Chainlink is approaching significant supply wall

Important takeaways

- Chainlink traded above $0.50 during Friday’s trading session.

- As the bullish pressure increases, LINK may gain enough momentum to advance to $10.

- Nevertheless, several indicators suggest that LINK may soon face a correction.

Share this article

Chainlink has seen a significant increase in bullish momentum, and is currently leading the cryptocurrency market. Nevertheless, several indicators suggest that LINK may experience a short correction if it enters the $10 zone.

Chainlink is approaching double digit territory

Chainlink has outperformed the top 10 cryptocurrencies by market cap, rising more than 6% since the start of Friday’s trading session.

LINK rose from a low of $8.97 to an intraday high of $9.50, before cooling to $9.21 at press time. As the upward pressure continues to increase, the token appears to have more room to rise. The development of a descending triangle on the daily chart suggests that Chainlink could rise another 11% before the uptrend reaches exhaustion.

The y-axis of this technical formation projects a $10.60 target for LINK since it overcame the $7.30 resistance level on July 29. Although the rest of the cryptocurrency market has shown signs of weakness, it appears that Chainlink may be achieving its upside potential from a technical perspective.

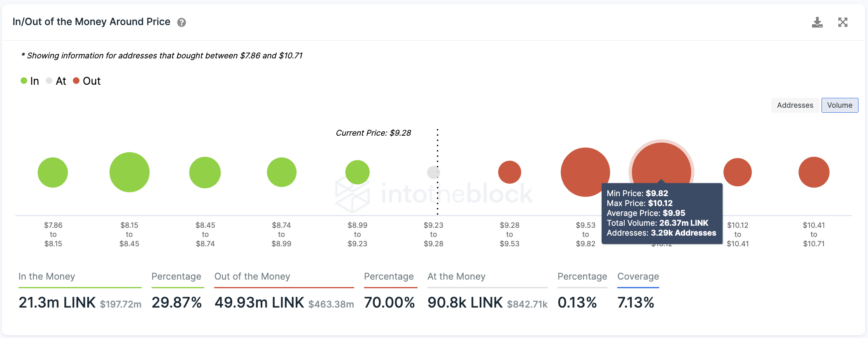

Still, IntoTheBlock’s In/Out of the Money Around Price model shows a stiff supply barrier going forward. About 3300 addresses have previously bought almost 26.4 million LINK between $9.82 and $10.12. This significant area of interest may negate the price rally as underwater investors may attempt to break even on some of their holdings.

While LINK may have the strength to hit double-digit territory, Chainlink is approaching a significant area of resistance. The Tom DeMark (TD) Sequential indicator is also highly likely to present a sell signal on the LINK daily chart. The potential bearish formation could lead to a correction of one to four daily candlesticks before the uptrend resumes.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

For more key market trends, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.