Kevin Helms

A student of Austrian economics, Kevin found Bitcoin in 2011 and has been an evangelist ever since. His interests lie in Bitcoin security, open source systems, network effects and the intersection of finance and cryptography.

all about cryptop referances

Charles Schwab’s $655 billion asset management arm is launching its first crypto-related exchange-traded fund (ETF). The new fund is expected to begin trading on the NYSE Arca exchange this week.

Schwab Asset Management, a subsidiary of The Charles Schwab Corp., announced last week the launch of the Schwab Crypto Thematic ETF (NYSE Arca: STCE ), calling the new product “the first crypto-related ETF.”

Charles Schwab is a large American brokerage, banking and finance company. Schwab Asset Management currently has over $655 billion in assets under management, according to its website. It is the third largest provider of index funds and the fifth largest provider of exchange traded funds (ETFs).

The first day of trading for the Schwab Crypto Thematic ETF is expected to be on or around August 4, the announcement details, adding:

The fund is designed to track Schwab Asset Management’s new proprietary index, the Schwab Crypto Thematic Index.

According to the fund’s prospectus filed with the US Securities and Exchange Commission (SEC) on Friday, the Schwab Crypto Thematic ETF “is designed to deliver global exposure to companies that may benefit from the development or use of cryptocurrencies (including bitcoin) and other digital assets, and the business activities related to blockchain and other distributed ledger technologies.” Furthermore, “The fund is non-diversified, meaning it may invest in securities of relatively few issuers,” the company warned.

The announcement notes:

The fund will not invest directly in cryptocurrency or digital assets. It invests in companies listed in the Schwab Crypto Thematic Index.

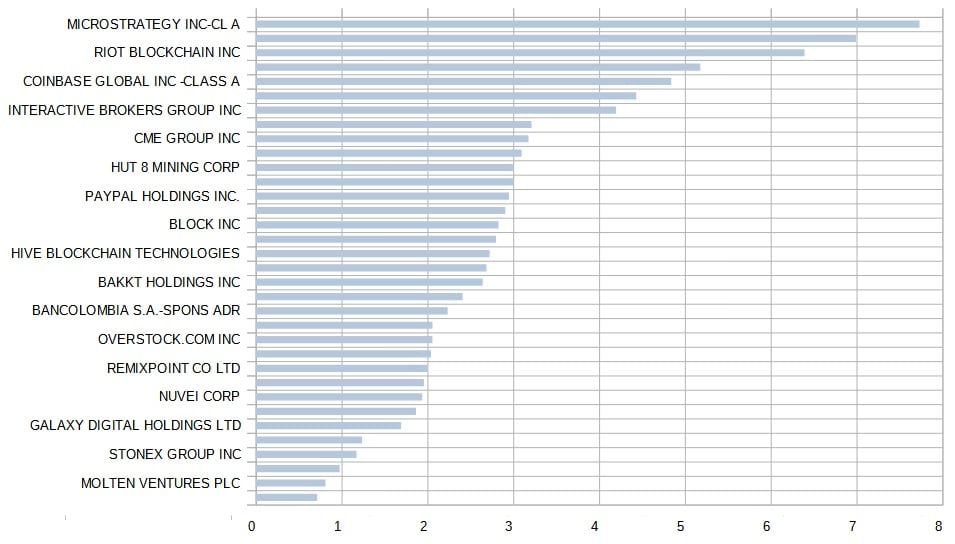

The Schwab Crypto Thematic Index’s constituents as of July 29 include Microstrategy, Marathon Digital Holdings, Riot Blockchain, Silvergate Capital, Coinbase Global, Robinhood Markets, Interactive Brokers, Nvidia, CME Group, Bitfarms, Hut 8 Mining, International Exchange, Paypal, SBI Holdings, Block Inc., Monex Group, Hive Blockchain, Internet Initiative Japan, Bakkt Holdings, NCR Corp. and Bancolombia.

David Botset, CEO and Head of Equity Product Management and Innovation at Schwab Asset Management, commented:

The Schwab Crypto Thematic ETF seeks to provide access to the growing global crypto ecosystem along with the benefits of transparency and low cost that investors and advisors expect from Schwab ETFs.

Meanwhile, the SEC still hasn’t approved a bitcoin spot ETF despite approving several bitcoin futures ETFs. In June, Grayscale Investments, the world’s largest digital asset manager, filed a lawsuit against the SEC after the securities regulator rejected its application to convert its flagship bitcoin trust, GBTC, into a spot bitcoin ETF.

What do you think about Schwab Asset Management launching its first crypto-related ETF? Let us know in the comments section below.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.