Can Riot Platform Inc. (RIOT Stock) Ride the Bitcoin Rally?

- Riot Platform Inc. sells Bitcoin mining computers and hopes to profit from BTC approaching 30K.

- The crypto industry’s market value also increased somewhat, which gave strong signals.

As Bitcoin Rises From Crypto Hibernation, Could BTC Miner Riot Platform Inc. Shares Also Rise? Currently, BTC is trading at $28,635.16, and the crypto industry’s global market capitalization is around $1.18 trillion after gaining 2.8% recently. All of these create positive emotions and can fuel the rally.

Riot Platforms Inc. and Bitcoin Mining

Riot Platforms Inc. provides dedicated cryptocurrency mining computers and data center hosting services. It was founded in 2000 and is headquartered in Castle Rock, Colorado, USA. The BTC mining industry was plagued with problems, rising energy costs, rising difficulty levels and falling prices. With BTC rising, one of the problems is solved for now.

At the time of writing, BTC was trading at $28,635.16 up 1.12%, market cap up 1.13% to $553 billion, and volume suffered 0.11% to $20.9 billion over the last 24 the hours. Ranked #1, Bitcoin has a market dominance of 46.54%, with an ROI of 21,042.49%.

Riot Platforms Inc. (RIOT) – The numbers game

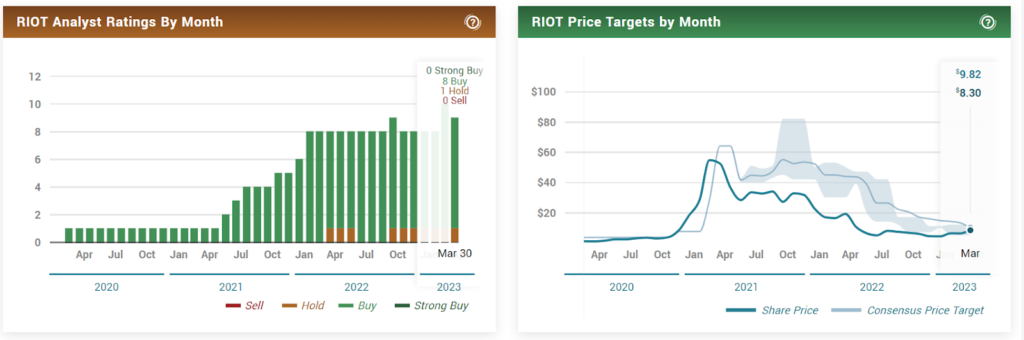

In trading, Riot Platforms Inc. (NASDAQ: RIOT ) changed hands at $9.32, jumping 13.81%. The previous close and open were at $8.11 and $8.54 respectively. The 52-week change fell 56.40%, with an average volume of 17.79M shares and a market value of $1.541B. The analysts have set the target at $9.82 with an upside of 6.4%.

With a moderate buy rating of 2.9 and bearish short interest with 19.69% shares sold short, RIOT appears to be in neutral territory. Looking at December 2022 data, revenue fell 33.82% from $60.15 million, with earnings per share of $1.86. Income on assets and equity fell by 11.32% and 40.77% respectively. In comparison, quarterly revenue growth suffered by 33.80%.

Operating expenses rose 28.43% from $91.78 million, while net income fell 477.79% from a negative $155.78 million. Net profit margin suffered massively after a fall of 773.23% from negative $259.00. EBITDA decreased by 285.44% from negative $42.08 million, while earnings per share (EPS) decreased by 2,098.82% from negative $0.34.

The last income was reported on March 2, 2023, with an estimated revenue of $55.501 million, while the reported income was $60.147 million. This came with a surprise of $4.646 million or a gain of 8.37%. The next earnings are scheduled for May 9, 2023, with an estimated revenue of $74.152 million.

Riot Platforms Inc. (RIOT) – The Candle Exploration

Both the crypto industry and RIOT share prices have been slowly rising since the start of 2023. There is a visible short-term rise in price, supported by a rising moving average and positive signals from the MACD. If everything goes as projected, the price may go above R1 to reach R2, but before that price, the immediate resistance present at the $10.41 mark must be broken.

If RIOT breaks below the immediate support at $7.78, it should bounce off S1 while consolidating to touch R2. S2 acts as a strong solid support. The price may come close to it, but the chances of a breakthrough are slim.

Disclaimer:

The views and opinions expressed by the author, or any person mentioned in this article, are for informational purposes only and do not constitute financial, investment or other advice. Investing in or trading crypto assets comes with a risk of financial loss.