Can Solana’s NFT space manage to restore SOL’s position in the crypto market

- Solana’s weekly chart was green and the metrics supported a positive outlook

- On the other hand, SOL’s Bollinger Band and RSI were flashing bearish signals

Solana [SOL] has been drifting away from the top ten list of cryptocurrencies in terms of market cap for quite a few weeks now. Although Solana failed to impress its investors, growth was seen in the NFT ecosystem.

Several new NFTs were noted on Solana in the past week, including Claynosaurz, Panda, Pixel Boy, Moo Doo, ACF and many others.

New listings Solana #NFTs With the highest volume in the last 7D@Claynosaurz#Treasure chests@THELILYNFT#Panda#MooDoo#PixelBoy#HolidayElf#ACF #CactusBOB#Applicant@hyperspacexyz #Solana $SOL pic.twitter.com/7p8HT5ZIc9

— Solana Daily (@solana_daily) 29 November 2022

Read Solana’s [SOL] Price prediction 2023-2024

Interestingly enough, Dune’s data showed that Solana’s NFT transaction volume increased recently. Magic Edan revealed a possible reason for this increase when it congratulated y00ts NFT for reaching over 2,100,000 SOL in trading volume. However, a slight decrease was noticed in Solana’s active wallets.

Over 2,100,000 $SOL in trading volume 🚀

Congratulations again @y00tsNFT for the huge numbers across not one, but TWO collections. LFG! 🔥 pic.twitter.com/KkPED5QwAW

— Magic Eden 🪄 (@MagicEden) 29 November 2022

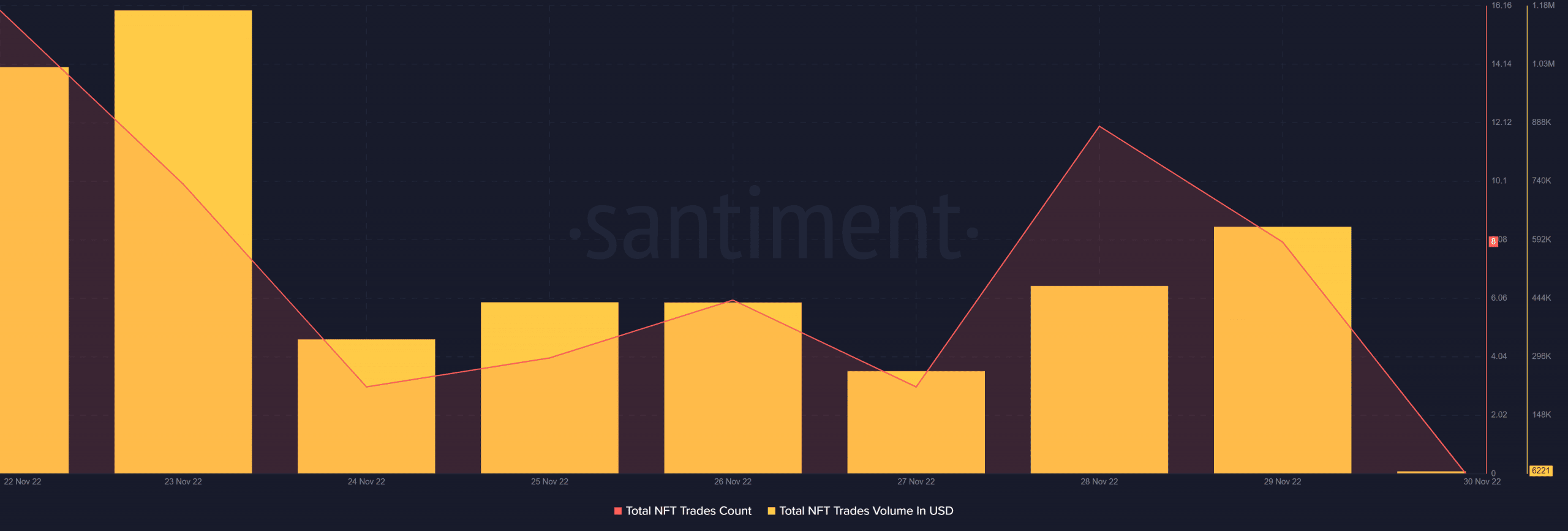

Santiment’s data regarding SOL’s NFT space was not very promising, as according to the chart, SOL’s total NFT trading numbers and trading volume in USD decreased in the last week.

Source: Sentiment

Can Solana NFT help SOL?

Considering the nature of this development, a positive update came in for SOL as its weekly chart was painted green. As per CoinMarketCapSOL’s price increased 4% over the past seven days and at press time was trading at $13.73 with a market capitalization of more than $4.9 billion.

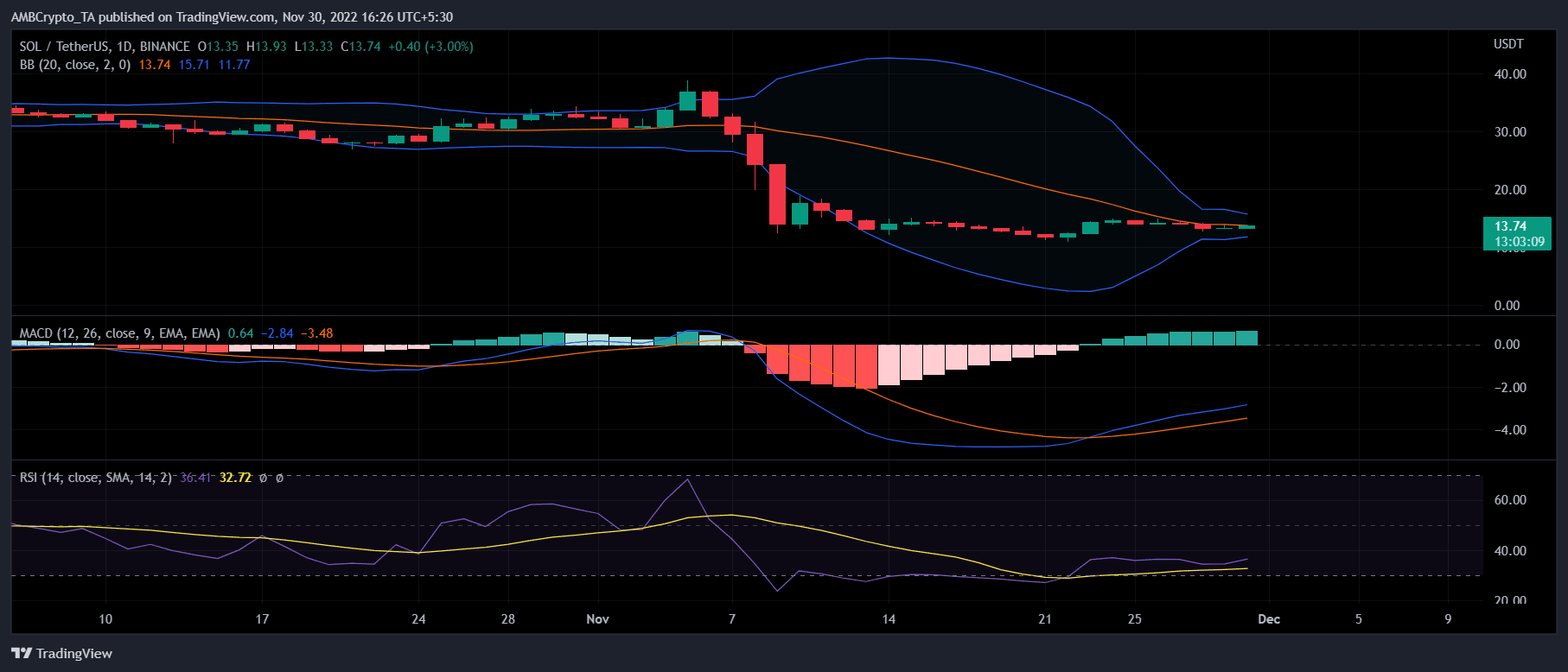

Nevertheless, a look at SOL’s daily chart revealed that the blockchain’s troubles were far from over. When considering the movement of Bollinger Bands, it can be seen that SUNits price had entered a depressed zone. This minimized the chances of an eruption in a northerly direction.

Furthermore, SUN‘s Relative Strength Index (RSI) rested well below the neutral mark. This was another bearish signal. The Moving Average Convergence Divergence (MACD) offered some hope as it showed a bullish crossover. Thus, we make room for a continued price increase.

Source: TradingView

The calculations may be useful

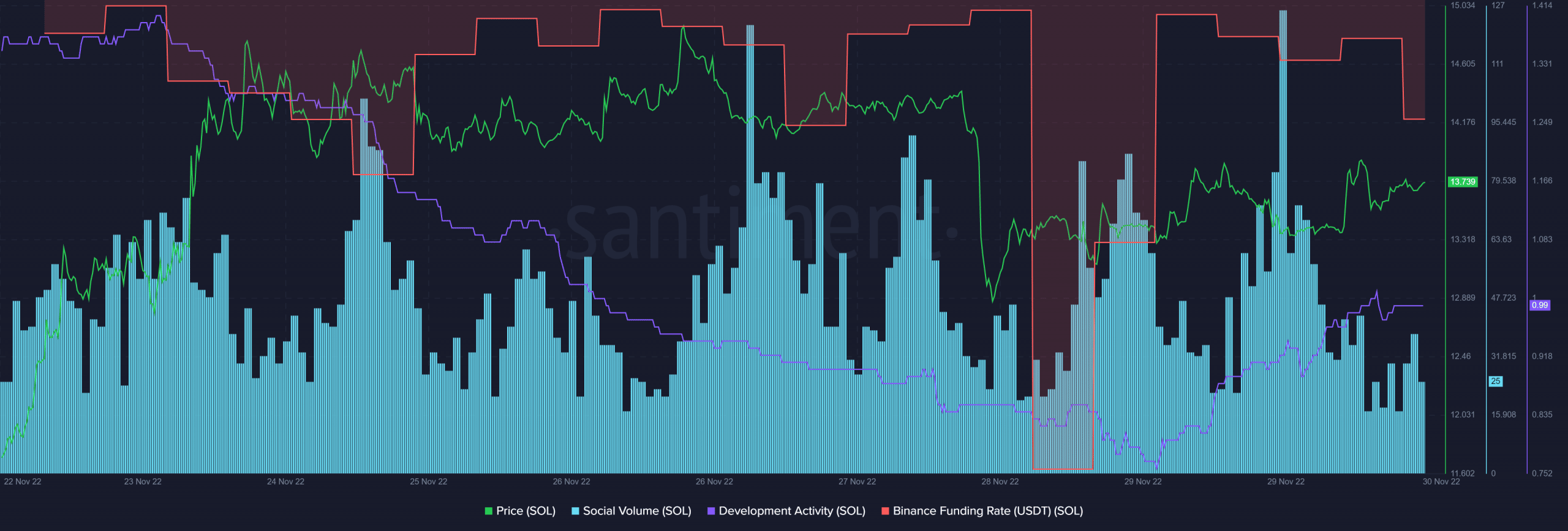

While the market indicators were not in favor of Solana, a few of the calculations on the chain showed some promising information. For example, after a sharp decline, SOL’s development activity has picked up in recent days, which was mostly a positive signal for a network.

SOL also managed to remain popular in the crypto community as its social volume increased. Furthermore, Solana’s Binance funding rate has also registered an uptick recently, indicating higher interest from the derivatives market.

Source: Sentiment