Can Newcomer Crypto Investors Still Become Millionaires?

As the world embraces the digital age, an exciting financial phenomenon has emerged: the rise of crypto millionaires. Pioneers of this revolution have amassed enormous fortunes, leaving many to wonder whether newcomers still have room to share in the prosperity.

In this article, BeInCrypto dives into the realm of cryptocurrency investing, examining past successes, current challenges, and future opportunities for aspiring digital asset investors.

A new breed of wealth

Cryptocurrencies have given rise to a new class of millionaires. From humble beginnings, digital assets like Bitcoin and Ethereum have transformed lives. Success stories abound, fueling the dreams of new investors. As the market evolves, can newcomers replicate this success?

Decoding past triumphs

Early crypto investors reaped undeniably huge rewards. Bitcoin, once worth mere cents, rose to astronomical heights. Ethereum also witnessed meteoric growth. But are these stories representative of future fortunes or simply outliers?

Take Erik Finman, for example. In 2011, aged 12, he invested $1,000 in Bitcoin. Fast forward to 2023 and his fortune exceeds $5 million. But Finman’s story is unique. Similar feats can prove elusive to newcomers.

Another example is the Winklevoss twins, who famously invested $11 million in Bitcoin back in 2013. Their foresight paid off handsomely, as they became billionaires in 2017. However, these early adopters had the benefit of a nascent market with plenty of room for growth.

Cryptolandscape: a changing terrain

The early days of cryptocurrencies were characterized by a sense of novelty and limitless possibilities. Many investors entered the market with an experimental mindset, eager to test the waters.

Today, however, the landscape has changed.

The market is more mature, with institutional investors and regulatory scrutiny increasing. This development has both advantages and disadvantages. On the one hand, mainstream adoption is more likely; on the other hand, competition is tougher, and regulatory challenges may arise.

Future potential: A cautious outlook

Assessing crypto’s future involves examining mass adoption. With time, more individuals and businesses are embracing digital assets. Governments are also considering central bank digital currencies (CBDCs). However, there is still uncertainty.

The FTX collapse undeniably rocked the market. Confidence waned, and investors questioned the industry’s stability. Despite this setback, the crypto market demonstrated resilience, recovering much of its lost ground.

Another potential roadblock is regulatory intervention. Governments around the world are keeping a close eye on the crypto sector. Increased regulation can hinder the industry’s growth, and affect investment returns.

Technological innovations: A driving force

Blockchain technology, the backbone of cryptocurrencies, is evolving rapidly. Innovations such as smart contracts, decentralized finance (DeFi) and non-fungible tokens (NFT) are reshaping the industry. These advances provide new investment opportunities for savvy investors.

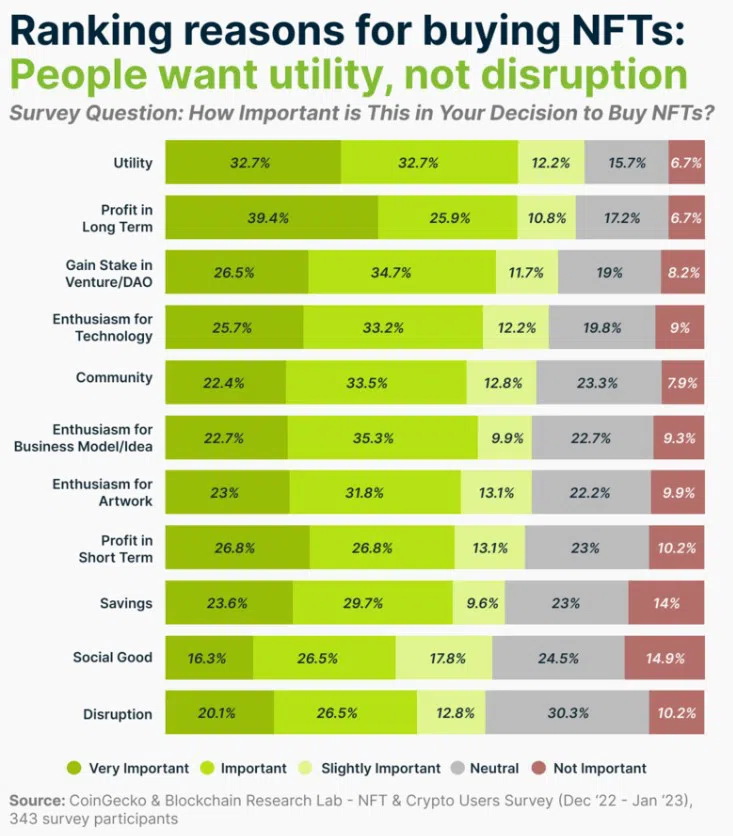

For example, decentralized platforms such as Uniswap and Aave have disrupted traditional finance by offering decentralized trading and lending services. NFTs, meanwhile, have revolutionized digital art, gaming and collectibles, opening up new avenues for investment.

Millionaire Dreams: A Realistic Goal?

New investors undoubtedly face challenges. Competition is fierce, and market conditions have evolved. Early participants enjoyed a different landscape; new investors must adapt.

Diversification is, as always, important. Investing exclusively in Bitcoin or Ethereum may no longer be sufficient. Exploring alternative assets such as DeFi tokens or NFTs can offer a hedge against risk.

Nevertheless, the potential for significant wealth remains. Crypto projects such as Solana and Cardano show impressive growth potential. Proper research, risk management and patience can still yield significant rewards. Perhaps, with Cardano, patience seems mandatory.

Solana, a high-performance blockchain platform, has grown exponentially since its launch in 2020. It offers a scalable solution to decentralized applications, attracting both developers and investors. On the other hand, Cardano is a third-generation blockchain that focuses on sustainability, scalability and security.

Layer 2 solutions such as Polygon (formerly known as Matic Network) and Optimism are also gaining traction. These technologies aim to improve Ethereum’s scalability and reduce transaction costs, making them attractive to developers and investors alike.

Balancing risk and reward

For aspiring crypto millionaires, the journey is undeniably difficult. Market volatility and competition create significant obstacles. But with calculated risks and diversified investments, significant wealth is still attainable.

Risk management is essential in the world of crypto investing. New investors should consider dollar cost averaging, a strategy that involves consistently investing a fixed amount over time. This approach can help mitigate the impact of market fluctuations and promote a long-term perspective.

In addition, it is important to stay informed about market trends, technological advances and regulatory developments. Knowledge is power in the ever-changing crypto landscape, and informed decision-making can be the difference between success and failure.

The way forward: persistence and adaptability

Becoming a crypto millionaire in today’s market requires adaptability and caution. New investors must temper expectations, conduct thorough research and develop a robust investment strategy. Although success is not guaranteed, the potential for life-changing returns remains.

The cryptocurrency market will continue to develop, offering both challenges and opportunities. As the industry matures and technology advances, investors who stay informed, manage risk effectively, and diversify their portfolios can still achieve the title of “crypto millionaire” or achieve significant wealth. Ultimately, persistence, adaptability and a keen eye for new trends will separate the successful from the rest.

Disclaimer

In accordance with Trust Project guidelines, this feature article presents the opinions and perspectives of industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect the views of BeInCrypto or its employees. Readers should verify information independently and consult with a professional before making decisions based on this content.