIFR)

anormark

The fastest growing public Bitcoin (BTC-USD) miner by production capacity is currently Cipher Mining (NASDAQ: CIFR). The company has rapidly scaled a mining operation over the past few months and is now one of the leaders in public Bitcoin mining site by several key figures. Cipher Mining became a public company through a SPAC merger with Good Works Acquisition Corp back in 2021. At the time, the company had a $2 billion valuation with plans to use cash from the merger to grow a Bitcoin mining operation.

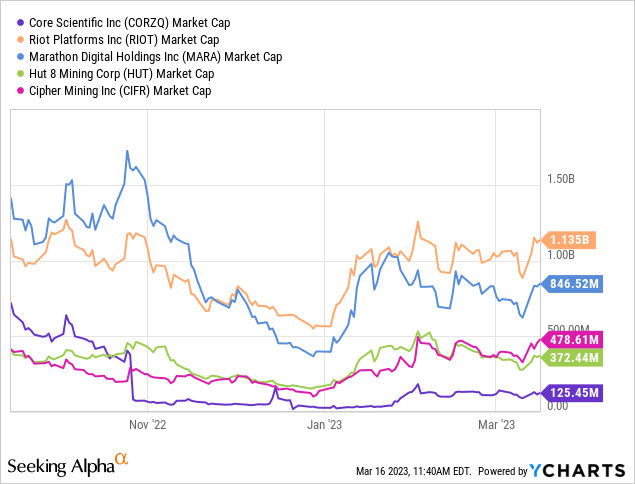

After 2 years since the SPAC merger was announced and over a year since it was completed, Cipher has become the third largest Bitcoin miner by market capitalization – albeit at a 75% reduction to the original merger announcement valuation of $2 billion . In this article we will look at production growth, financial strategy and point out some things to keep an eye on.

Production and capacity guidance

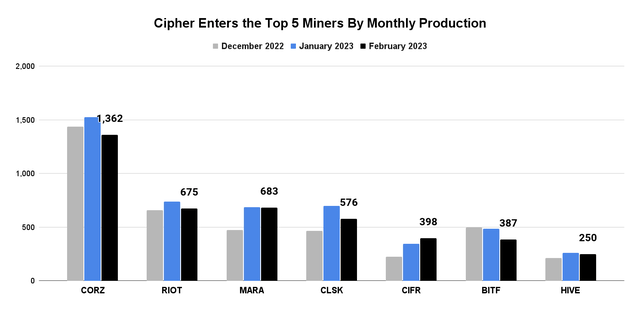

As mentioned, Cipher Mining has very quickly scaled a mining operation in recent months. The capacity at the end of February was 5.2 EH/s. This rapid increase in mining capacity since November has catapulted Cipher into the top 5 public miners by production capacity as of last month:

BTC production trend (Company documents)

With 398 Bitcoin produced in the month of February, Cipher now produces more Bitcoin each month than Bitfarms (BITF), HIVE Blockchain (HIVE) and Hut 8 Mining (HUT). While EH/’s growth has been strong since the company’s Odessa site went online, Cipher has guided a somewhat conservative approach to scaling from here compared to what has been brought in the last 3 months.

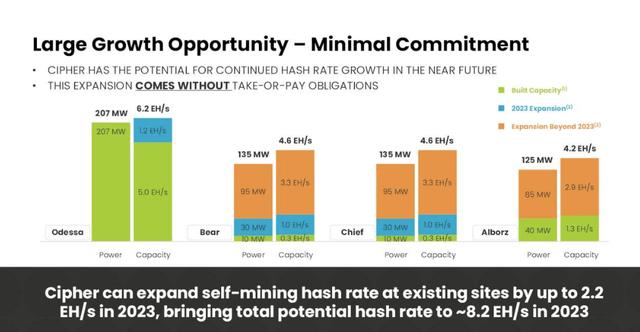

EH/s Guidance (Cipher Mining)

Cipher expects a total potential hash rate of 8.2 EH/S this year, which will primarily come from the Bear and Chief sites. In the earnings call earlier this week, CEO Tyler Page provided insight into the strategic approach going forward and provided a rationale for why the company has not jumped on faster expansion despite machine acquisition opportunities being available:

However, given volatile market conditions, we want to be mindful not to overextend ourselves. So we will continue to consider expansion in light of market conditions. This opportunity for near-term growth with strong built-in unit economics, but without operational cost commitments, is one that few if any of our competitors have and demonstrates Cipher’s continued approach to looking for low-risk opportunities.

Some of the opportunities the company says it has declined to pursue involved credit terms that were unfavorable and acquisitions of businesses that have fundamental deficiencies.

Financial strategy

One of the things I look at each month is the net change in Bitcoin balances for each listed miner. While selling down BTC positions is not always As a sign of a company in financial trouble, I see “stacking” as a positive sign. In the event that BTC increases significantly, the value of the assets the company has in the treasury will also increase, and these spikes in the BTC price can be used to opportunistically raise more money without diluting shareholders.

| BTC in the treasury | January 2023 | February 2023 | Mon/Mon |

|---|---|---|---|

| Cipher Mining | 424 | 465 | 9.7% |

| Riot Platforms (RIOT) | 6,978 | 7,058 | 1.1% |

| Bit farms | 405 | 405 | 0.0% |

| Marathon Digital (MARA) | 11,418 | 11,392 | -0.2% |

| Cabin 8 | 9,274 | 9,242 | -0.3% |

| HIVE Blockchain | 2,430 | 2,365 | -2.7% |

| Argo Blockchain (ARBK) | 115 | 101 | -12.2% |

| Bit Digital (BTBT) | 971 | 697 | -28.2% |

| CleanSpark (CLSK) | 301 | 100 | -66.8% |

Source: Company announcements

In February, Cipher had the largest percentage change in BTC HODL – a nearly 10% increase from January. The nominal increase was only 40 Bitcoin, or about 10% of Cipher’s output in February, indicating a balanced approach to the BTC treasury as the company sells most of its monthly output to pay expenses while holding some for price appreciation. This option is important because the company could potentially need to raise money soon and has a couple of different levers to bring in new money.

Risks to consider

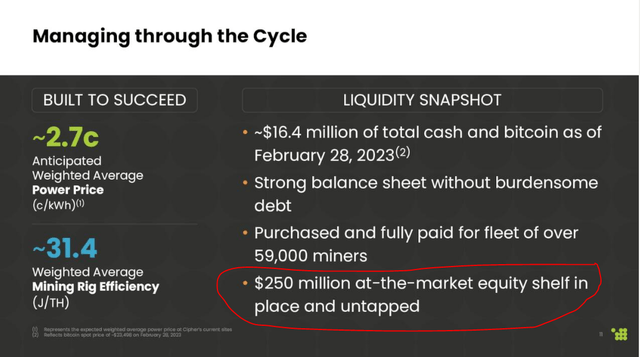

In the company’s earnings report from earlier this week, it revealed just under $12 million in cash at the end of December, although that figure has increased to $16.4 million at the end of February as Cipher has been able to use BTC sales to to finance the operation. . In the event that the company needs funding, which I see as likely if the price of Bitcoin reverses lower, there is a $250 million shelf that Cipher has yet to draw from:

Earnings cover (Cipher Mining)

During the conference call, Page was quite clear that the shelf would be tapped if it made sense to do so from an operational expansion perspective. The example CEO gave involved immediate use of equity offering cash to scale capacity in Odessa.

However, the financial viability of Bitcoin mining in 2023 is still up in the air and depends significantly on the price of Bitcoin. If the price of Bitcoin does indeed fall back below the $20k range for an extended period, Cipher may have to hit the shelf for operating expenses given the total operating expenses of $41.1 million in the last six months. Cipher’s SG&A expenses were more than six times Q4-22 revenue, and CFO Ed Farrell indicated on the call that the run rate from the second half of 2022 may be a reasonable expectation for 2023. This run rate is probably good at $25k BTC, that’s a lot less good at $20k BTC.

And this brings us to the expenses. Cipher reported production costs of $5,143 in power per Bitcoin on the Alborz site and $6,293 in power per Bitcoin on the Bear and Chief sites. This is unprecedented compared to peers, but we don’t have clarity on the electricity cost in Odessa, which is where the majority of mining has taken place so far this year:

| The website | BTC mined YTD | Cipher owner |

|---|---|---|

| Odessa | 770 | 770 |

| Alborz | 186 | 91 |

| Bear and chief | 111 | 54 |

Source: Cipher Mining

I think it’s also important to mention that Alborz, Bear and Chief are joint ventures with WindHQ LLC and Cipher owns about half of the Bitcoins that have been mined on these sites so far this year. This means that 84% of Cipher’s Bitcoin that has been mined in 2023 has come from Odessa, and this is the site that we do not yet have clarity on electrical expenses.

Summary

Although I think Cipher is interesting, I will wait a bit before considering opening a position. I’m a little concerned about the company’s non-operating expenses, and I want to see how it looks after a quarter of operations that are more reflective of current production levels. There’s no doubt that the power costs the company revealed at Alborz, Bear and Chief would be industry-leading, but I still think it’s a bit early to jump in on this one. I would only sell CIFR shares if you think the price of Bitcoin is going down. Other than that, Cipher stock is a hold.