Chainlink price is linked from top cryptoassets like whale buy LINK En Masse

Chainlink has attracted investor eyes and high social volumes in recent days due to the evolution of the ecosystem. The support from whales and positive social sentiment for the project has resulted in price gains for LINK.

As of September 22nd, LINK rallied over 20% picking up from the lower price level of $6.80 and reaching the press time price level of $8.01. Analysts have noticed a disconnect narrative in LINK’s price action as the altcoin experiences a period of increased whale activity.

Disconnection from top crypto assets

Since September 21, Chainlink has shown signs of being somewhat disconnected from the larger crypto market, according to data from Santiment. After regaining the $8 threshold again, LINK has reversed its losses in mid-September

A drop in LINK’s correlation with Bitcoin from September 10 onwards is consistent with the price gains noted by the altcoin over the time period.

Apart from the falling correlation, another sign of disconnection was that the LINK/BTC pair broke above a long-term resistance level. Pseudonymous analyst and crypto investor CryptoGodJohn pointed out that the pair was on the verge of breaking out of a 780+ day downtrend.

The veteran trader also highlighted that LINK is one of the first coins to pump out of the bear market into the bull market and one of the first coins to enter the bear market during the bull market.

LINK whale back in game

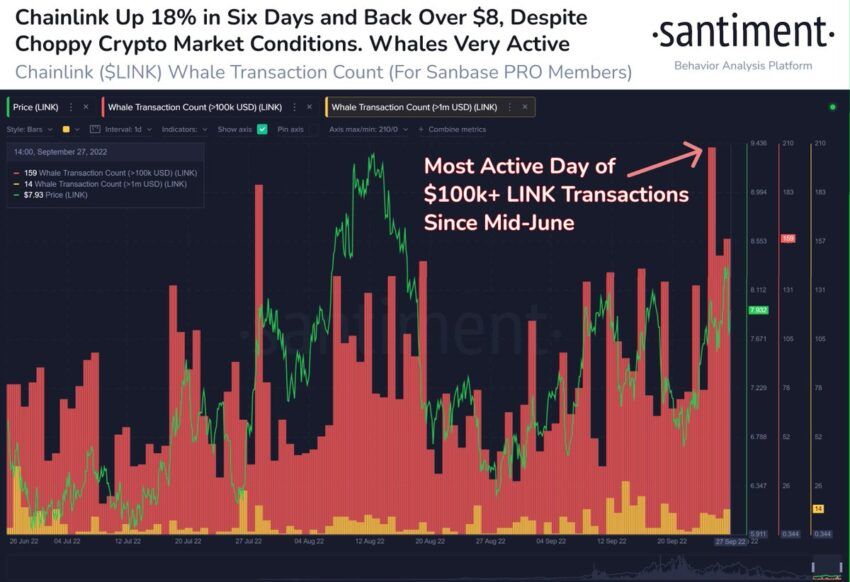

The recent solo run shown by LINK’s price managed to bring whales back to the scene with whale transactions recording a significant increase. Recently, LINK saw its most active day of $100k+ transactions since mid-June.

A higher activity from whales amid positive price momentum and decent retail volumes could further help LINK’s bullish trajectory in the near term.

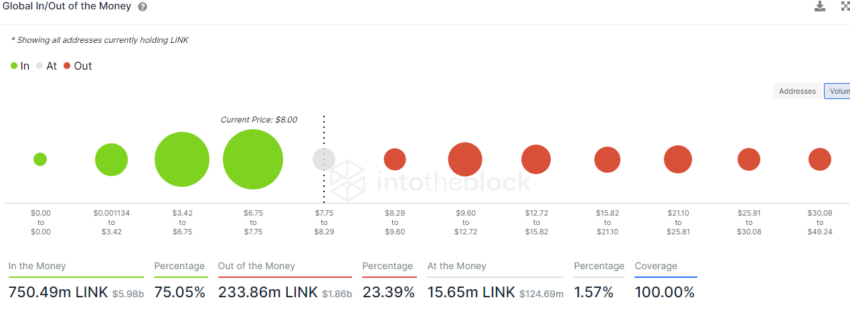

For now, bulls need to keep LINK’s price above $7.95, where over 15 million LINKs are held by 9370 addresses. The next solid supply barrier according to Global In and Out of Money is at $8.92, where over 13 million LINK are held by over 15,000 addresses.

At press time, LINK was trading at $8.05, but was down 3.4% on the daily chart due to the broader market’s bearishness. However, a pullback below the $7.95 mark could lead to a u-turn to the $7.22 mark which is the next support barrier.

For now, the upcoming SmartCon Chainlink event scheduled for September 28 has kept social euphoria high for the project and could potentially boost LINK’s price further in the short term.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.