Can crypto reach 1 billion users by 2025?

Introduction

Since its inception in 2010, Bitcoin has seen its value and popularity increase exponentially, creating the foundation for a market that reached $1 trillion in value in a decade. Cryptocurrencies have seen increased adoption in the wake of broader macroeconomic turmoil, with millions of new users entering the decentralized world of cryptocurrencies as a hedge against traditional finance.

Despite the current growth, some believe that the crypto industry will have a limited lifespan. Critics expect the increase to plateau and decline as regulatory pressure and internal market struggles create more user losses.

However, many expect the new technology to follow the same adoption curve that the internet and telephones did before it.

This report examines the factors that could contribute to Bitcoin’s growth and help the crypto industry reach 1 billion users by 2025.

Diffusion of innovations

Diffusion of innovation theory best describes the speed with which new technology is adopted and spread. It explains how the adoption of new technology follows a bell curve – a small group of innovators and early adopters at the beginning gives way to a larger group of early majority adopters, followed by an even larger group of late majority adopters. Finally, the bell curve ends with a small group of late adopters.

The ubiquitous bell curve graph has been used on everything from steam engines to telephones, showing how quickly the technologies have been adopted by wider society.

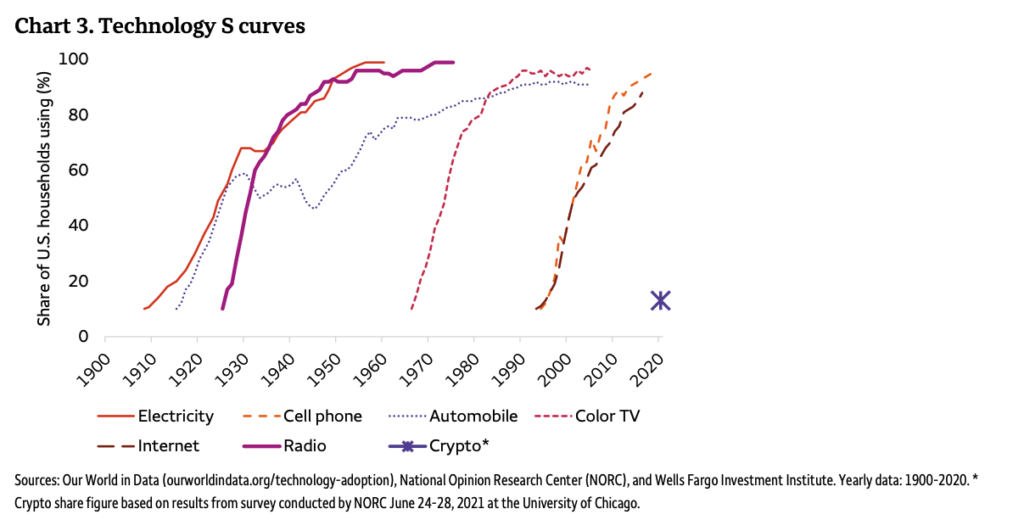

Applying the scale to Bitcoin shows that the crypto market is still in its early days. A 2022 report by Wells Fargo calculated that cryptocurrencies still have not reached an adoption inflection point, comparing them to the popularity of the internet in the mid-to-late 1990s.

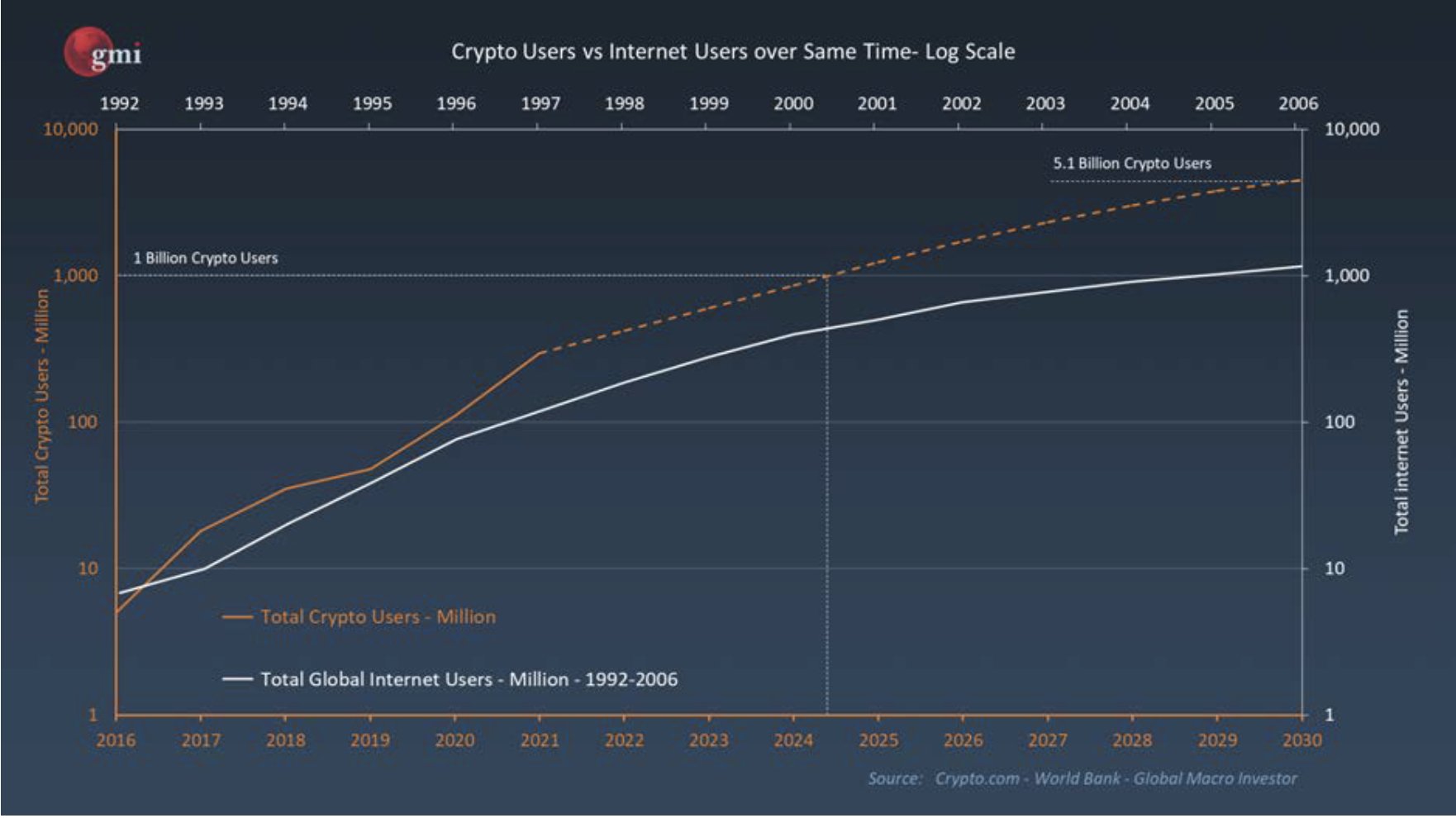

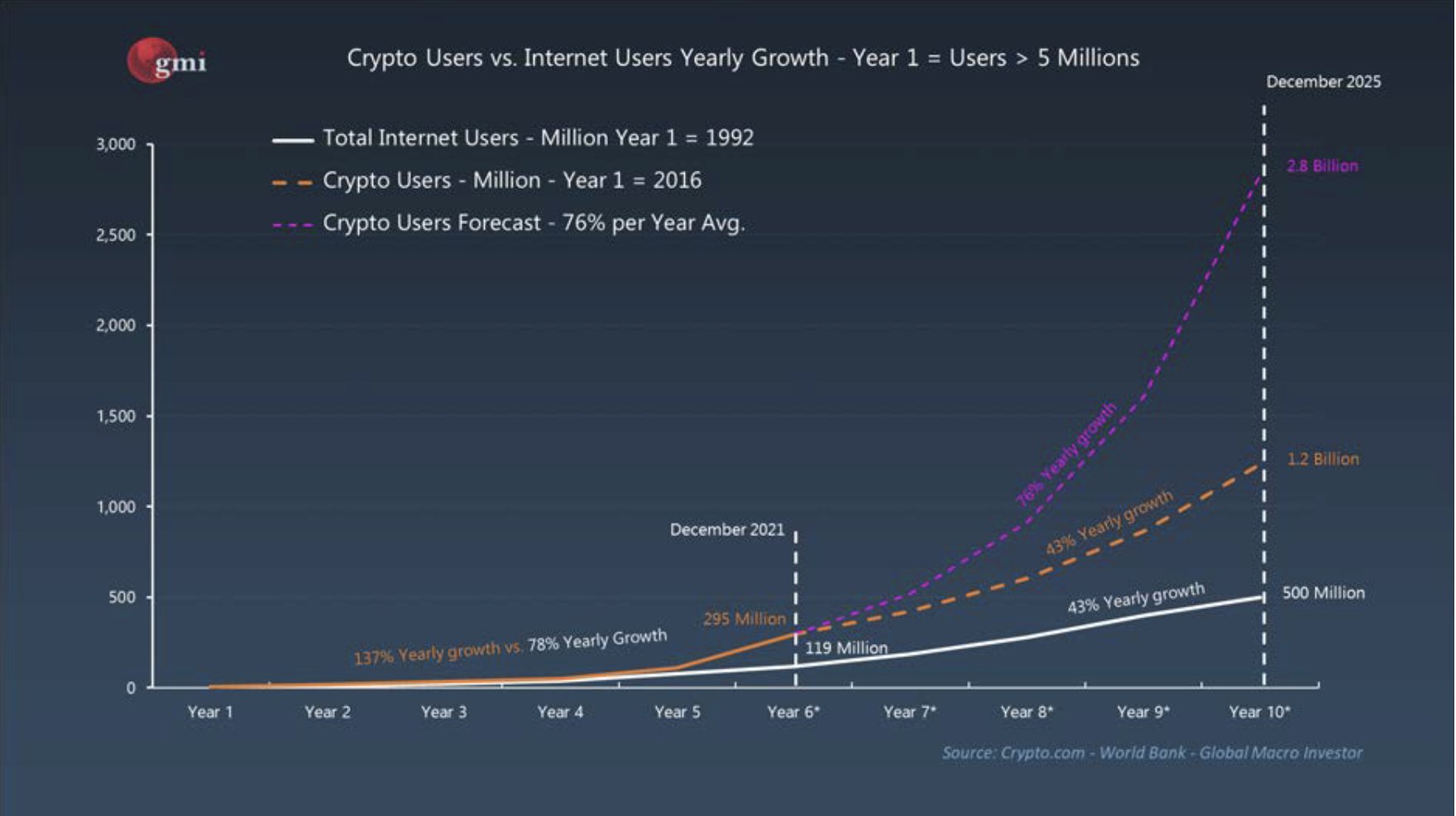

Comparing Bitcoin to the internet has become the best case study for those rooting for the success of the crypto industry. Data from Global Macro Investor found that cryptocurrencies have had the fastest rate of technology adoption in any event in history, growing at 137% per year.

Aside from the exponential growth both the internet and Bitcoin experienced in their early years, the two technologies have many other similarities. Both saw their popularity rise after a small group of tech-savvy users brought them into the mainstream. Both struggled to attract a wider audience due to the technical knowledge required to use it. Both experienced regulatory pressure as government agencies struggled to police the technology.

The problem of defining Bitcoin adoption

Calculating crypto adoption is very complicated. Unlike the internet, which requires looking at the number of people with direct access to an internet connection, cryptocurrencies and their adoption are much harder to quantify.

Adoption can be measured by the amount of capital flowing into the market. While this method certainly puts the value of the market into perspective, it tells little about the actual number of active users.

It can also be measured through transaction volume and the number of transactions on a given network.

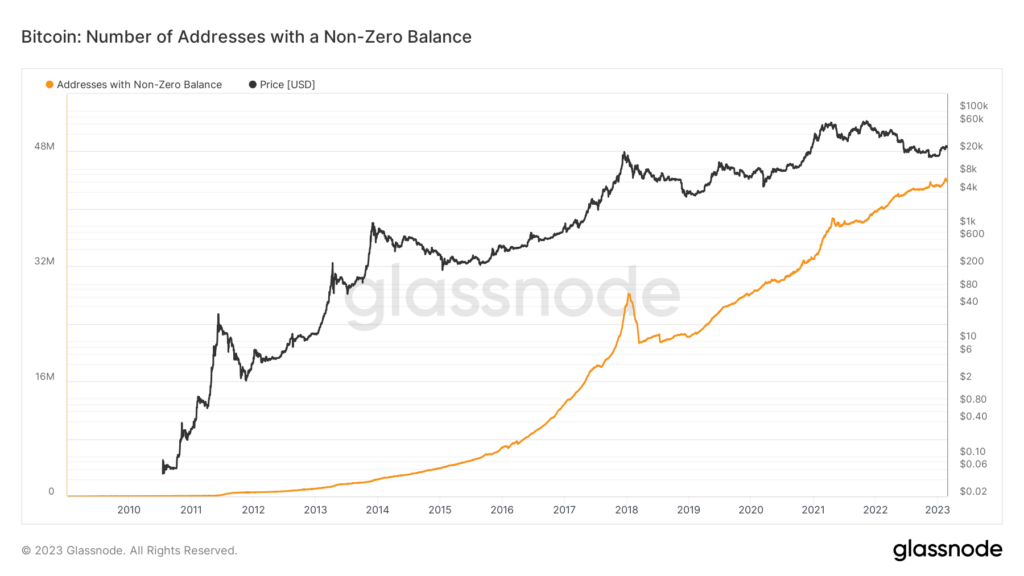

Another, more reliable way to measure adoption is to calculate the number of users. However, this presents a different set of problems due to the pseudonymous nature of blockchain technology. Simply counting crypto addresses will not give a reliable result, since one address does not equal one user.

For this report, an increase in non-zero Bitcoin addresses and the number of active users on centralized exchanges is a sign of growing usage.

Calculating crypto adoption

The number of users on centralized exchanges can be used as a proxy for broader crypto adoption.

Take Coinbase for example. By 2021, around 25% of the entire crypto market used the US-based exchange, making it one of the most popular cryptocurrency services in the world. From February 2023, the exchange has around 110 million verified users.

With an average year-over-year user growth of 92%, Coinbase is outperforming the internet with an average year-over-year growth of 43%. If the exchange continues to grow its user base at the internet’s 43% conservative estimate, it could see its user base triple by 2025.

Comparing the size of the crypto user base to the internet further confirms the industry’s potential for growth.

Some experts believe that the current state of the crypto industry is on par with the Internet in 1999. At that time, the new technology was slowly giving way to what would later be known as the dot-com boom and had around 248 million users. The Internet took another six years to reach 1 billion users in 2005.

Some estimates show that the crypto industry could have around 605 million users by 2023. Using the average of 43% annual growth internet looked at cryptocurrencies shows that the sector could reach 1.2 billion users by 2025.

Even with the 17% annual growth the internet experienced between 2002 and 2006, the crypto industry could see over 900 million users by 2025.

According to the innovation model, a technology is in its early phase even when it reaches 13.5% of the market.

Given that the 605 million crypto users in 2023 represent 7.5% of the world’s population, we can safely say that the industry is still in its early stages. The 605 million users are still considered early adopters, as crypto would take another 700 million users to reach the early majority.

Conclusion

While cryptocurrencies and the Internet are inherently different technologies, they share many similarities due to their transformative potential.

Applying the most conservative adoption rate the internet has seen to cryptocurrencies shows that not only could the industry reach 1 billion users, but it could reach it much faster than any other technology in history.

A rise in distrust of the traditional financial system fueled by macroeconomic turmoil makes cryptocurrencies, particularly Bitcoin, an extremely useful proposition for millions. As the technology continues to evolve and the use cases increase, we can see this usage rate increase.

However, it is important to note that these are rough estimates. Any number of Black Swan events could impact this adoption rate and set the industry back several years. A tectonic shift in regulatory approach could render cryptocurrencies essentially useless in many parts of the world.

Nonetheless, putting the crypto industry’s growth into perspective shows that it is still in its early stages and awaiting its full potential.