Choppy sessions continue, will it be a weekend?

Bitcoin (BTC) and Ethereum (ETH) have experienced a lack of volatility, with both cryptocurrencies fluctuating between gains and losses. For the time being, it is uncertain whether there will be a significant price movement during the weekend. Earlier, BTC/USD prices traded choppy between a narrow range of $22,000 to $22,500.

Let’s look at the fundamentals and technical side of the market.

FTX reports $8.9 billion loss in customer funds and ‘highly mixed’ assets in recent presentation to debtors

FTX’s debtors released their second stakeholder presentation on March 2, 2023. The presentation includes a preliminary analysis of the defunct cryptocurrency exchange’s shortcomings, revealing a significant shortcoming.

The analysis found that approximately $2.2 billion of the company’s total assets were in FTX-related addresses, but only $694 million are considered “Category A Assets,” which include liquid cryptocurrencies such as bitcoin, tether or Ethereum.

In addition, FTX’s current CEO, John J. Ray III, stated that the debtor’s efforts were significant and added that the exchange’s assets were “heavily commingled.”

FTX’s debtors and CEO, John J. Ray III has released a presentation documenting the cryptocurrency exchange’s shortcomings. The report highlights a cyber attack that occurred after FTX filed for bankruptcy.

The report categorizes FTX’s holdings into two groups, “Category A Assets” and “Category B Assets.” The public presentation reveals a shortfall of $8.9 billion in customer funds. The report states that only a small amount of cash, stablecoin, Bitcoin, Ethereum and other Category A assets remain in wallets currently associated with FTX.com. Much of the shortage can be traced back to Alameda Research.

Silvergate Bank uncertainty could weaken the cryptocurrency market

Silvergate informed the Securities and Exchange Commission (SEC) in a filing after Wednesday’s market close that it would need to delay filing its annual report as it assesses the impact of various events on the business.

The delay in Silvergate’s annual report has caused a sharp decline in cryptocurrency values, including the price of BTC. However, the market has since given mixed signals about the event’s impact. It is worth noting that the Silvergate situation has significantly affected the cryptocurrency market.

On Wednesday night, Silvergate Capital ( SI ) announced it would delay filing its annual report due to losses from the FTX crash in November and various regulatory probes. This news hurt market sentiment, causing investors and traders to lose confidence in the stability and security of the cryptocurrency industry.

This could potentially result in a market-wide sale. It is worth noting that the Silvergate situation highlights the challenges and risks associated with investing in cryptocurrencies.

In addition, the delay in Silvergate Capital’s annual report filing has resulted in increased regulatory scrutiny of the cryptocurrency industry, which is already facing significant backlash.

This could make governments more hesitant to grant licenses to crypto-related businesses, potentially limiting the industry’s growth and expansion. The situation highlights the need for stricter regulation and greater transparency in the cryptocurrency market to ensure investor protection and stability.

Bitcoin price

Bitcoin is currently trading at $22,396, with a 24-hour trading volume of $18 billion. Technical analysis of the BTC/USD pair suggests a breach of the symmetrical triangle pattern at the $23,250 level. If this happens, a breakout could push the BTC price past the $22,046 support zone.

Alternatively, if the price breaks below this support zone, BTC could fall to the $21,450 mark.

The appearance of a bearish engulfing candle indicates a significant selling bias. However, if the candles close above this level, there could be potential for a bullish rejection, with a target of $22,800 or higher, towards the $23,750 mark.

Buy BTC now

Ethereum price

The current market price of Ethereum (ETH) is $1567 and its 24-hour trading volume is $6.6 billion. From a technical point of view, the ETH/USD pair has broken a symmetrical triangle pattern, suggesting a potential for further selling until it reaches the $1,560 level.

If the $1560 level is breached, ETH could be exposed to the $1500 mark. However, it is worth noting that there is strong resistance around the $1,620 or $1,680 levels that could limit further price declines.

Buy ETH now

Top 15 Cryptocurrencies to Watch in 2023

Take a look at the top 15 altcoins to watch in 2023, curated by Cryptonews’ Industry Talk team. The list is regularly updated with new ICO projects and altcoins, so remember to check back often for the latest updates.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

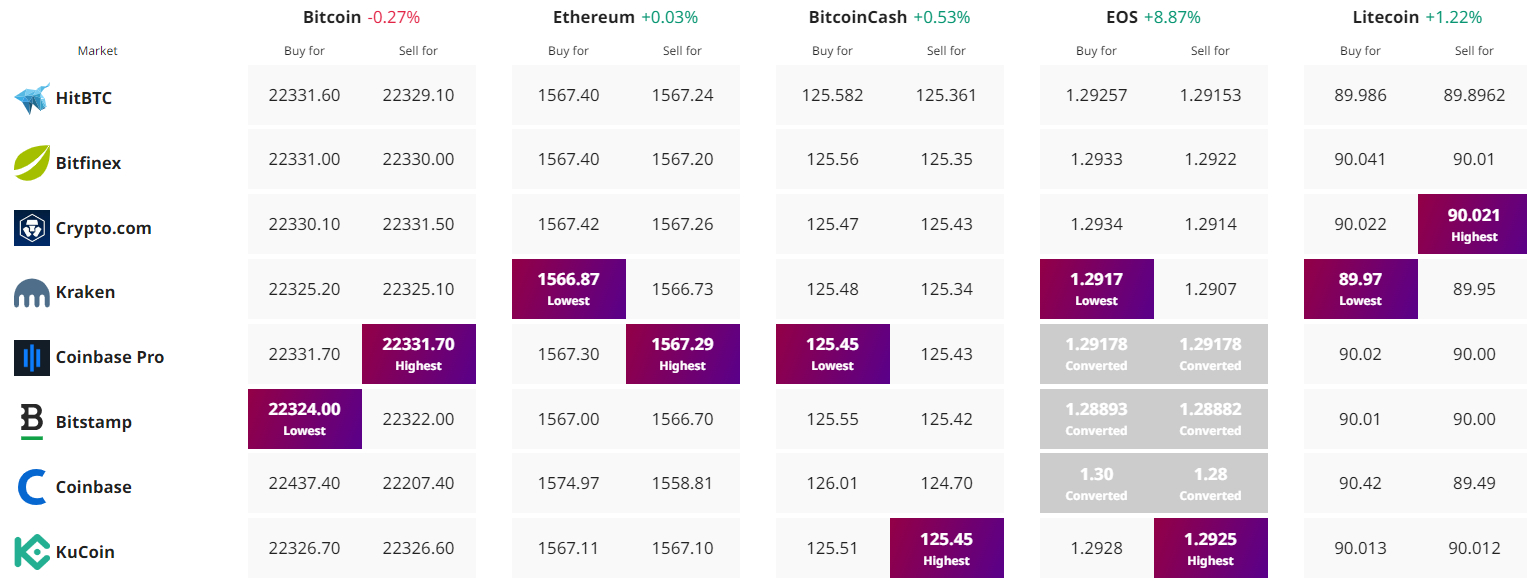

Find the best price to buy/sell cryptocurrency